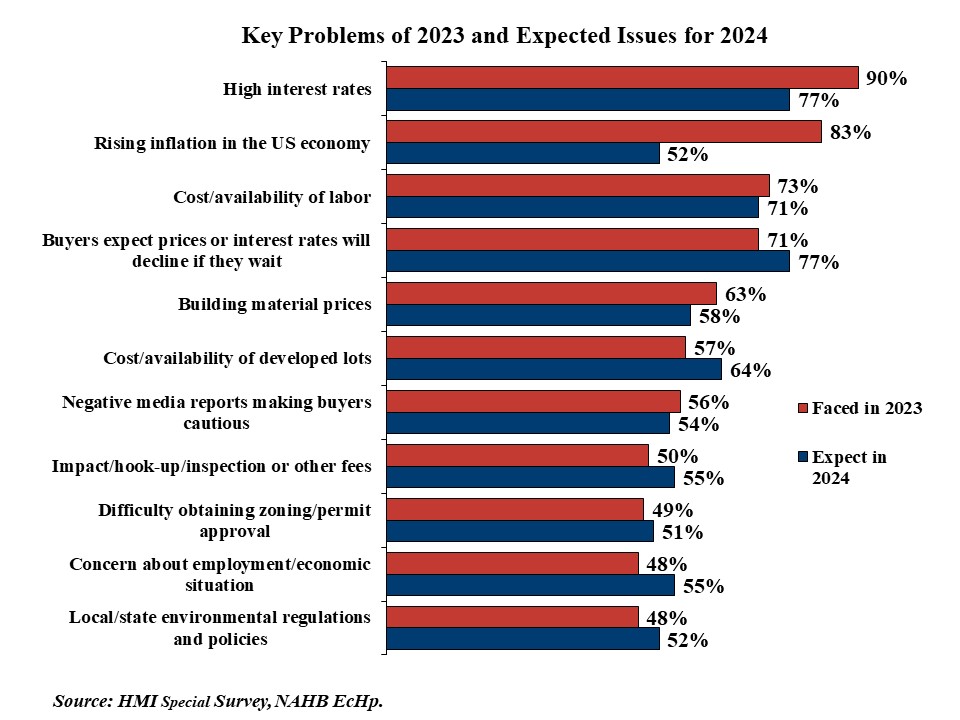

According to the January 2024 survey for the NAHB/Wells Fargo Housing Market Index, high interest rates were a significant issue for 90% of builders in 2023, and 77% expect them to be a problem in 2024. The second most widespread problem in 2023 was rising inflation in US Economy, cited by 83% of builders, with 52% expecting it to be a problem in 2024.

The cost and availability of labor was a significant problem to only 13% of builders in 2011. That share has increased significantly over the years, peaking at 87% in 2019. Fewer builders reported this problem in 2020 (65%), but the share rose again in 2021 (82%) and 2022 (85%). The share eased slightly in 2023 to 74%. A similar 75% expect the cost and availability of labor to remain a significant issue in 2024.

In 2011, building materials prices was a significant problem to 33% of builders. The share has fluctuated over the years, from a low of 42% in 2015 to a peak of 96% in 2020, 2021, and 2022. The slowdown in single-family construction in 2023 made this less of a problem for builders last year, as ‘only’ 63% reported it as a significant issue. Fewer expect it to face it in 2024 (58%).

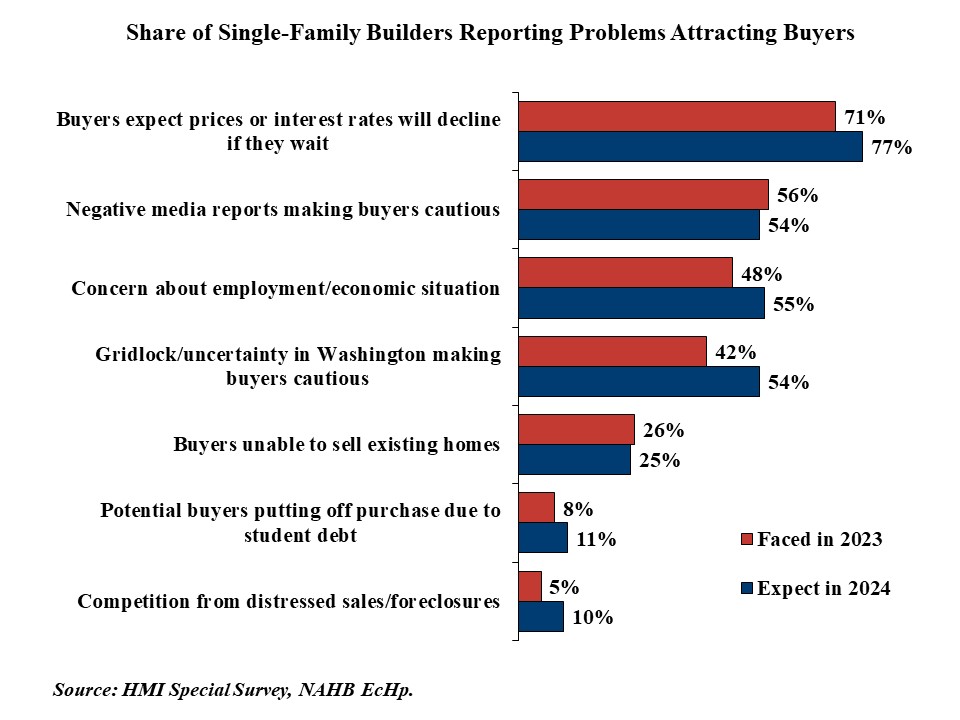

Compared to the supply-side problems of materials and labor, problems attracting buyers have not been as widespread, but builders expect many of them to become more of a problem in 2024. Buyers expecting prices or interest rates to decline if they wait was a significant problem for 71% of builders in 2023, with 77% expecting it to be an issue in 2024. Negative media reports making buyers cautious was reported as a significant issue by 56% of builders in 2023, and 54% expect this problem in 2024. Concern about employment/economic situation was another buyer issue for 48% of builders in 2023, but 55% anticipate this issue in 2024. Gridlock/uncertainty in Washington making buyers cautious was a significant problem for 42% of builders in 2023, but a larger 54% expect it to be a problem in 2024. Less than 30% of builders experienced problems in 2023 with buyers being unable to sell existing homes, potential buyers putting off purchase due to student debt, and competition from distressed sales/foreclosures.

For additional details, including a complete history for each reported and expected problem listed in the survey, please consult the full survey report.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Great insights! Reading about the top challenges for builders in 2024, it’s clear how crucial financial planning and access to construction loans are. Navigating issues like rising material costs and labor shortages requires strategic funding, making construction loans a key resource. It emphasizes the need for builders to secure flexible financing options to overcome challenges and ensure the successful completion of projects in this dynamic construction landscape.