Single-family production fell back after four straight monthly gains as elevated construction costs and rising mortgage rates led to a reduction in home building activity and affordability conditions worsened for home buyers.

Overall housing in June decreased 8% to a seasonally adjusted annual rate of 1.43 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

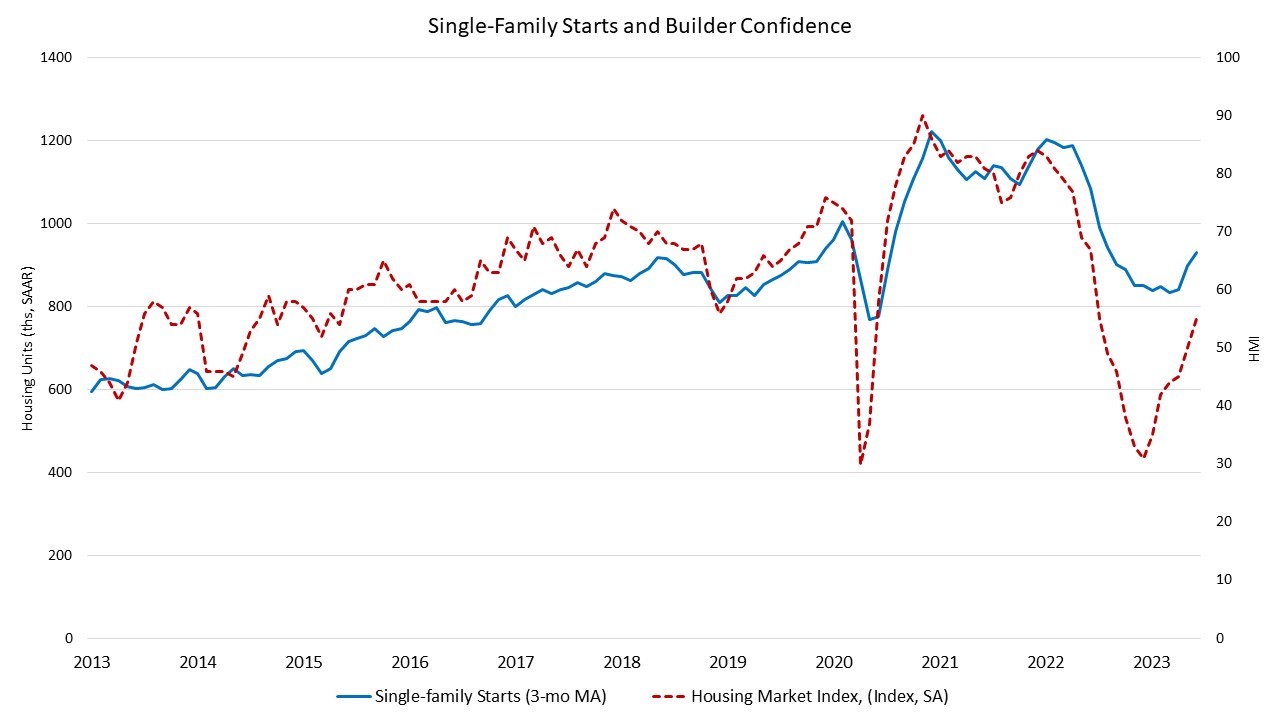

The June reading of 1.43 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts decreased 7% to a 935,000 seasonally adjusted annual rate. The three-month moving average (a useful gauge given recent volatility) edged up to 929,000 starts, as charted below. On a year-over-year basis, single-family housing starts are down 7.4% compared to June 2022.

The multifamily sector, which includes for-rent apartment buildings and condos, decreased 9.9% to an annualized 499,000 pace for 2+ unit construction in June. The three-month moving average for multifamily construction has been a solid 518,000-unit annual rate. On a year-over-year basis, multifamily construction is down 9.4%.

On a regional and year-to-date basis, combined single-family and multifamily starts are 13.9% lower in the Northeast, 19.4% lower in the Midwest, 11.5% lower in the South and 21% lower in the West.

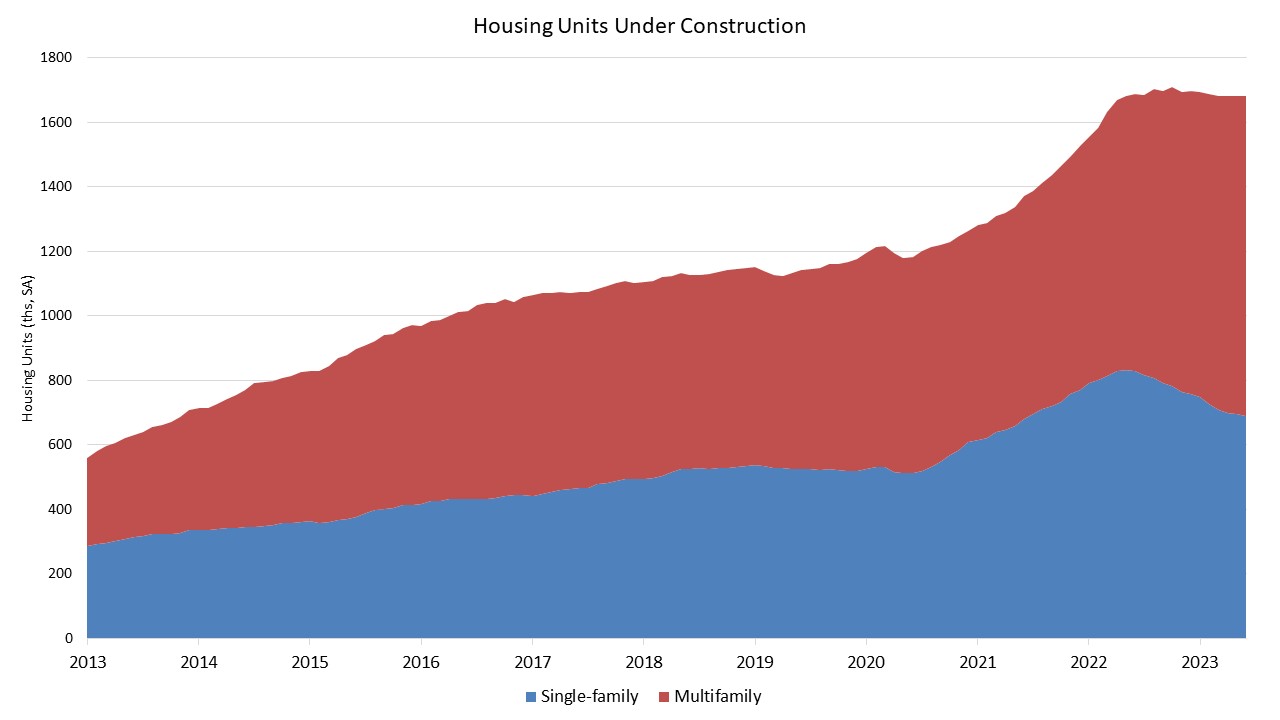

As an indicator of the economic impact of housing, there are now 688,000 single-family homes under construction. This is 17.0% lower than a year ago. There are currently 994,000 apartments under construction, the highest levels since May 1973, and is up 15.7% compared to a year ago (859,000). Total housing units now under construction (single-family and multifamily combined) are 0.3% lower than a year ago.

While single-family starts are down 21.1% year-to-date, single-family completions are down just 2.3% compared to a year ago. Multifamily completions are up 25.8% compared to June 2022. Any additional housing supply is good news for inflation data because more inventory will help reduce shelter inflation, which is now a leading source of growth for the CPI.

Overall permits decreased 3.7% to a 1.44 million unit annualized rate in June. Single-family permits increased 2.2% to a 922,000 unit rate but are down 2.7% compared to a year ago. Multifamily permits decreased 12.8% to an annualized 518,000 pace and is down 31.2% compared to June 2022. The June pace for multifamily permits are at lowest level since late 2020, which is a sign of future apartment construction slowing.

Looking at regional permit data on a year-to-date basis, permits are 23.4% lower in the Northeast, 20.8% lower in the Midwest, 16.2% lower in the South and 23.6% lower in the West.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

The mixed performance of single-family starts and permits in June 2023 could impact the construction loan market. While the gain in permits suggests future activity, the decline in starts may signal caution among lenders in extending construction loans until a clearer trend emerges. Check us out at builderloans.net for construction financing.