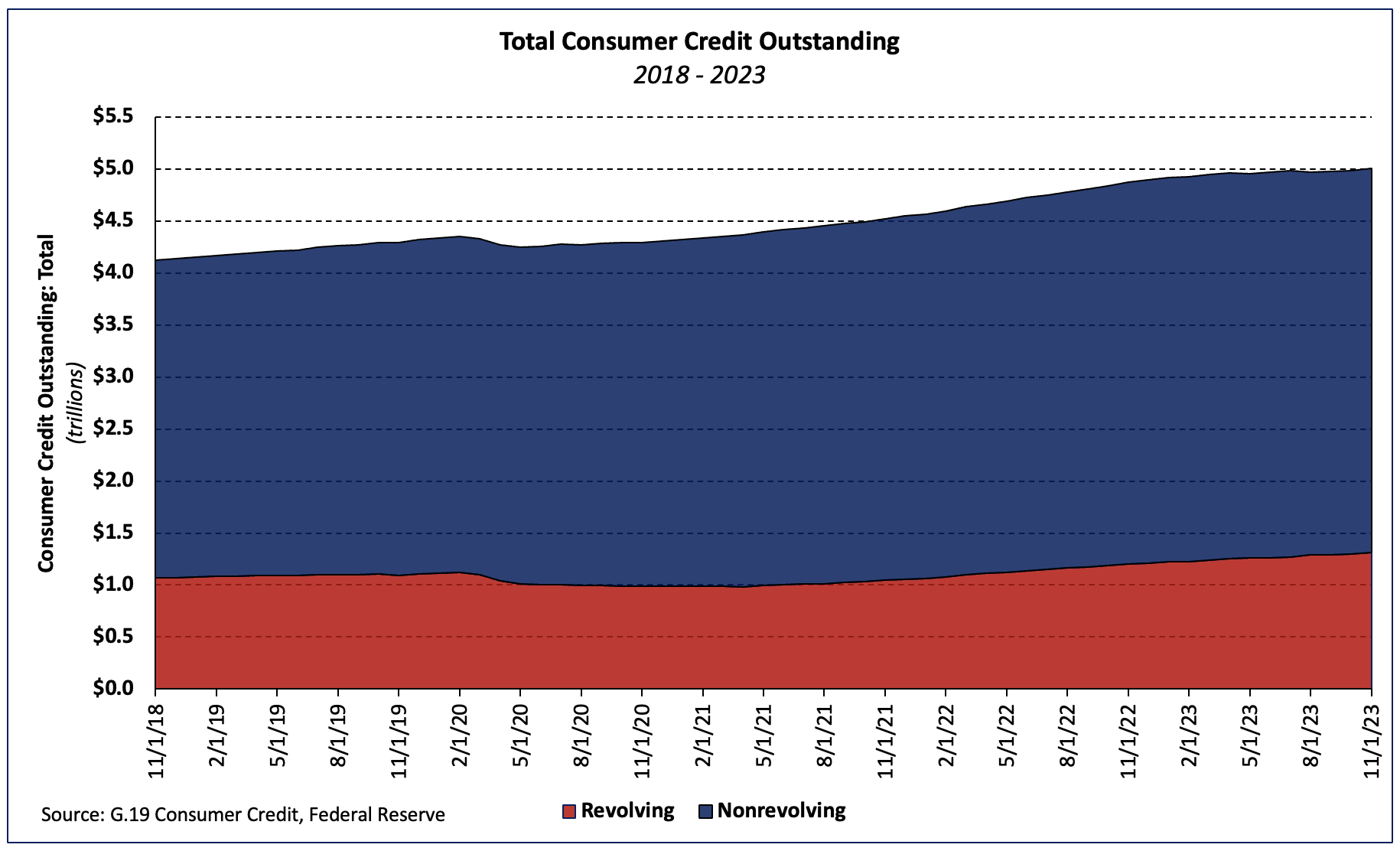

According to the Federal Reserve’s latest G.19 Consumer Credit report, total consumer credit outstanding totaled $5.00 trillion (seasonally adjusted) for the first time in November—a 5.7% monthly increase (seasonally adjusted annual rate). The increase reflected a 17.7% surge in revolving credit and a more modest 1.5% rise in nonrevolving credit (SAAR).

The level of revolving debt (primarily credit card debt) rose $19.1 billion over the month. Both the dollar amount as well as the percentage increase were the largest since March 2022 and the second-largest since April 1998.

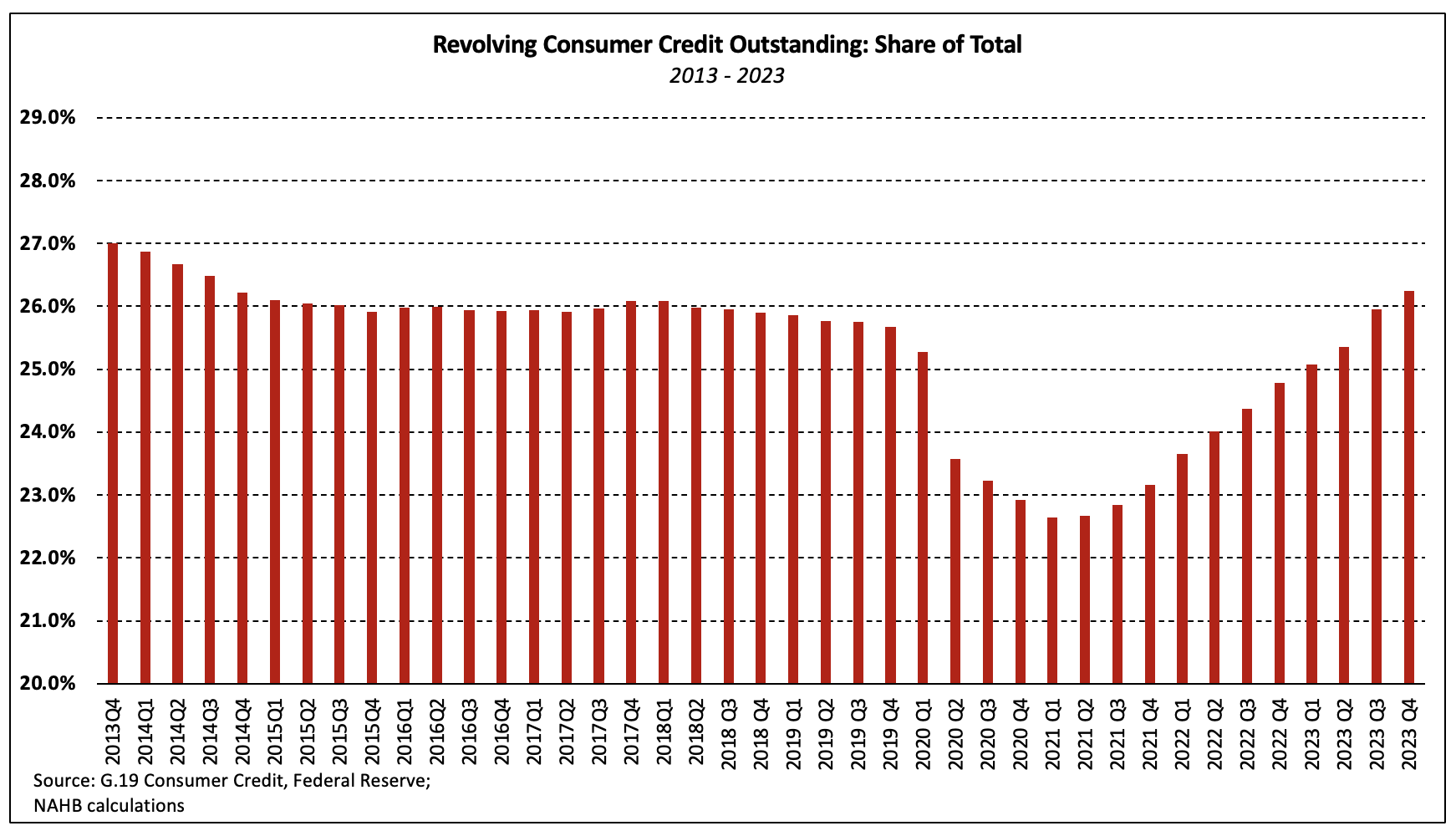

Revolving and nonrevolving debt accounted for 26.2% and 73.8% of total consumer debt, respectively. Although it reached a 32-year low in April 2021, revolving consumer credit as a share of the total has slowly risen to its highest level since December 2014.

Credit Card and Auto Loan Terms

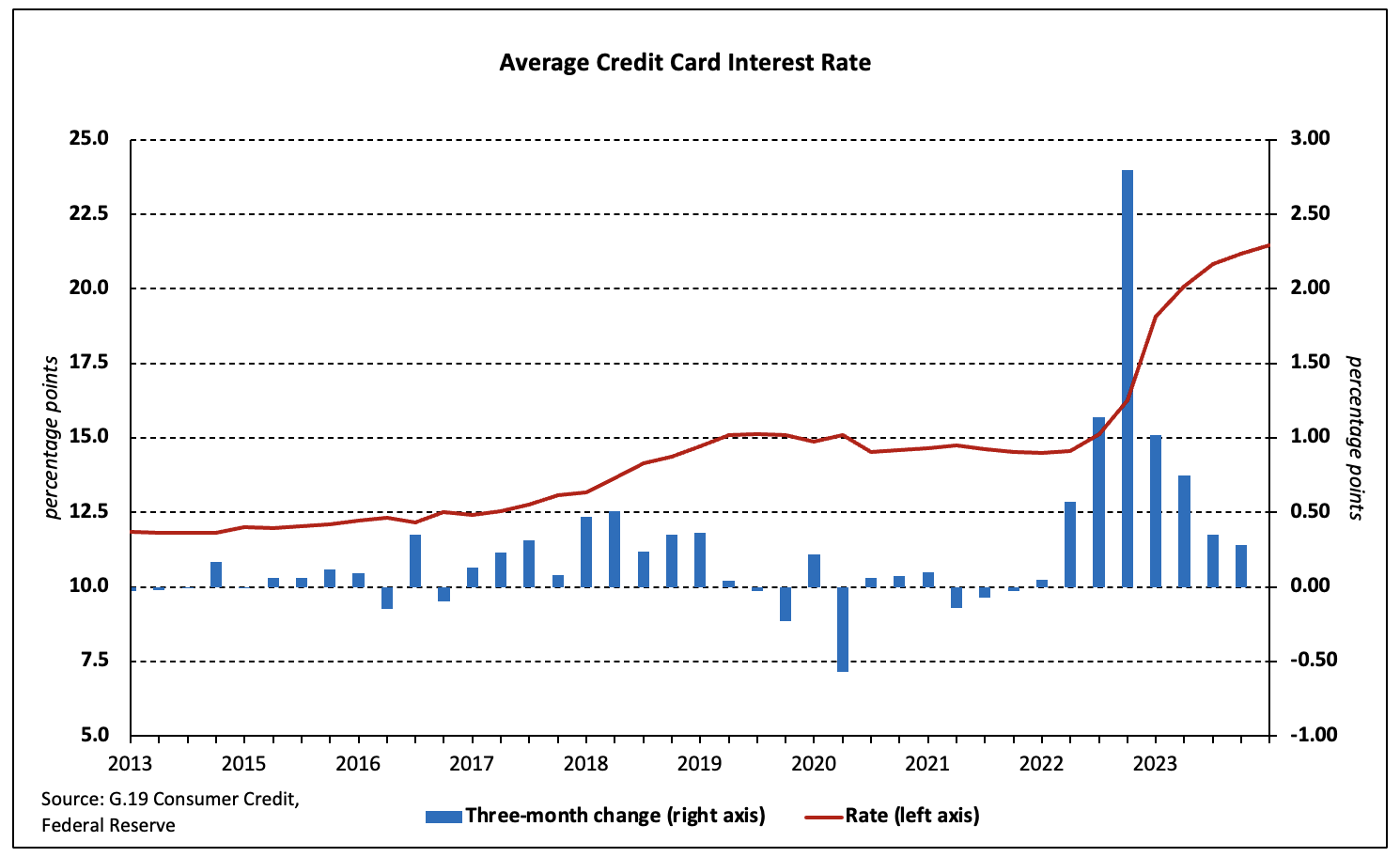

Every three months, the G.19 report includes average interest rates on credit card plans and new car loans. The average interest rate assessed on credit cards rose 0.3 percentage point to 21.5%–the highest rate in series history—between August and November.

Auto loan interest rates continued to climb as the rate for a 60-month new car loan increased to 8.15% in November—the highest reading on record. The rate has surged 3.63 ppts—roughly 80%–since the Federal Reserve began the current rate hike cycle in the first quarter of 2022.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Fascinating insights into the surge in consumer credit outstanding, particularly the spike in credit card debt. Construction professionals should stay vigilant as increased consumer indebtedness may impact borrowing environments. Monitoring lending conditions becomes crucial for those seeking construction loans to manage potential shifts in the financial landscape and maintain project feasibility