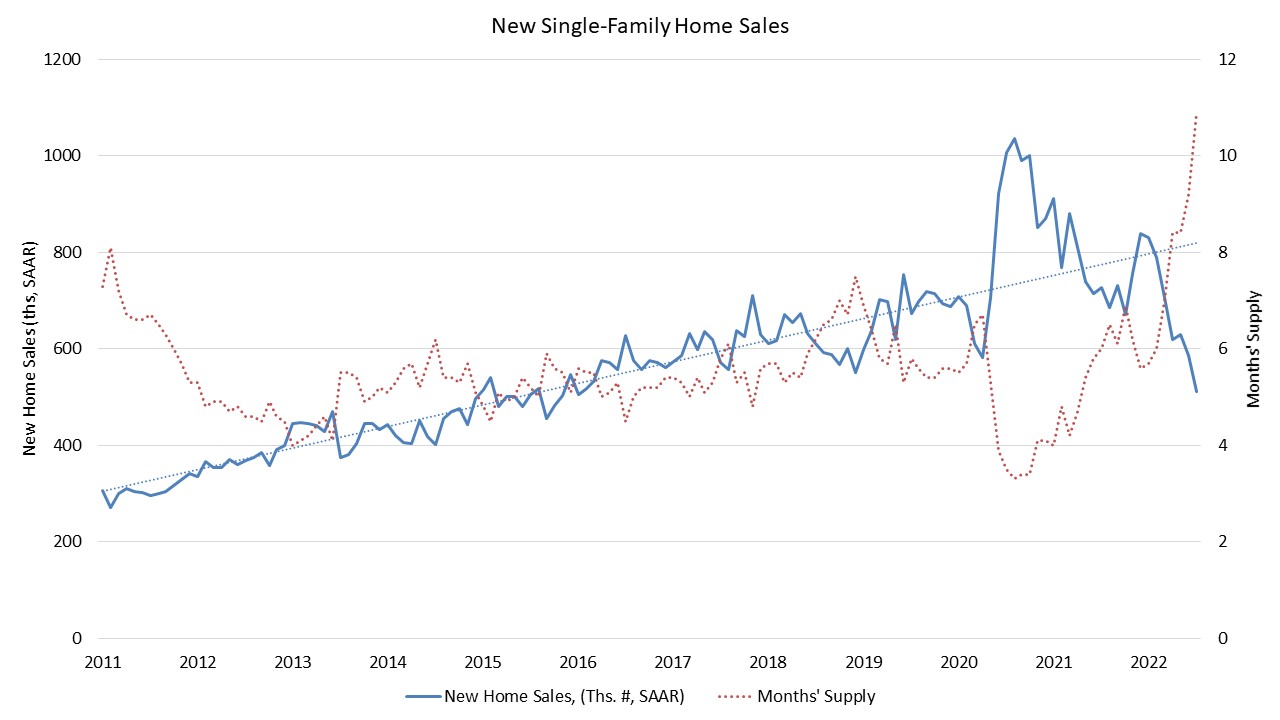

New home sales in July fell to their lowest level since January 2016 as the industry grapples with supply chain disruptions that are delaying new home building projects and raising housing costs as mortgage interest rates increased. The U.S. Department of Housing and Urban Development and the U.S. Census Bureau estimated sales of newly built, single-family homes in July at a 511,000 seasonally adjusted annual pace, which is a 12.6% decline over downwardly revised June rate of 585,000 and is 29.6% below the July 2021 estimate of 726,000.

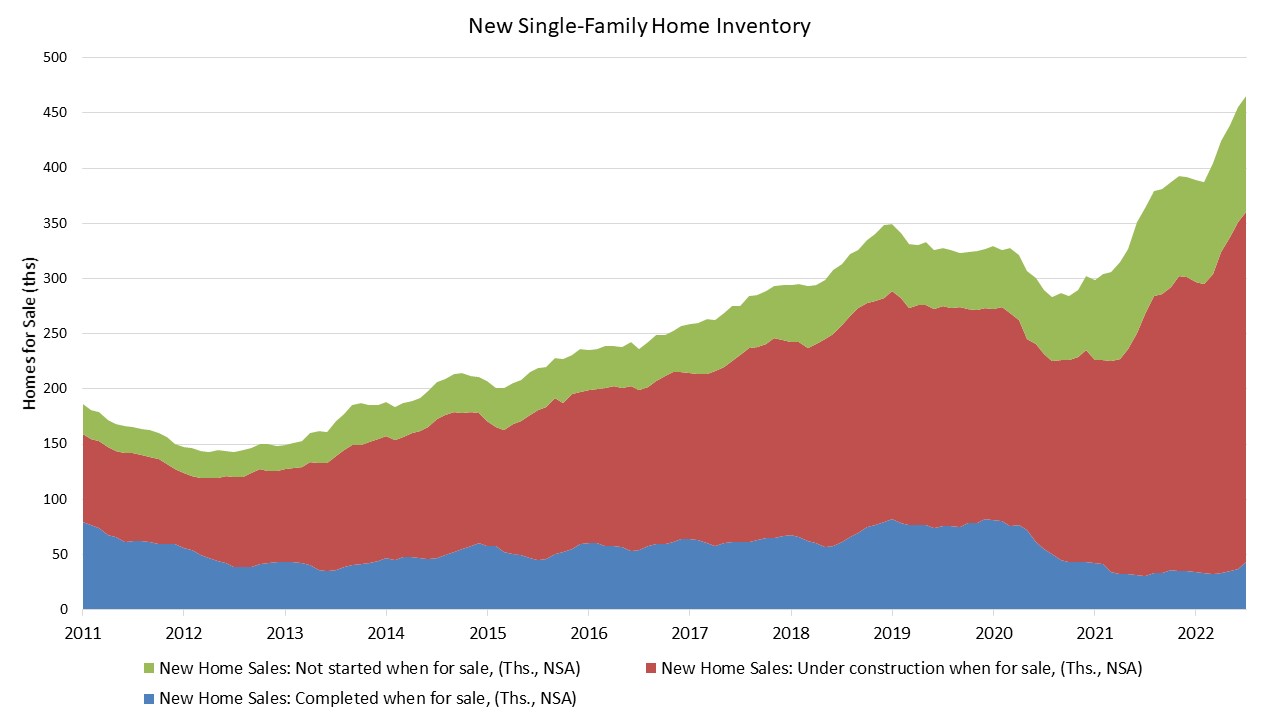

Sales-adjusted inventory levels are at an elevated 10.9 months’ supply in July. However, only 45,000 of the new home inventory is completed and ready to occupy. This count has been going up in recent months and is up 40.6% compared to a year ago. Moreover, sales are increasingly coming from homes that have not started construction, with that count up 22.6% year-over-year, not seasonally adjusted (NSA). The median sales price increased to $439,400 in July, up 5.9% compared to June and is up 8.2% compared to a year ago.

Nationally, on a year-to-date basis, new home sales are down 15.7% for the first seven months of 2022. Regionally, on a year-to-date basis, new home sales fell in all four regions, down 14.9% in the Northeast, 26.5% in the Midwest, 13.4% in the South, and 15.7% in the West.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

At this point, it would be wise of builders to focus on preserving their sales backlog. I suggest builders have a thorough review of their backlog conducted. If a builder has a buyer that does not have a locked in an interest rate valid until the time the home is to be completed, it’s time to get that done. If a builder has a buyer in the backlog that may not qualify at today’s or an interest rate 1% higher, it’s time to address that problem. The only thing worse than losing a sale out of the sales backlog is to have it occur after the new home is completed.