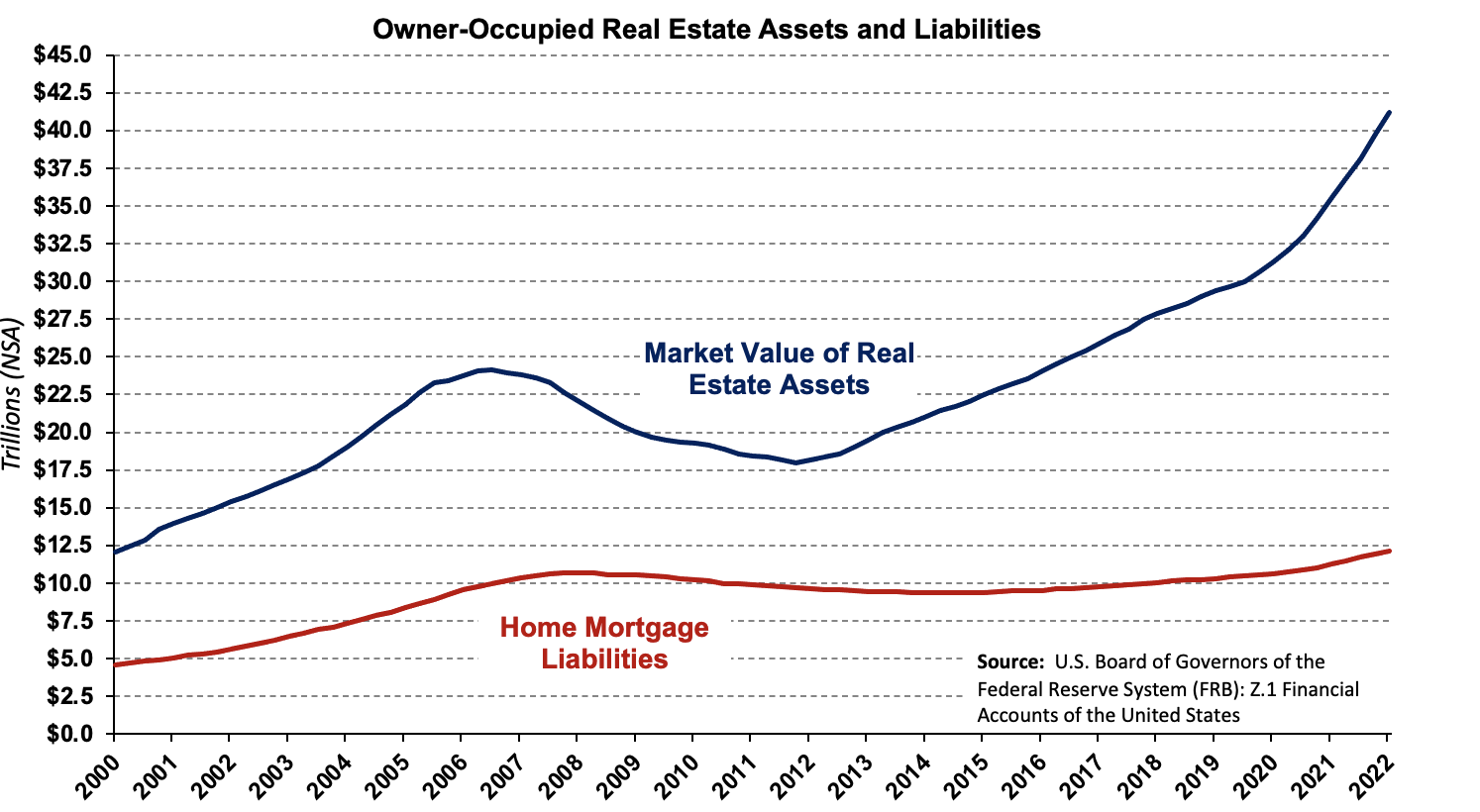

The latest results from the Federal Reserve’s Z.1 Financial Accounts of the United States, i.e., the Flow of Funds, show that in the second quarter of 2022, growth of the market value of all owner-occupied real estate in the United States slowed after showed the largest year-over-year percentage gain since 2001 the prior quarter.

The market value of owner-occupied real estate increased $1.5 trillion to $41.2 trillion in the second quarter of 2022, on a non-seasonally adjusted basis.

Household real estate assets’ year-over-year gain in the second quarter was 15.9%, down from 16.2% the prior quarter. Quarter-over-quarter increases slowed from 4.3% to 3.7% in Q2 2022 in line with slowing home price growth. Remodeling also contributed to the slowdown in total market value as a remodeling activity declined both year-over-year as well as quarter-over-quarter.

Real-estate secured liabilities of households’ balance sheets, i.e., mortgages, home equity loans, and HELOCs, increased 2.2% over the prior quarter and 8.0%, year-over-year. Similarly, aggregate owners’ equity (i.e., the difference between homeowners’ real estate-secured assets and liabilities) rose from $27.8 trillion to $29.0 trillion, representing 70.4% of all owner-occupied household real estate.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

It’s already going DOWN. This data is OLD.