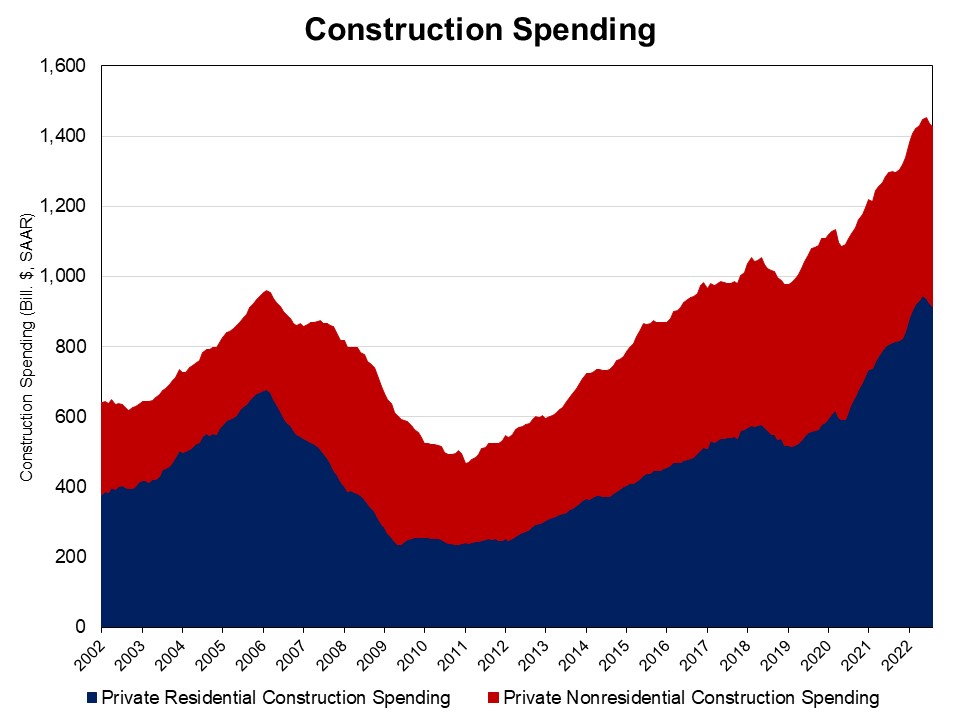

Private residential construction spending declined 0.9% in August, as single-family construction spending slid amid surging mortgage rates. Private residential construction spending declined for the third consecutive month, standing at an annual pace of $921.9 billion, according to NAHB’s analysis of the Census Construction Spending data. However, this spending category was 12.5% higher year-over-year.

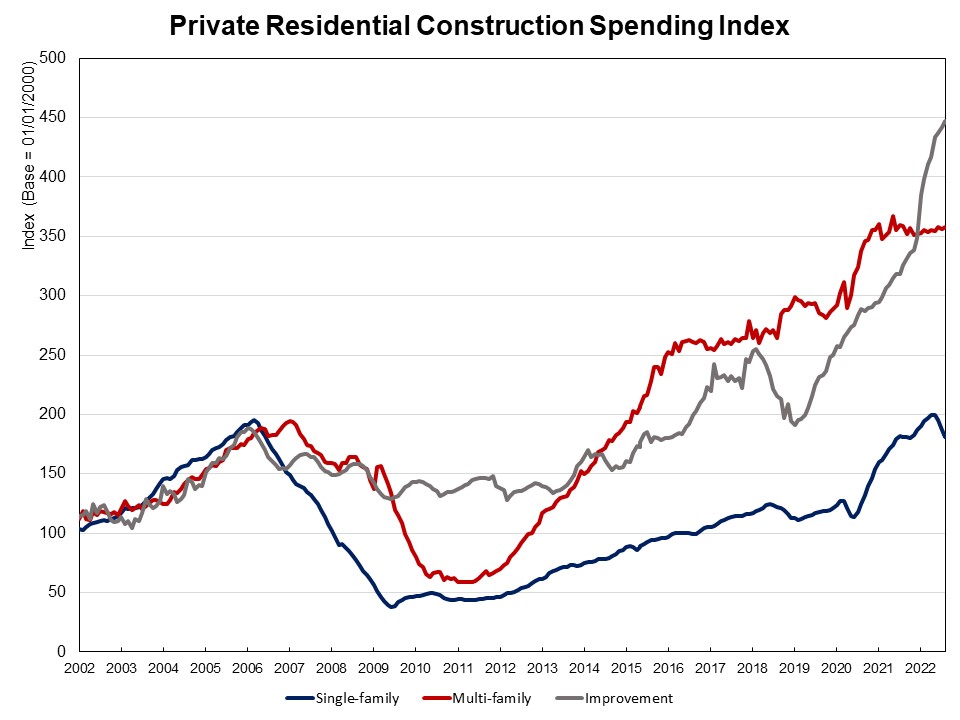

The monthly declines are largely attributed to lower spending on single-family construction. Single-family construction spending dropped 2.9% in August, after a decline of 4.3% in July. Rising mortgage rates and supply chain disruptions put a damper on the housing market. Nonetheless, single-family construction spending was virtually unchanged over a year ago.

Multifamily construction spending edged up by 0.4% in August, after a decrease of 0.4% in July. However, spending on multifamily construction was 0.2% below the August 2021 estimates.

Private residential improvements rose by 1% in August and was 37.2% higher over a year ago, as summer is the best time for remodeling. Keep in mind that construction spending reports the value of property put-in-place, so it is a measure of property value placed in service at the end of the construction pipeline.

The NAHB construction spending index, which is shown in the graph below (the base is January 2000), illustrates how construction spending on single-family has slowed since early 2022 under the pressure of supply-chain issues and elevated interest rates. Multifamily construction held steady in recent months, while improvement spending has increased pace since early 2019. Before the COVID-19 crisis hit the U.S. economy, single-family and multifamily construction spending experienced solid growth from the second half of 2019 to February 2020, followed by a quick post-covid rebound since July 2020.

Spending on private nonresidential construction decreased by 0.1% in August to a seasonally adjusted annual rate of $513.1 billion. The monthly private nonresidential spending decrease was mainly due to smaller spending on the class of power property (-$0.9 billion), followed by the manufacturing category (-$0.5 billion), and the educational category (-$0.04 billion).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.