U.S. Consumer Debt Rises to $5.1 Trillion in the Third Quarter

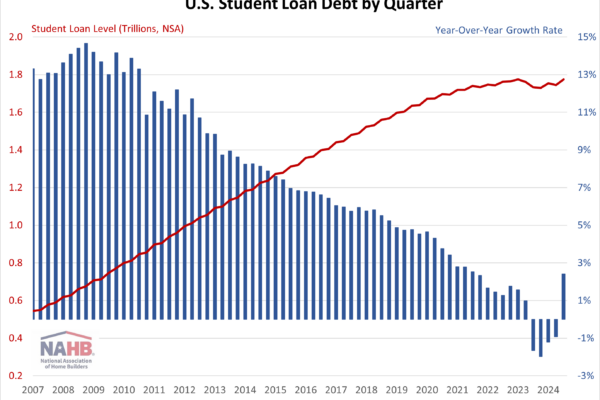

Total outstanding U.S. consumer debt stood at $5.10 trillion for the third quarter of 2024, increasing at an annualized rate of 3.28% (seasonally adjusted), according to the Federal Reserve’s G.19 Consumer Credit Report. In general, consumer debt has been slowing over the past two years,…