The financial performance of any company is directly linked to the industry environment in which it operates. Factors such as the number and size of its competitors, barriers to enter or exit, capital requirements, economies of scale, or the bargaining power of customers and suppliers all play a role in the potential profitability of a company. Given this reality, one of the most useful strategies to evaluate a company’s competitiveness is to compare its financial performance against profitability benchmarks for the industry as a whole. In order to create such reference points, NAHB periodically conducts the Builders’ Cost of Doing Business Study – a nationwide survey of single-family builders designed to produce exactly those profitability benchmarks for the home building industry. This post summarizes the findings published in the 2022 edition of the study.

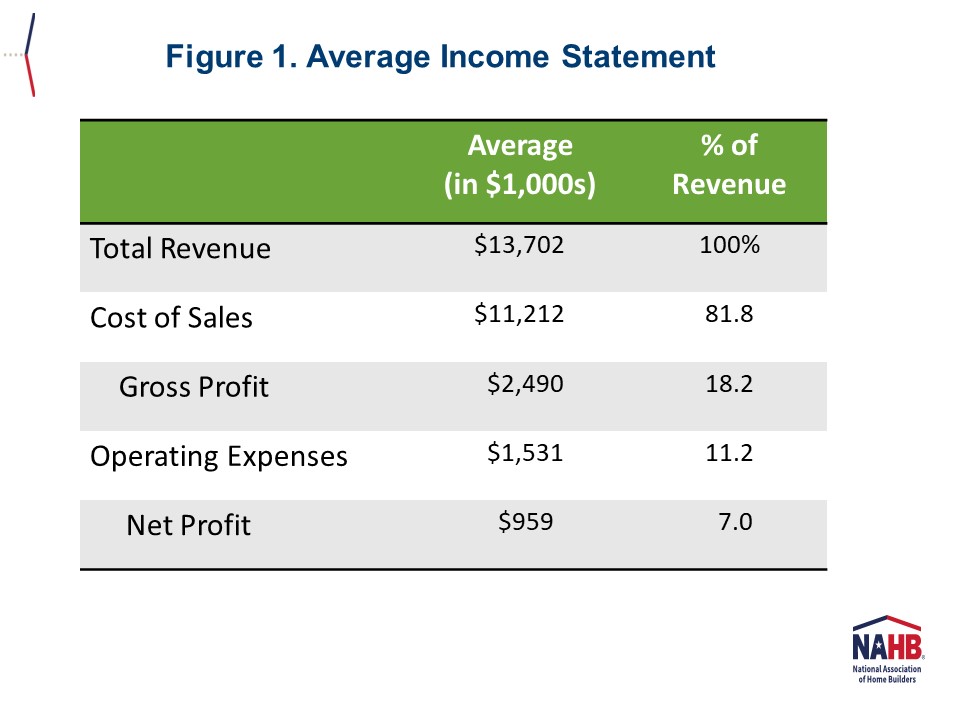

On average, builders reported $13.7 million in revenue for fiscal year 2020, of which $11.2 million (81.8%) was spent on cost of sales (i.e. land costs, direct and indirect construction costs) and another $1.5 million (11.2%) on operating expenses (i.e. finance, S&M, G&A, and owner’s compensation). As a result, builders averaged a gross profit margin of 18.2% and a net margin of 7.0% (Figure 1).

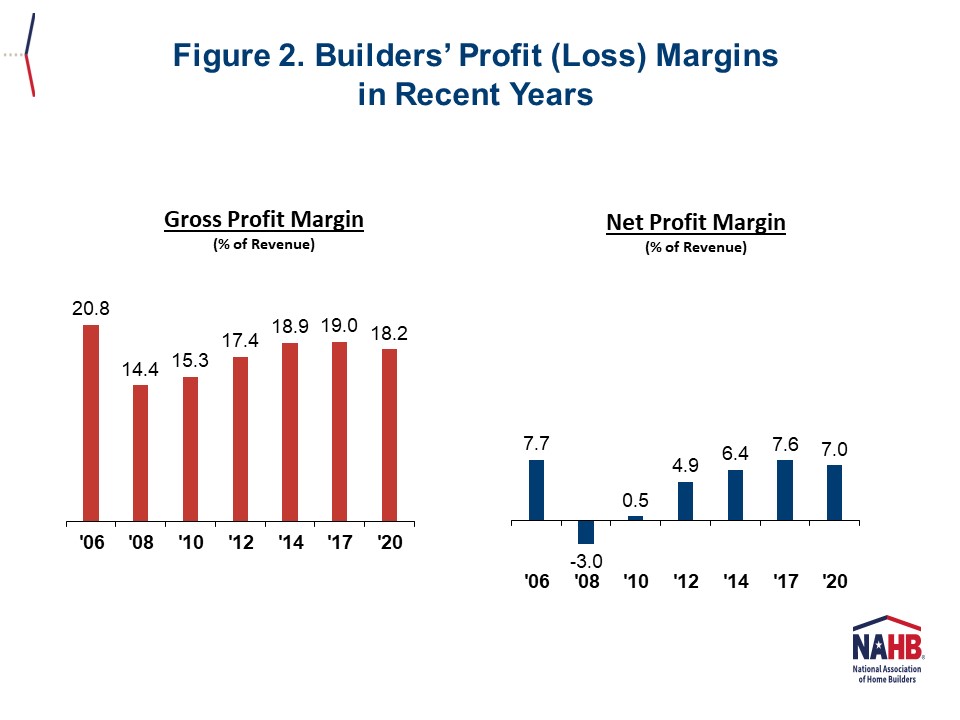

Builders’ profit margins declined in 2020 for the first time since 2008. As Figure 2 shows, their average gross margin fell dramatically during the housing recession (from 20.8% in 2006 to 14.4.% in 2008), but then rose steadily through 2017 (19.0%) before edging lower in 2020 (18.2%). Similarly, builders’ average net margin plummeted between 2006 and 2008 (7.7% to -3.0%), gradually increased through 2017 (7.6%), and then slipped back in 2020 (7.0%).

It is important, however, to put the latest results in context of the circumstances and realities of the time. 2020 was not a normal year for any person or business in any part of the world, as the COVID-19 pandemic engulfed our lives and economy. Like most businesses in the US, many builders were forced to shut down operations for a period of time, reinvent processes to ensure safety, provide health training to workers, limit visits to model homes, and adapt to office staff working remotely. Builders in 2020 also had to quickly learn how to navigate the uncertainties of supply-chain disruptions that made many building materials significantly costlier and unavailable on-demand. And, as if those issues were not challenging enough, the industry’s chronic labor shortage worsened as fear of the virus spread among workers and subcontractors.

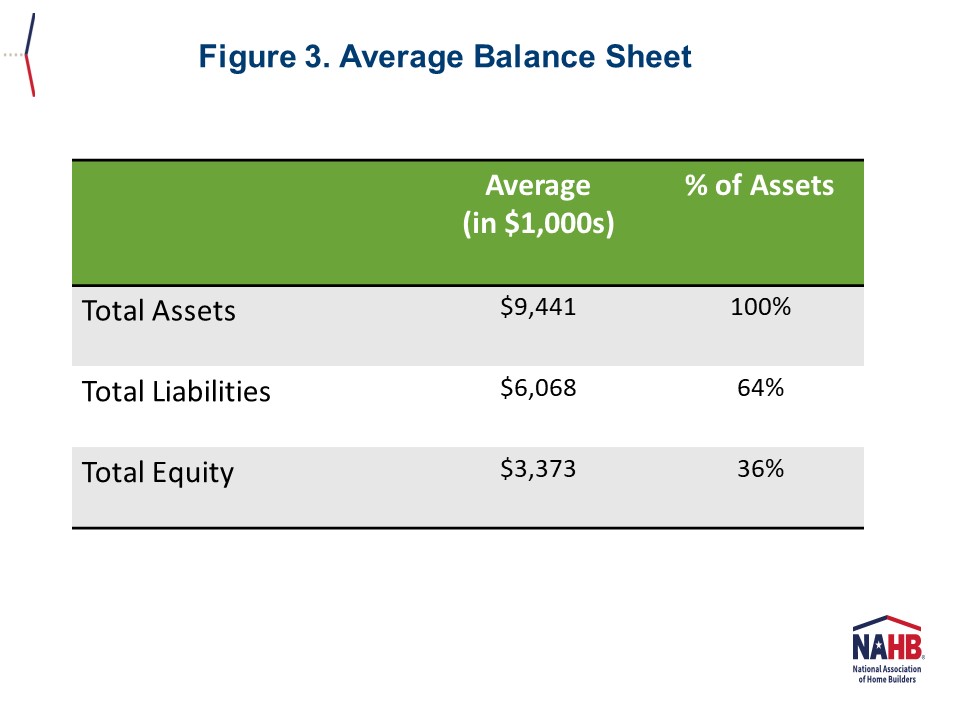

The Cost of Doing Business Study also tracks builders’ balance sheets. On average, builders reported $9.4 million in total assets on their 2020 balance sheets. Of that, $6.1 million (64%) was backed-up by liabilities (either short- or long-term) and the other $3.4 million (36%) by equity builders held in their companies (Figure 3).

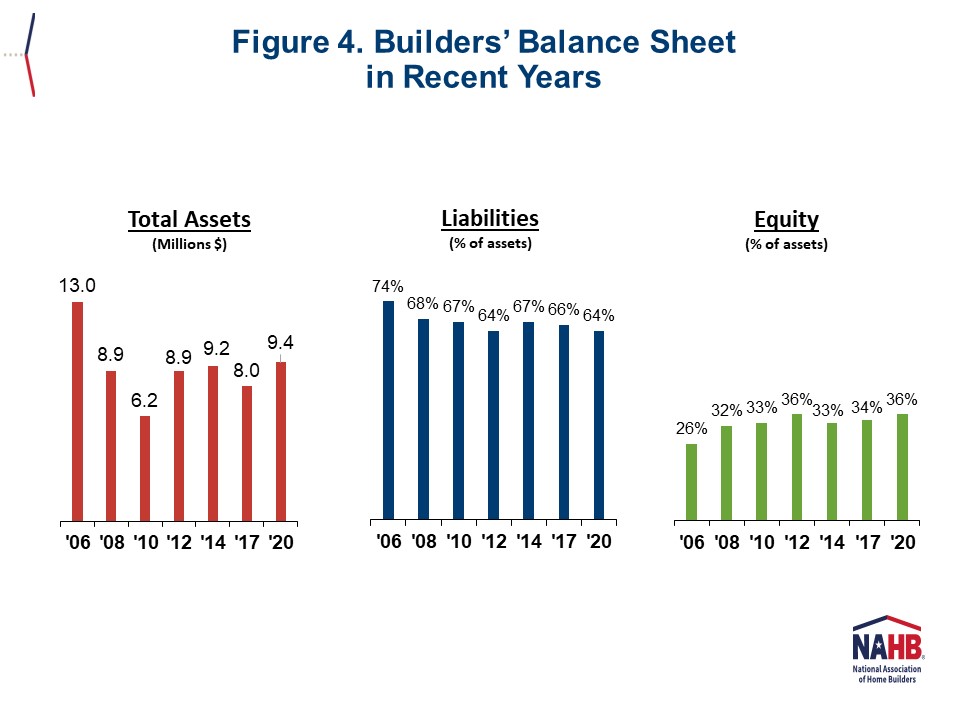

Builders’ balance sheets were larger in 2020 than at any time since 2006. That year, they owned an average of $13.0 million in assets. By 2010, that number had been cut in half to $6.2 million. Assets gained some ground and fluctuated over the next few years, before reaching $9.4 million in 2020 – the highest point since 2006 (Figure 4).

Historical data from the Cost of Doing Business Study shows that builders’ reliance on debt to finance their operations has declined over the years. In 2006, they had liabilities equivalent to 74% of their assets. By 2020, that share was down to 64%. The latter means builders started using more of their own capital to run their companies, and as a result equity went from representing 26% of assets in 2006 to 36% in 2020.

The NAHB Economics team is currently conducting similar research for the residential remodeling industry. If that is the primary activity of your firm, we need your help. Without your input, we can’t produce benchmarks for residential remodelers. Please email Rose Quint to participate at rquint@nahb.org.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.