Existing home sales rose in November from a 13-year low, ending a five-month decline, according to the National Association of Realtors (NAR). This increase in sales was driven by a strong gain in the South, where homes are considered more affordable. Low inventory and strong demand continued to drive up existing home prices. However, recent declines in mortgage rates and a continued improvement in inventory are expected to fuel more demand in the coming months.

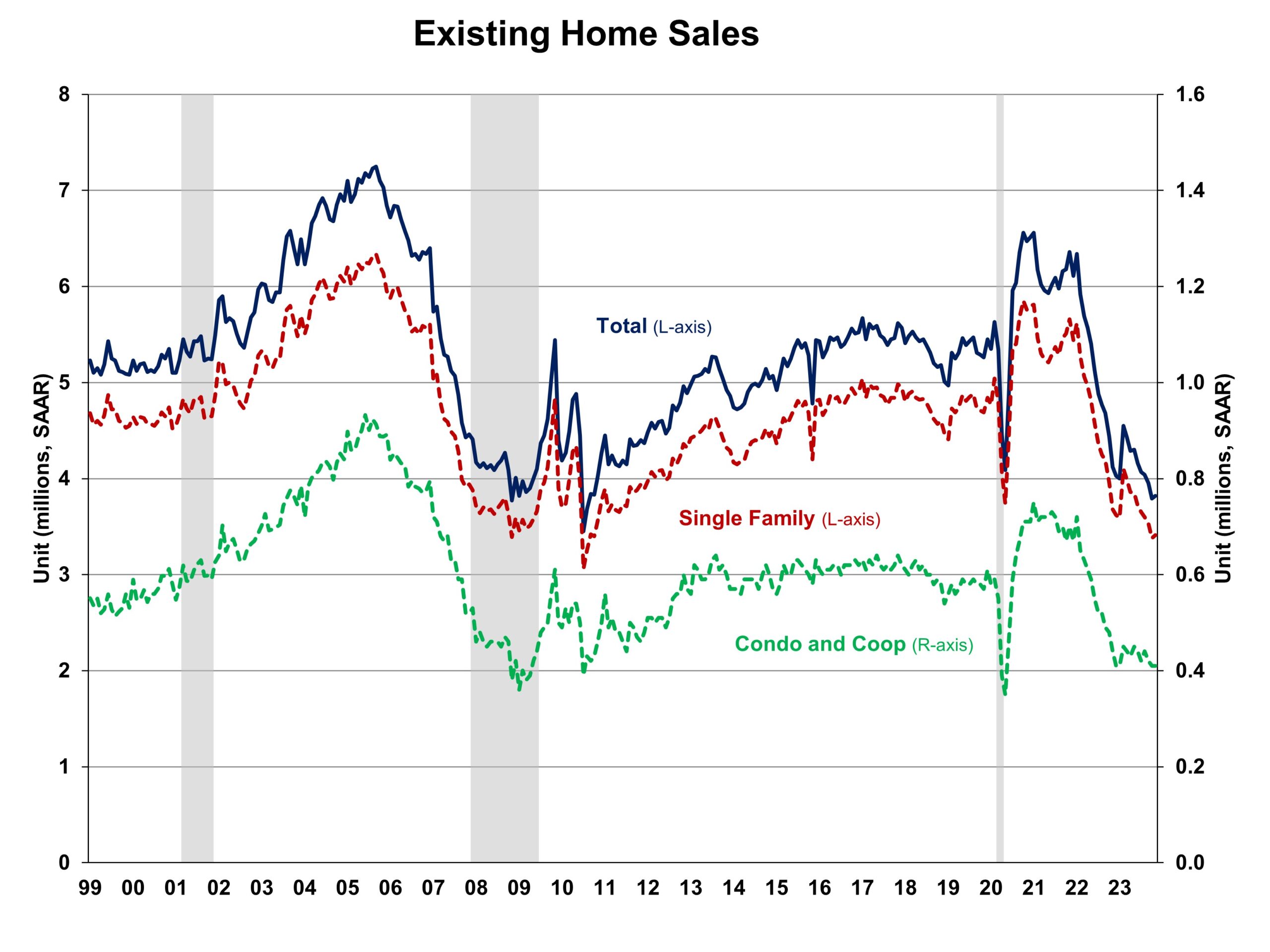

Total existing home sales, including single-family homes, townhomes, condominiums, and co-ops rose 0.8% to a seasonally adjusted annual rate of 3.82 million in November. On a year-over-year basis, sales were 7.3% lower than a year ago.

The first-time buyer share rose to 31% in November, up from 28% in October 2023 and November 2022. The November inventory level decreased slightly to 1.13 million units but was up 0.9% from a year ago.

At the current sales rate, November unsold inventory sits at a 3.5-months’ supply, down from 3.6-months last month and 3.3-months a year ago. This inventory level remains very low compared to balanced market conditions (4.5 to 6 months’ supply) and illustrates the long-run need for more home construction.

Homes stayed on the market for an average of 25 days in November, up from 23 days in October 2023 and 24 days in November 2022. In November, 62% of homes sold were on the market in less than a month.

The November all-cash sales share was 27% of transactions, down from 29% in October but up from 26% a year ago. All-cash buyers are less affected by changes in interest rates.

The November median sales price of all existing homes was $387,600, up 4.0% from last year. The median condominium/co-op price in November was up 8.6% from a year ago at $350,100.

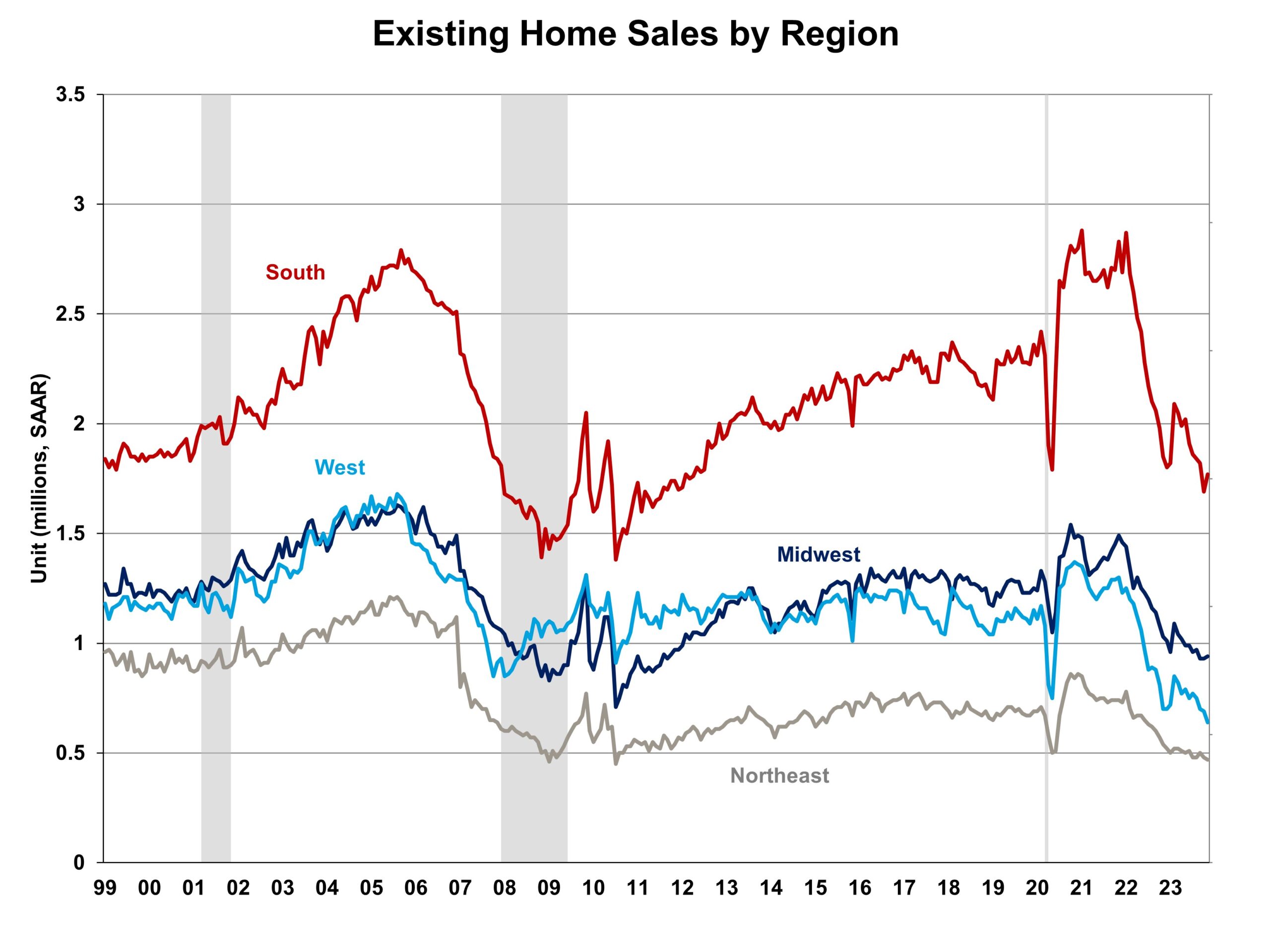

Existing home sales in November were varied across the four major regions. Sales in the Midwest and South increased 1.1% and 4.7% in November, while sales in the Northeast and West fell 2.1% and 7.2%. However, on a year-over-year basis, all four regions continued to see a decline in sales, ranging from 4.3% in the South to 13.0% in the Northeast.

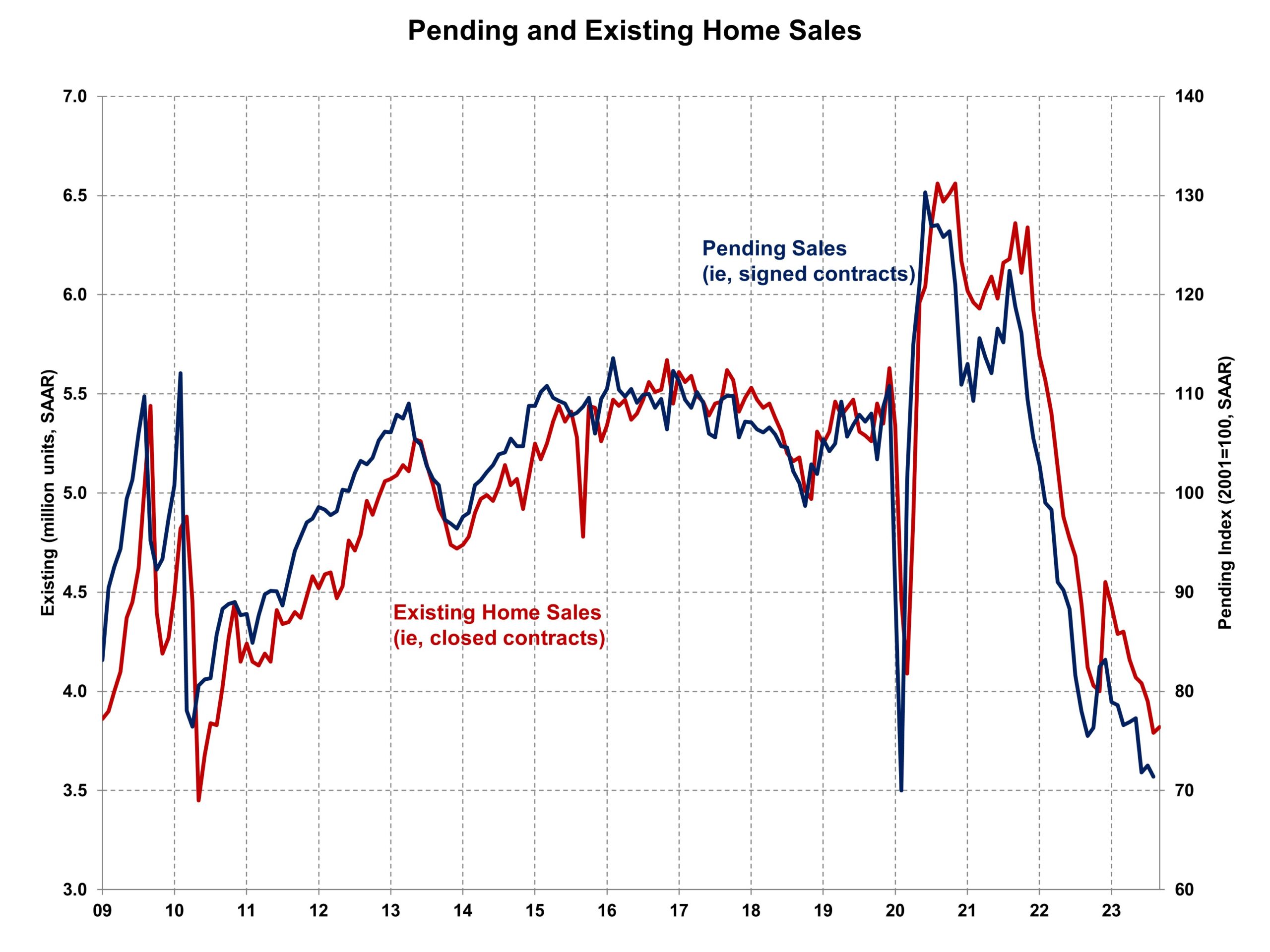

The Pending Home Sales Index (PHSI) is a forward-looking indicator based on signed contracts. The PHSI fell 1.5% from 72.5 to 71.4 in October, the lowest level since the index started in 2001. On a year-over-year basis, pending sales were 8.5% lower than a year ago per the NAR data.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.