Mortgage rates that continue to hover in the 7% range along with elevated construction financing costs continue to put a damper on builder sentiment.

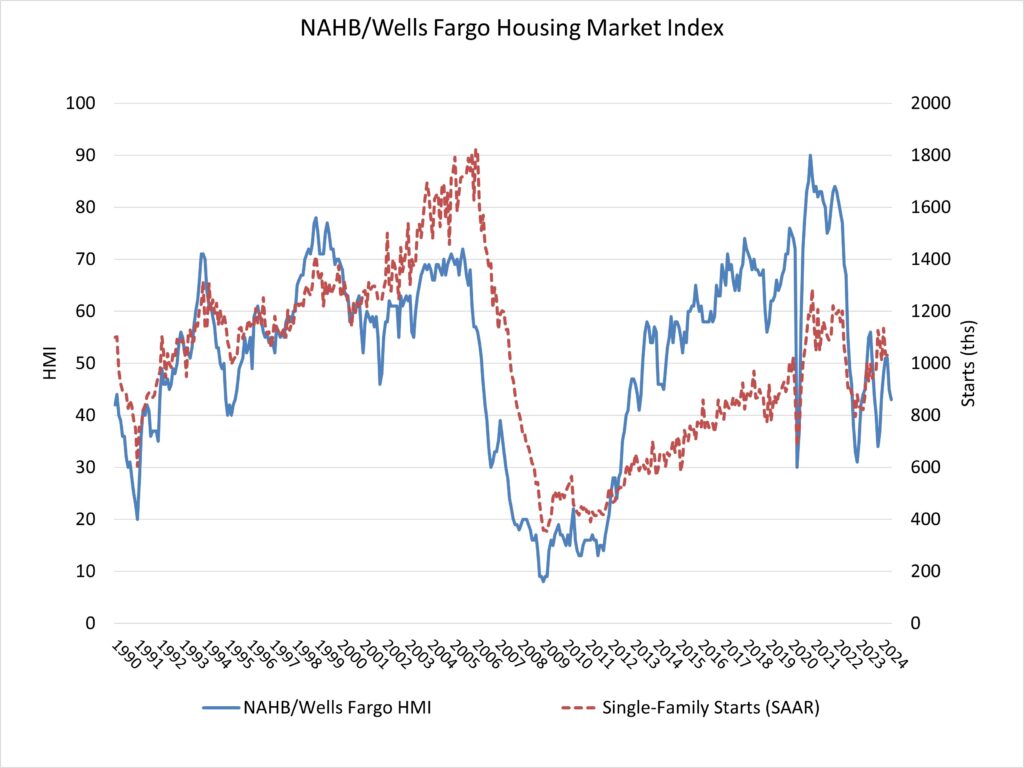

Builder confidence in the market for newly built single-family homes was 43 in June, down two points from May, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the lowest reading since December 2023.

Persistently high mortgage rates are keeping many prospective buyers on the sidelines.

The economy, and monetary policy more directly, is in an unusual situation because a lack of progress on reducing shelter inflation, which is currently running at a 5.4% year-over-year rate, is making it difficult for the Federal Reserve to achieve its target inflation rate of 2%. The best way to bring down shelter inflation and push the overall inflation rate down to the 2% range is to increase the nation’s housing supply. A more favorable interest rate environment for construction and development loans would help achieve this aim.

The June HMI survey also revealed that 29% of builders cut home prices to bolster sales in June, the highest share since January 2024 (31%) and well above the May rate of 25%. However, the average price reduction in June held steady at 6% for the 12th straight month. Meanwhile, the use of sales incentives ticked up to 61% in June from a reading of 59% in May. This metric is at its highest share since January 2024 (62%).

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI component indices posted declines in June and all are below the key threshold of 50 for the first time since December 2023. The HMI index charting current sales conditions in June fell three points to 48, the component measuring sales expectations in the next six months fell four points to 47 and the gauge charting traffic of prospective buyers declined two points to 28.

Looking at the three-month moving averages for regional HMI scores, the Northeast held steady at 62, the Midwest dropped three points to 47, the South decreased three points to 46 and the West posted a two-point decline to 41. HMI tables can be found at nahb.org/hmi.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.