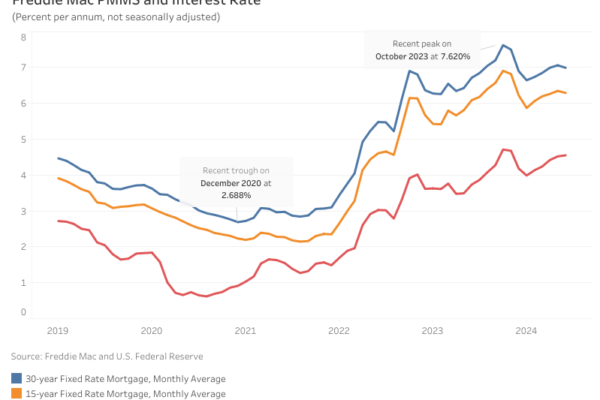

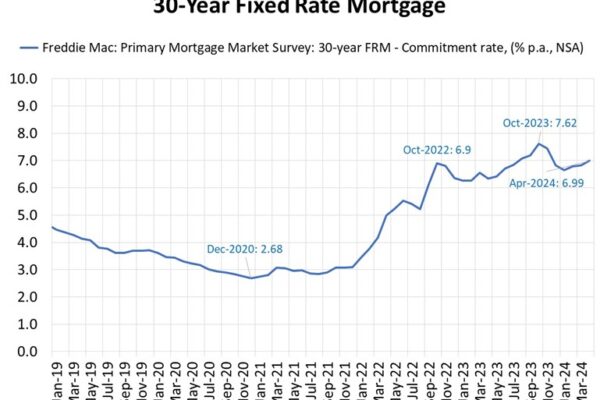

Mortgage Rates Declined in June but Remain High

According to Freddie Mac, the average 30-year fixed-rate mortgage decreased by 14 basis points (bps) from 7.06% in the previous month to 6.92% in June 2024. This decline comes after increases from 6.64% in January to a peak above 7.2% in May. Nonetheless, the current…