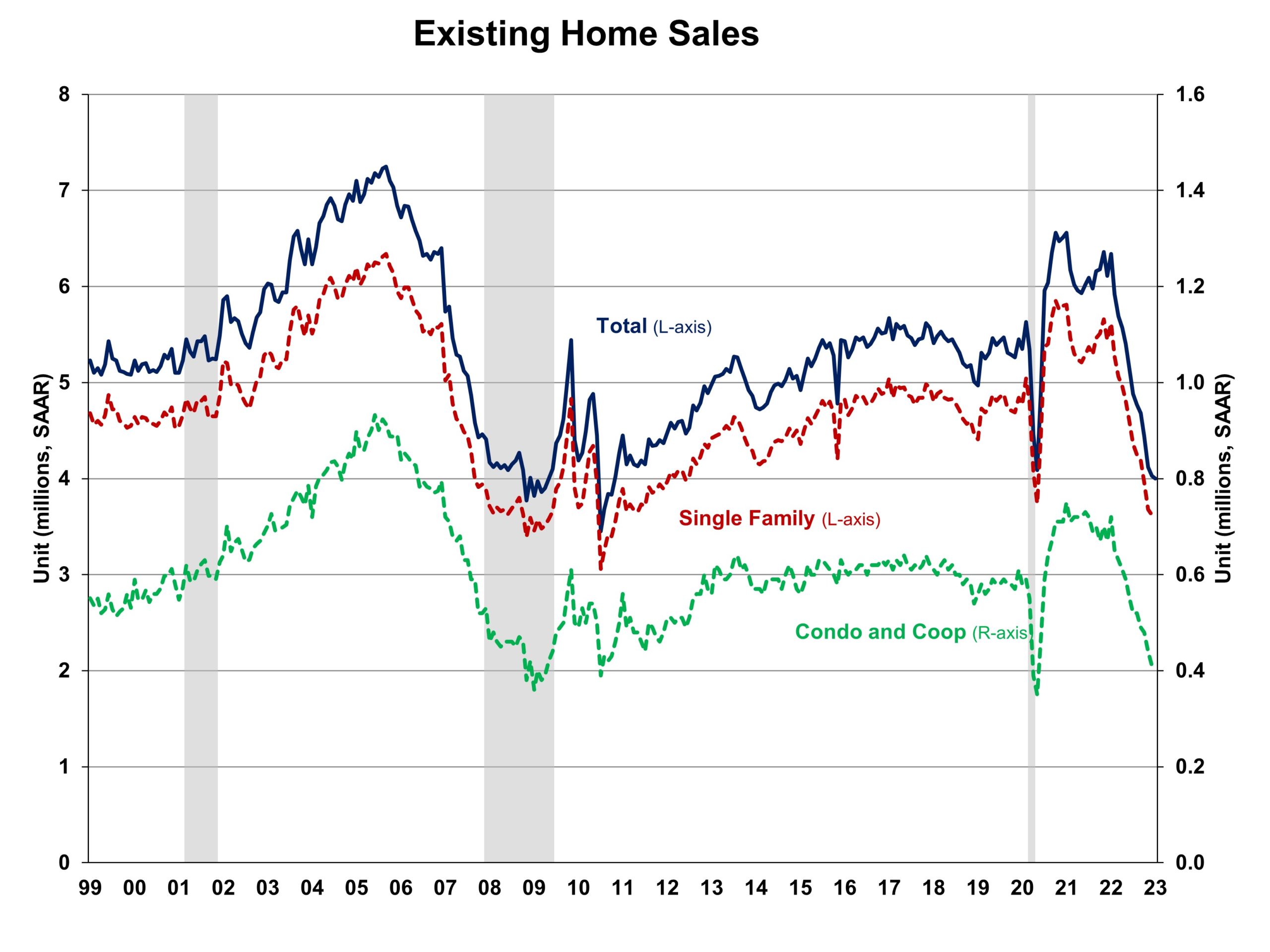

As elevated mortgage rates and tight inventory continue to weaken housing demand, the volume of existing home sales declined for a twelfth consecutive month as of January, according to the National Association of Realtors (NAR). This is the longest run of declines since 1999. While mortgage rates have stabilized in January, they are likely to see a rise in the short run with additional tightening of monetary policy. Additionally, home price appreciation slowed for a consecutive seventh month after reaching a record high existing home average of $413,800 in June.

Total existing home sales, including single-family homes, townhomes, condominiums and co-ops, fell 0.7% to a seasonally adjusted annual rate of 4.0 million in January, the lowest pace since November 2010 with the exception of April and May 2020. On a year-over-year basis, sales were 36.9% lower than a year ago.

The first-time buyer share stayed at 31% in January, unchanged from last month but up from 27% in January 2022. The fact that this share has stayed stable is a positive sign of future homebuying demand. The January inventory level measure rose from 0.96 to 0.98 million units and was up 0.85 million from a year ago.

At the current sales rate, January unsold inventory sits at a 2.9-month supply, unchanged from last month but up from a 1.6-months reading a year ago.

Homes stayed on the market for an average of 33 days in January, up from 26 days in December and 19 days in January2022. In January, 54% of homes sold were on the market for less than a month.

The January all-cash sales share was 29% of transactions, up from 28% last month and 27% a year ago. All-cash buyers are less affected by changes in interest rates.

The January median sales price of all existing homes was $359,000, up 1.3% from a year ago, representing the 131st consecutive month of year-over-year increases, the longest-running streak on record. The median existing condominium/co-op price of $320,000 in January was up 5.2% from a year ago.

Regionally, existing home sales were mixed in January. Sales in the South and West rose 1.1% and 2.9% last month, while sales in the Northeast and Midwest fell 3.8% and 5.0%, respectively. On a year-over-year basis, all four regions continued to see a double-digit decline in sales, ranging from 33.3% in the Midwest to 42.4% in the West.

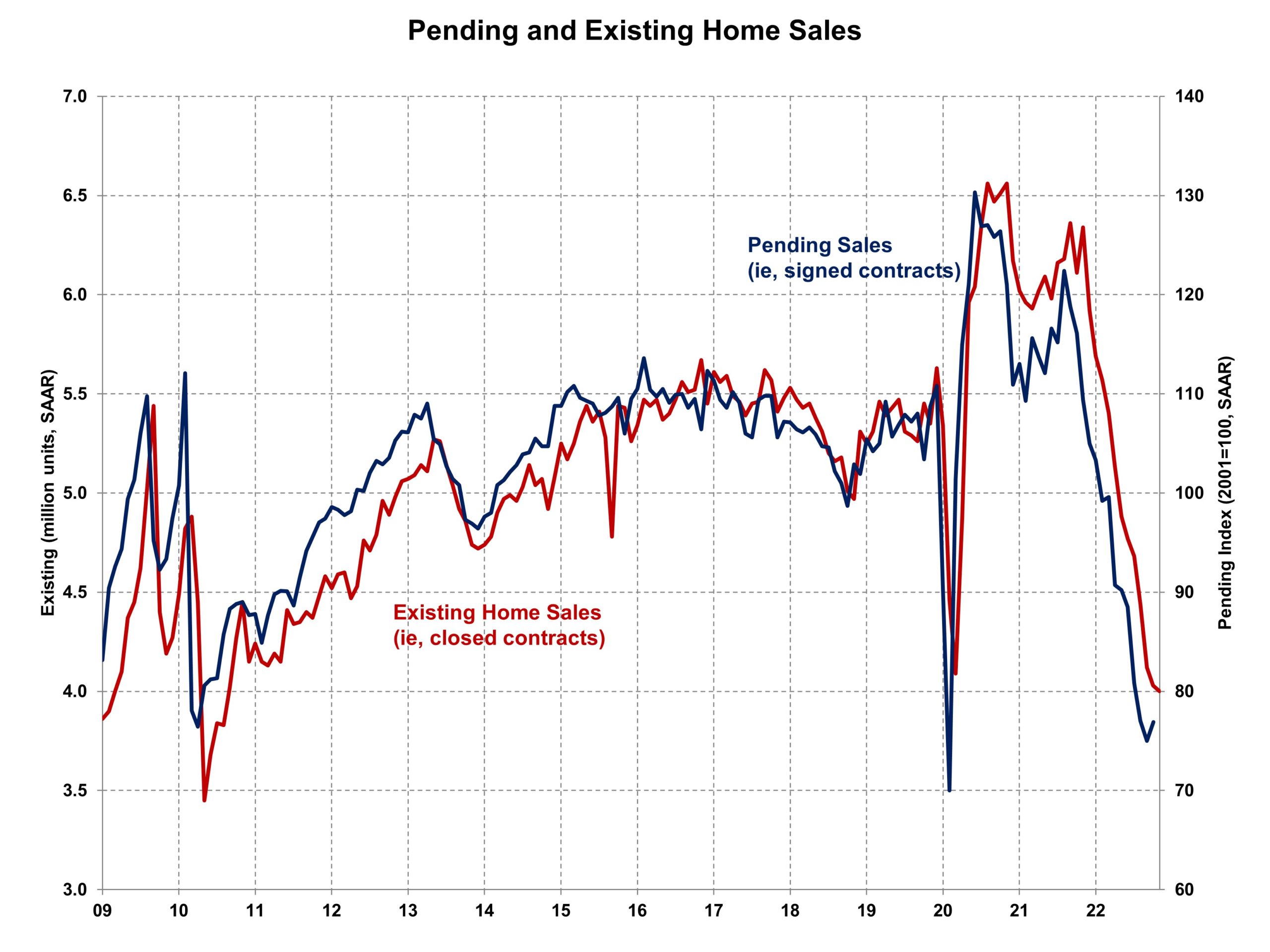

The Pending Home Sales Index (PHSI) is a forward-looking indicator based on signed contracts. The PHSI rose 2.5% from 75.0 to 76.9 in December, the first time increase since May 2022. On a year-over-year basis, pending sales were 33.8% lower than a year ago per the NAR data.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.