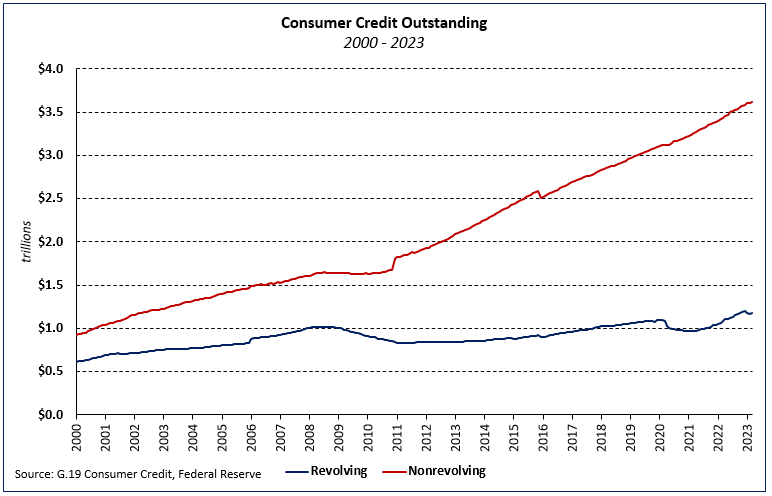

According to the Federal Reserve’s latest G.19 Consumer Credit report, the growth of total consumer credit outstanding slowed from 7.4% to 5.4% (seasonally adjusted annual rate) in the first quarter of 2023. Nonrevolving (excluding real estate debt) and revolving debt grew 3.1% and 12.3%, respectively, over the quarter. On an unadjusted basis, the level of nonevolving credit outstanding at the end of Q1 2023 was $3.6 trillion while the level of revolving debt—primarily credit card debt—was $1.2 trillion.

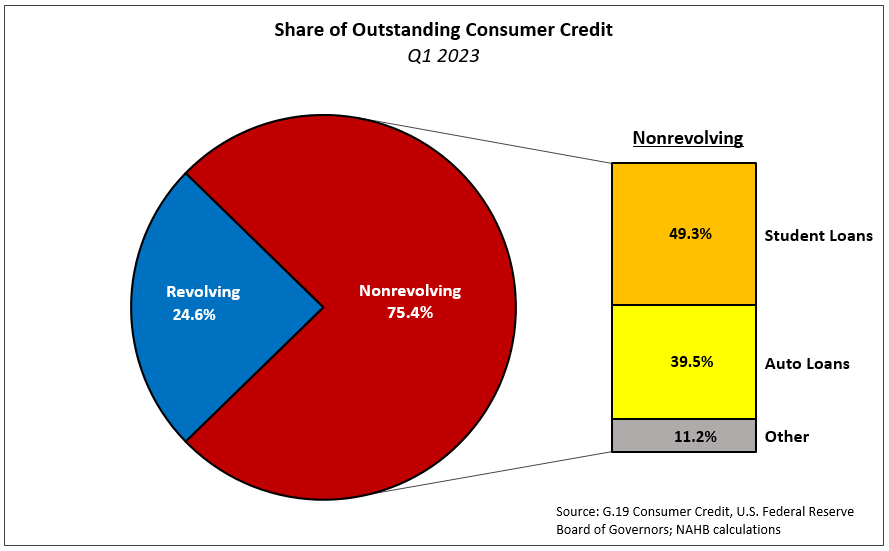

Revolving and nonrevolving debt accounted for 24.6% and 75.4% of total consumer debt, respectively. Revolving consumer credit outstanding as a share of the total decreased 0.6 percentage point over the quarter but remains 1.6 ppt above the Q1 2023 level.

With every quarterly G.19 report, the Federal Reserve releases a memo item covering student and motor vehicle loans’ outstanding. The most recent release shows that the balance of student loans was $1.8 trillion (not seasonally adjusted) at the end of the first quarter while the amount of auto loan debt outstanding stood at $1.4 trillion (NSA).

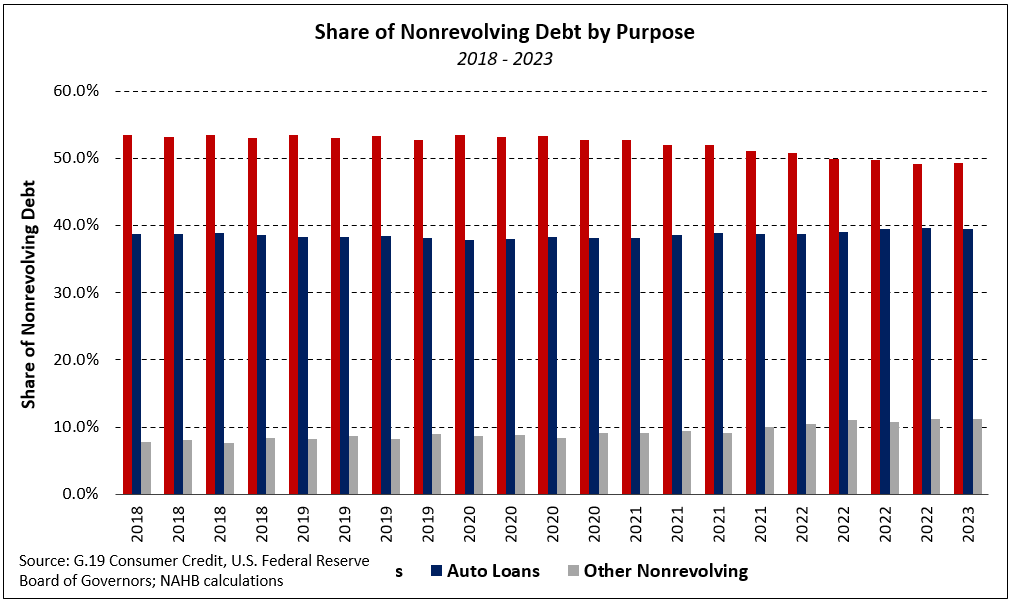

Together, these loans made up 88.8% of nonrevolving credit balances (NSA)—the smallest share since Q2 2011 and 2.1 ppts lower than the share in Q1 2022.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.