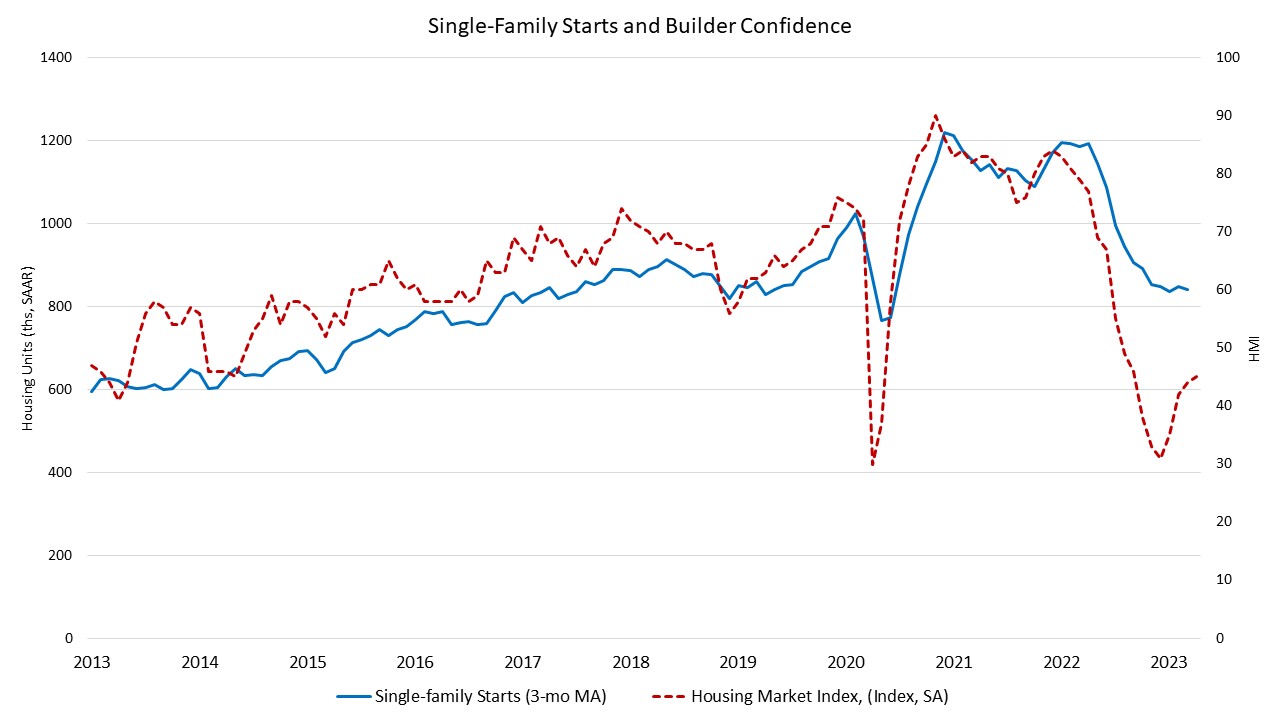

Single-family production showed signs of a gradual upturn in March as stabilizing mortgage rates and limited existing inventory helped to offset stubbornly high construction costs, building labor shortages and tightening credit conditions. This is reflected in the slight uptick in builder sentiment in April.

Overall housing starts in March decreased 0.8% to a seasonally adjusted annual rate of 1.42 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

The March reading of 1.42 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 2.7% to an 861,000 seasonally adjusted annual rate. The three-month moving average (a useful gauge given recent volatility) edged down to 841,000 starts, as charted below. On a year-over-year basis, single-family housing starts are down 27.7% compared to March 2022.

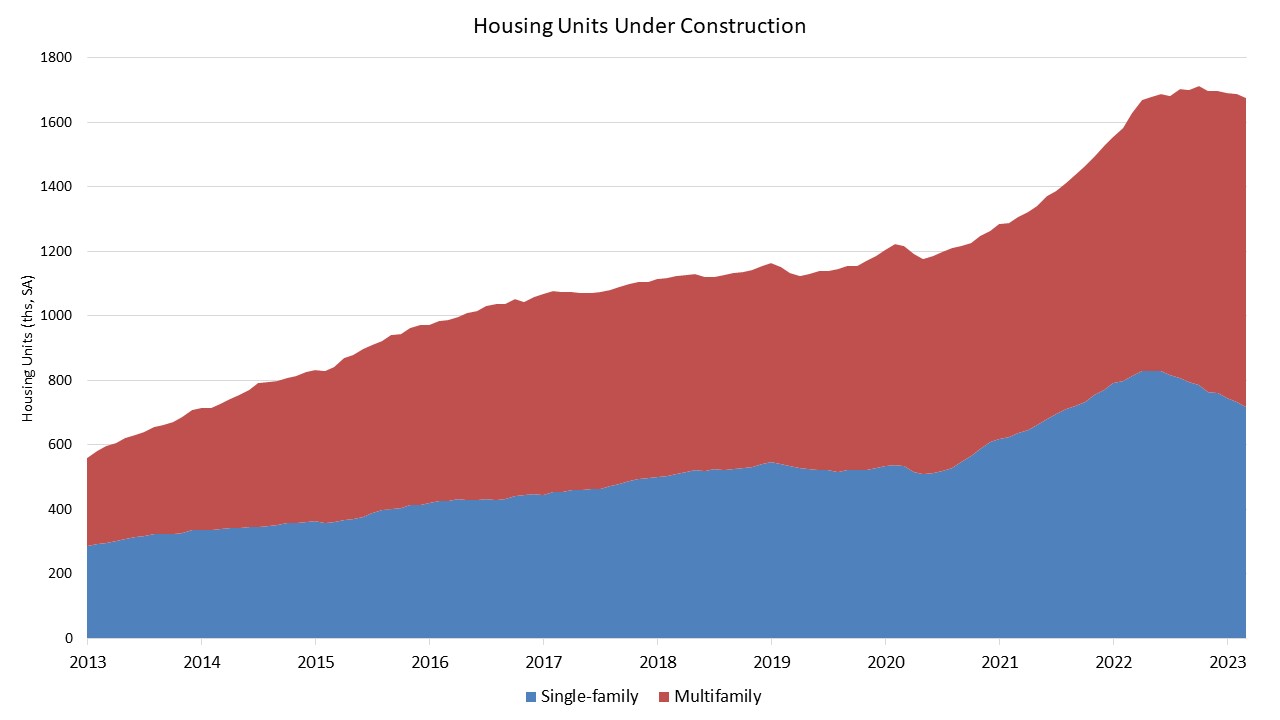

The multifamily sector, which includes for-rent apartment buildings and condos, decreased 5.9% to an annualized 559,000 pace for 2+ unit construction in March. The three-month moving average for multifamily construction has been a solid 555,000-unit annual rate. On a year-over-year basis, multifamily construction is up 6.5%.

On a regional and year-to-date basis, combined single-family and multifamily starts were 8.3% lower in the Northeast, 34.5% lower in the Midwest, 11.5% lower in the South and 28.2% lower in the West.

As an indicator of the economic impact of housing, there are now 716,000 single-family homes under construction. This is 11.8% lower than a year ago. There are currently 958,000 apartments under construction, the highest levels since the fall of 1973, and is up 17.3% compared to a year ago (817,000). Total housing units now under construction (single-family and multifamily combined) are 2.8% higher than a year ago. In March, builders completed 15,000 more homes than began construction, resulting in a decline for the construction pipeline.

Overall permits decreased 8.8% to a 1.41 million unit annualized rate in March. Single-family permits increased 4.1% to an 818,000 unit rate, but are down 29.7% compared to a year ago. Multifamily permits decreased 22.1% to an annualized 595,000 pace and is down 16.9% compared to March 2022.

Looking at regional overall permit data on a year-to-date basis, permits were 24.5% lower in the Northeast, 25.3% lower in the Midwest, 15.7% lower in the South and 28.1% lower in the West.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.