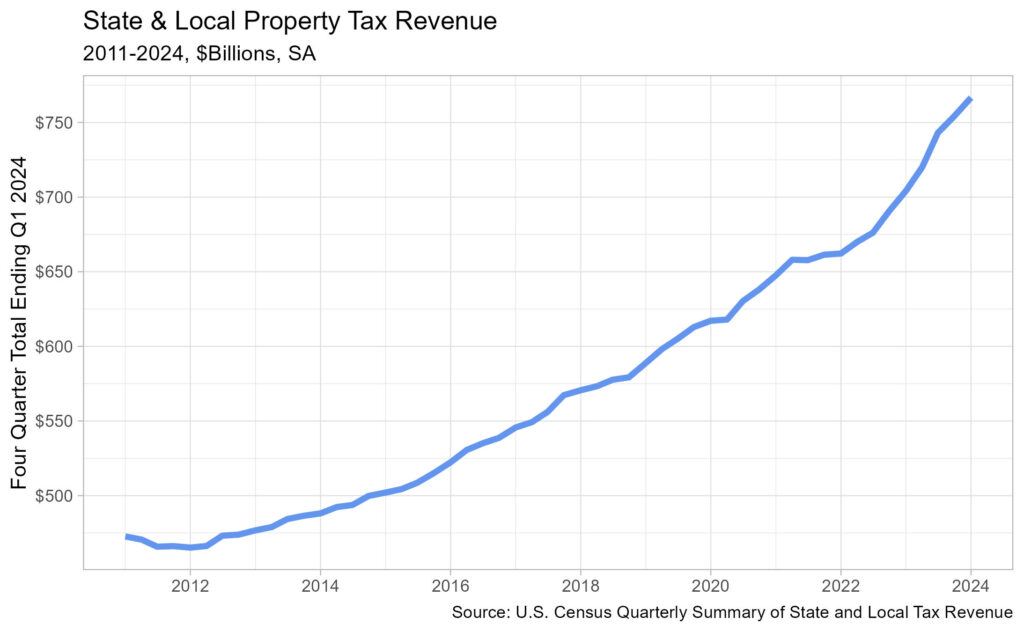

The Census Bureau’s quarterly summary of State & Local Tax Revenue shows a 1.7% increase in property taxes paid, rising from a revised estimate of $754.1 to $766.7 billion in the seasonally adjusted four quarters ending in the first quarter of 2024.

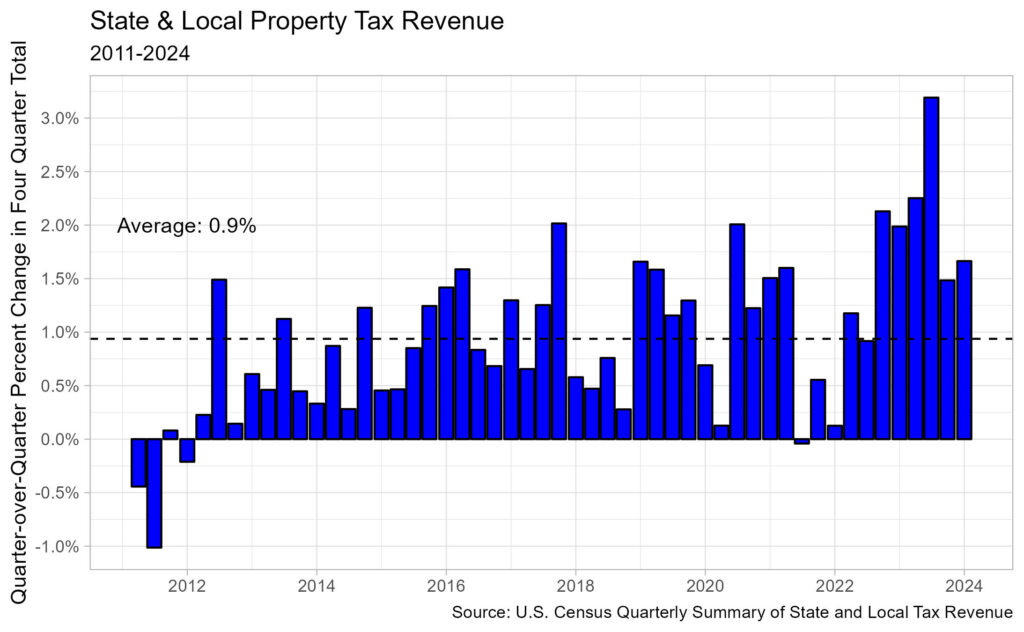

The rate of quarterly increases ticked up slightly, up from 1.5% in the fourth quarter of 2023 to 1.7% in the first quarter of 2024. This was the sixth straight quarter where the quarterly percentage increase was above the historical average since 2011 of 0.9%.

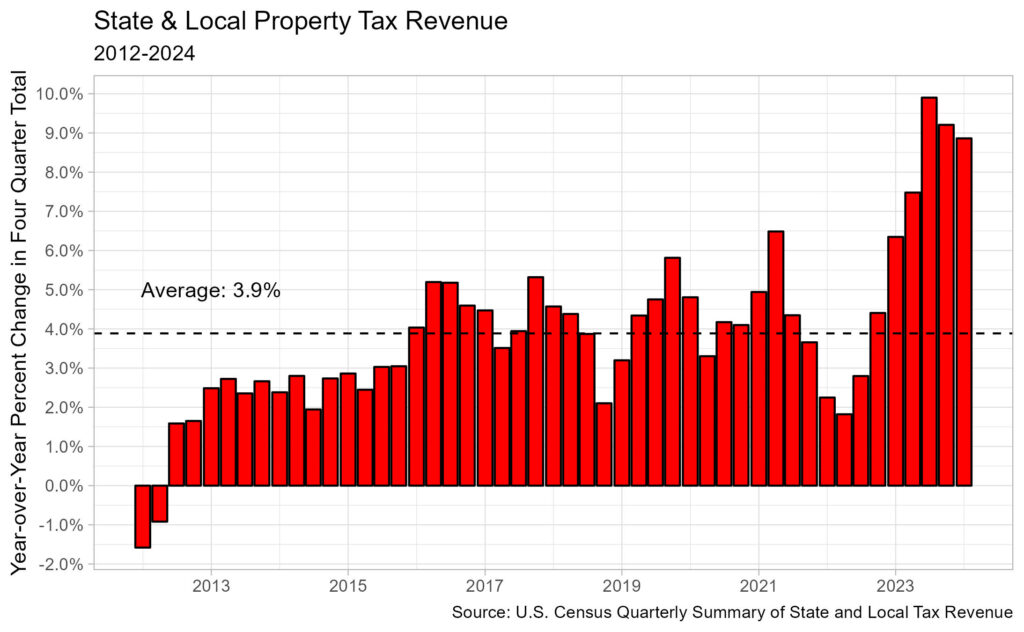

Year-over-year, property tax revenue was 8.9% higher. This was the third straight decrease in the year-over-year rate of change in the property tax data. Despite this, the first quarter of 2024 still experienced a year-over-year increase that is double what it has historically been.

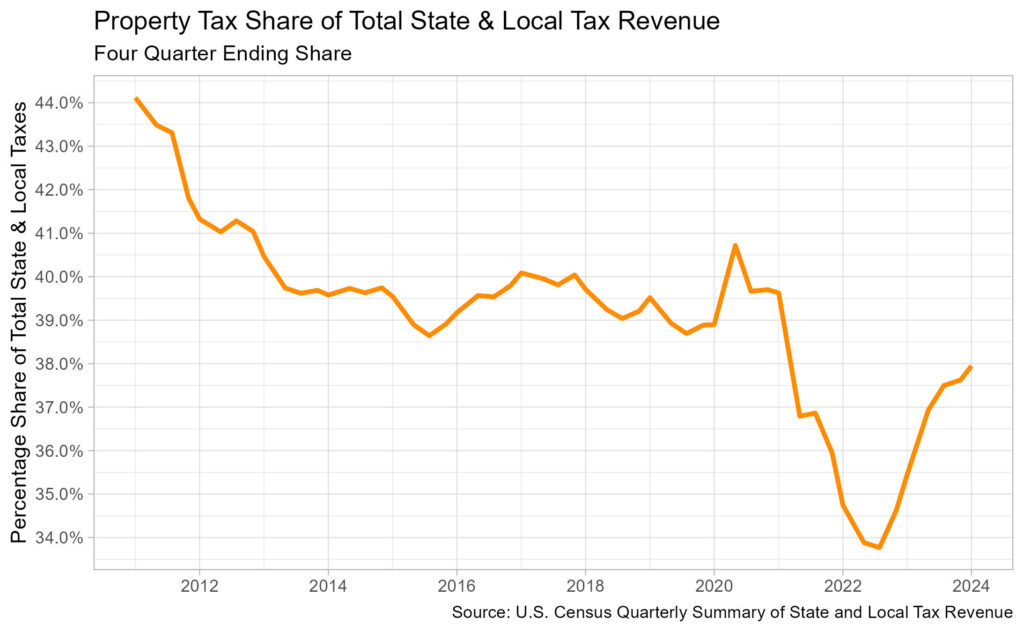

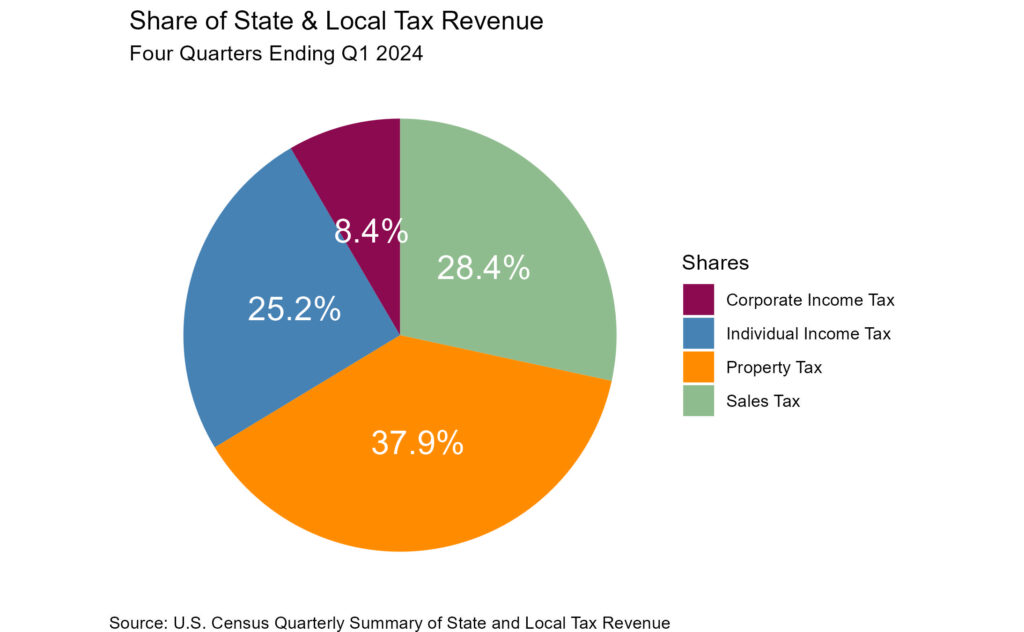

Property tax share of total state & local tax collections in the first quarter stood at 37.9%, up a marginal 0.3 percentage points from the previous quarter. This share had been trending upward since the third quarter of 2022 when it was at 33.7%.

Of total collections, property tax made up the largest share, followed by sales at 28.4%. Individual income tax represented 25.2% of tax revenue, while corporate tax made up the remaining 8.4% of revenues for state & local governments in the first quarter of 2024.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.