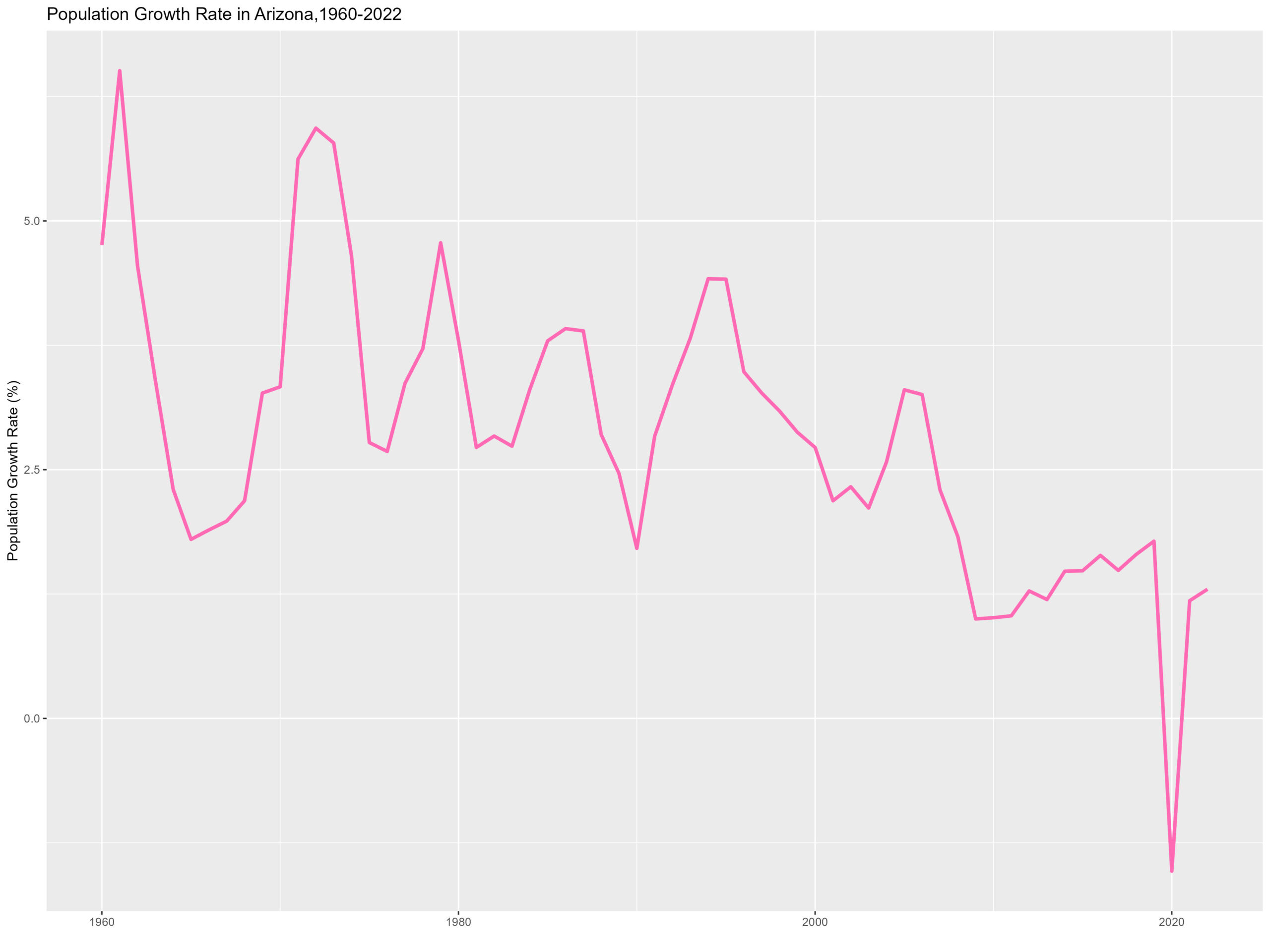

Arizona’s population growth increased for the second consecutive year after falling during 2020. The population growth rate was 1.30% between 2021 and 2022 with the population increasing by 94,320 persons, the 8th fastest growth rate and 5th largest nominal increase in the U.S. between the years respectively.

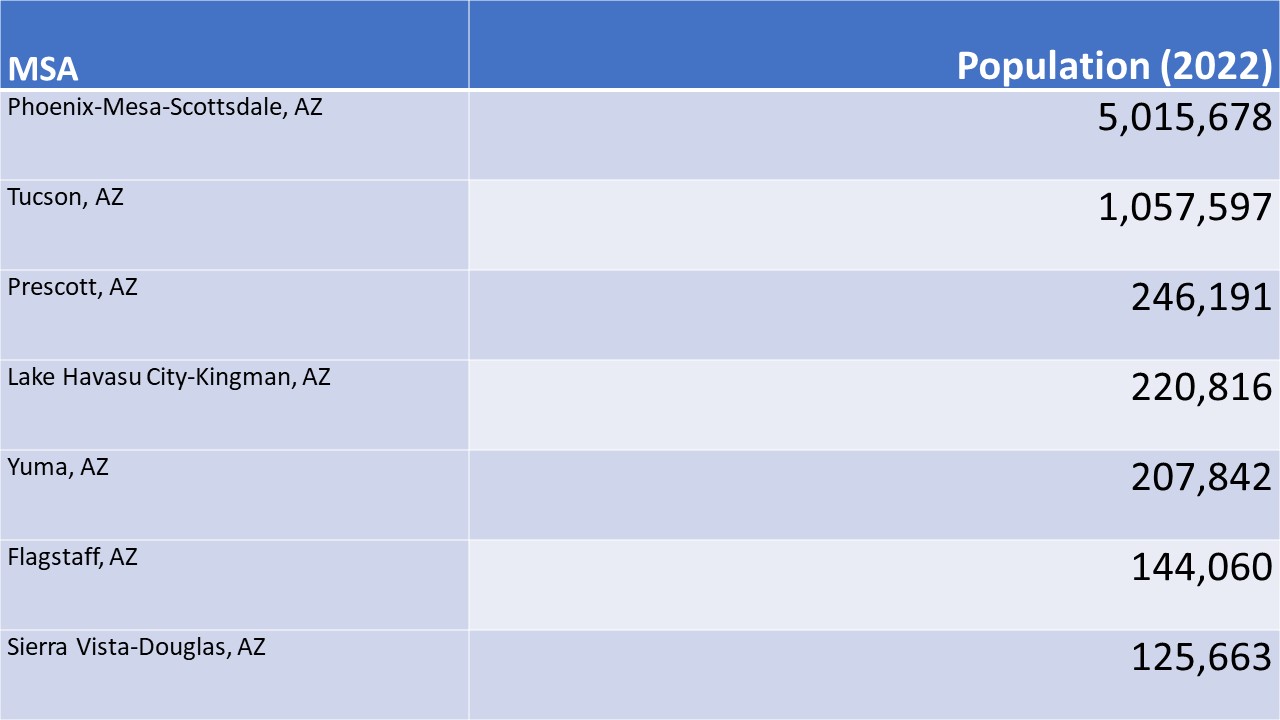

Arizona contains seven census designated MSAs. Two of the MSAs have populations above one million with the Phoenix-Mesa-Scottsdale having an estimated population just above five million and Tucson having a population just above one million. The Phoenix-Mesa-Scottsdale MSA is the tenth largest in the U.S. based on population.

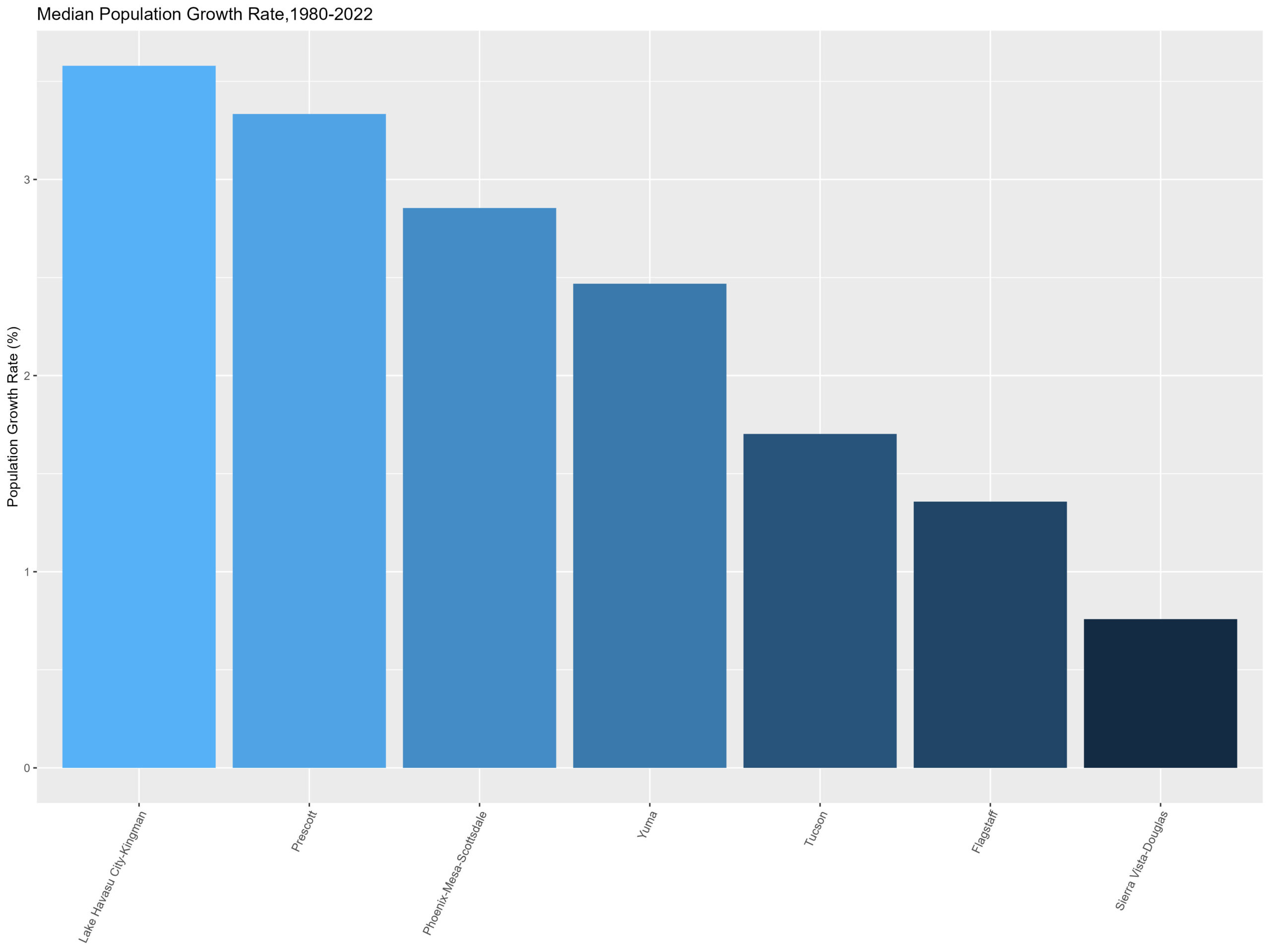

Between 1980-2022, the MSAs of Arizona all had a positive median population growth rate. The Sierra Viesta-Douglas MSA was the only one to have a median population growth below 1% at 0.76%. Lake Havasu City-Kingman and Prescott both had median population growth above 3% between these years. The Phoenix-Mesa-Scottsdale MSAs had a median population growth rate of 2.85% while the second largest MSA, Tucson, had a median population growth rate of 1.7%.

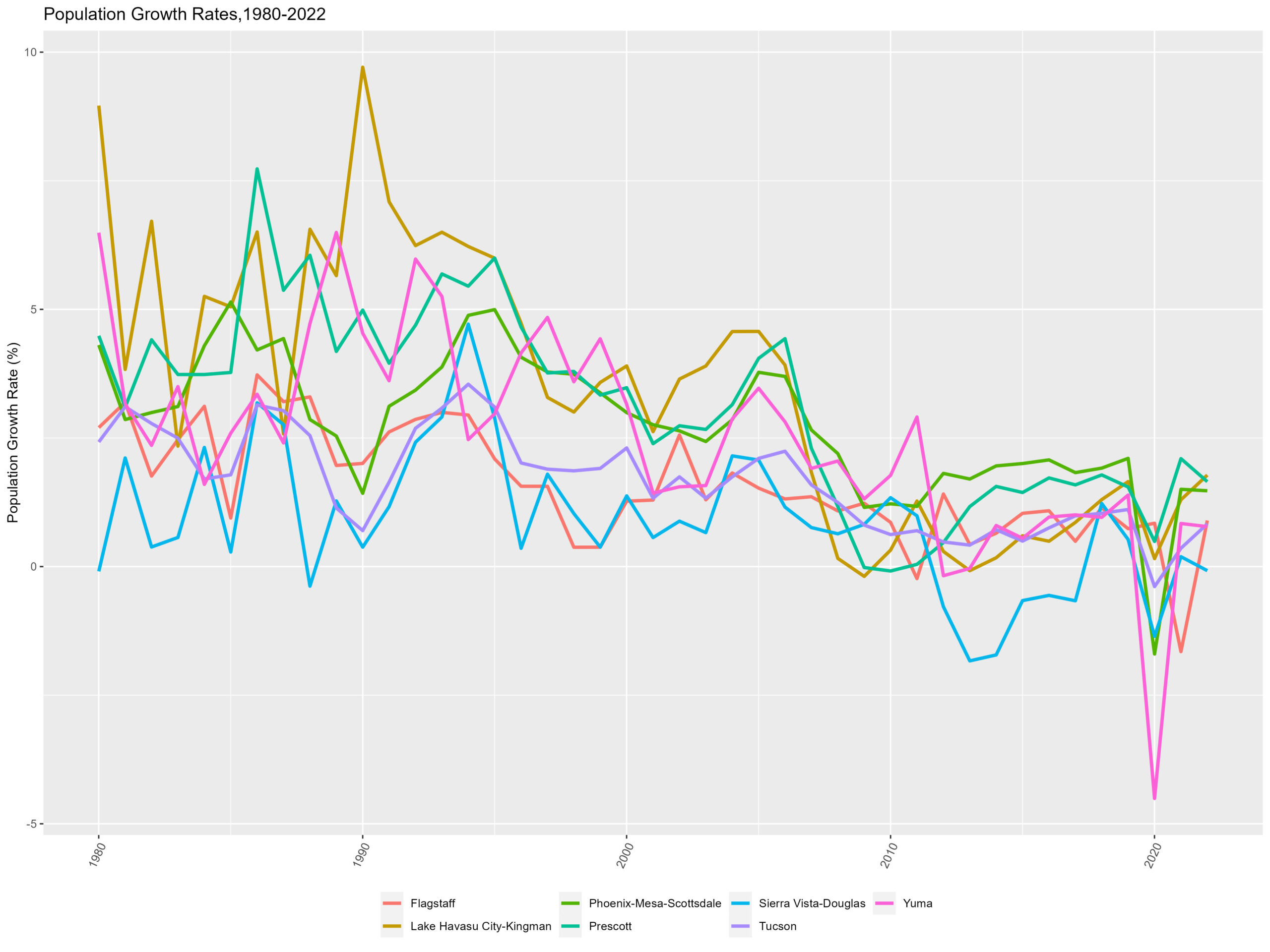

The second population growth rate plot below displays each MSA’s yearly population percentage change since 1980. The growth rates for all MSAs have trended downwards over time. While three MSAs had a median growth rate above 2.5% in the chart above, the last time any MSA had a population percentage increase of 2.5% or higher was in 2011 when Yuma saw a population increase of 2.9%.

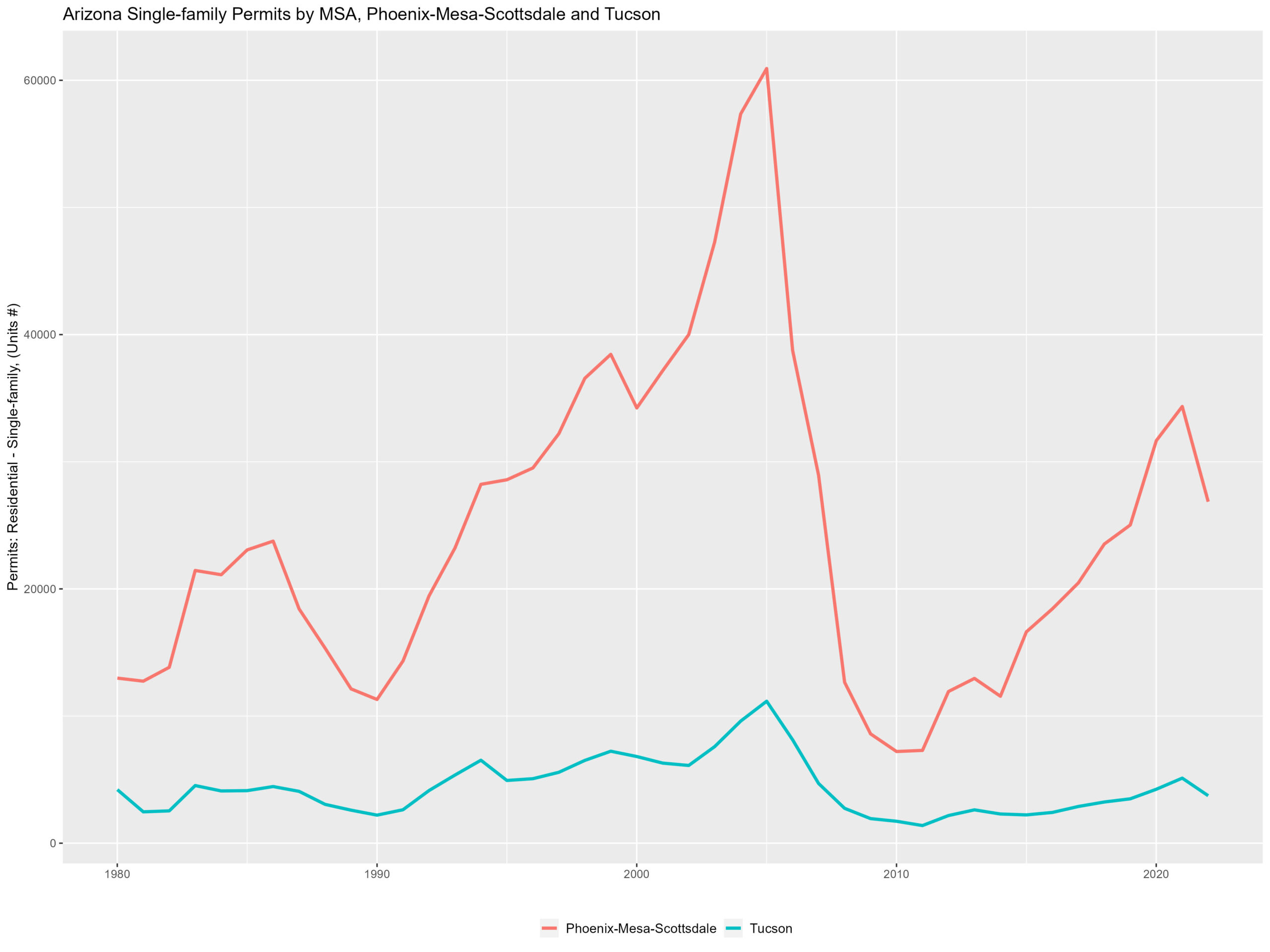

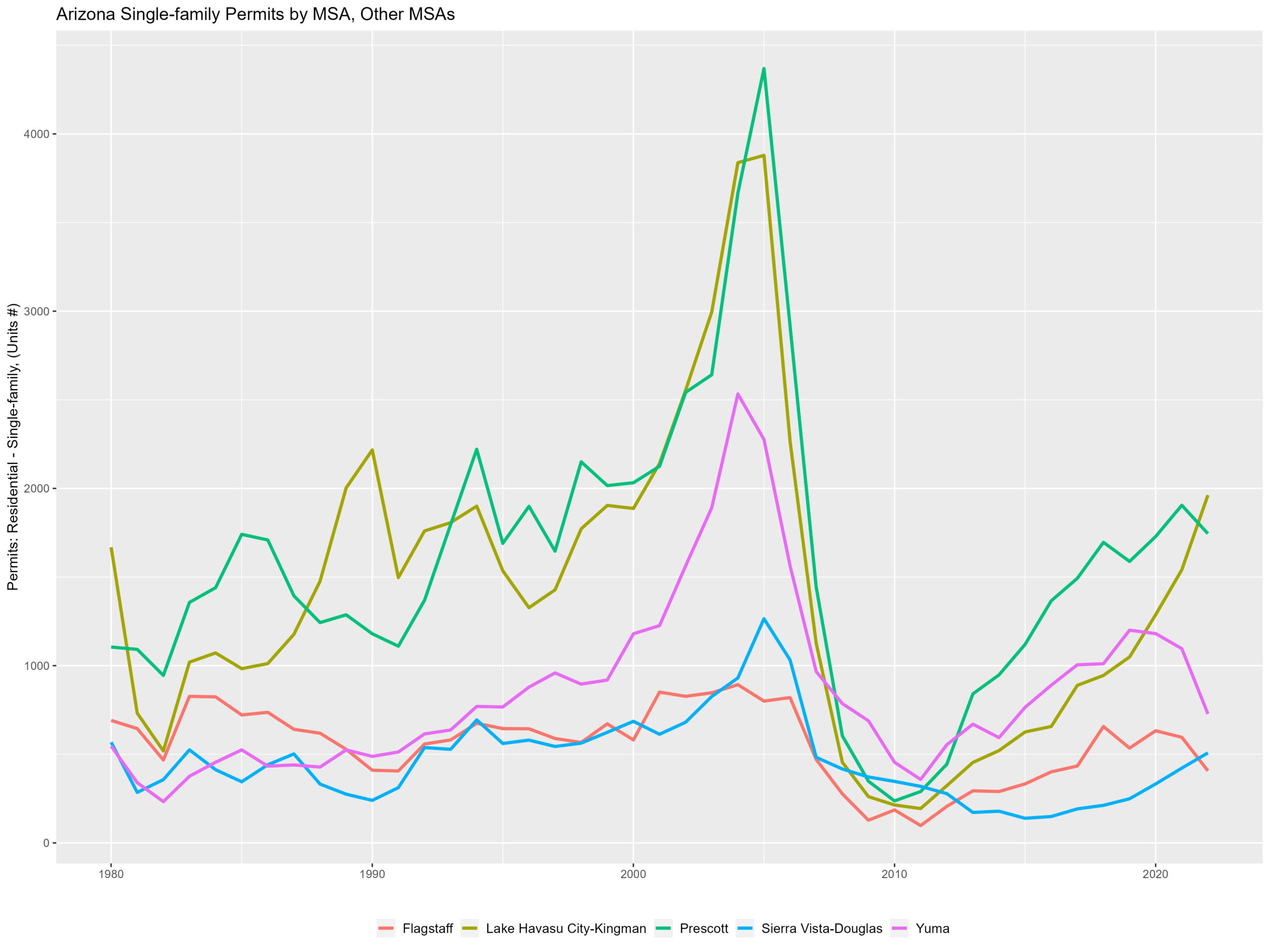

With the Phoenix-Mesa-Scottsdale MSA being significantly larger in population than the other MSAs in Arizona, it also had vastly more permits in 2022. Between 2021 and 2022, the single-family permits in Phoenix-Mesa-Scottsdale fell from 34,347 to 26,857. This decline between 2021 and 2022 in single-family permits was present for the other MSAs in Arizona as the only MSAs to gain single-family permits were Sierra Vista-Douglas and Lake Havasu City-Kingman.

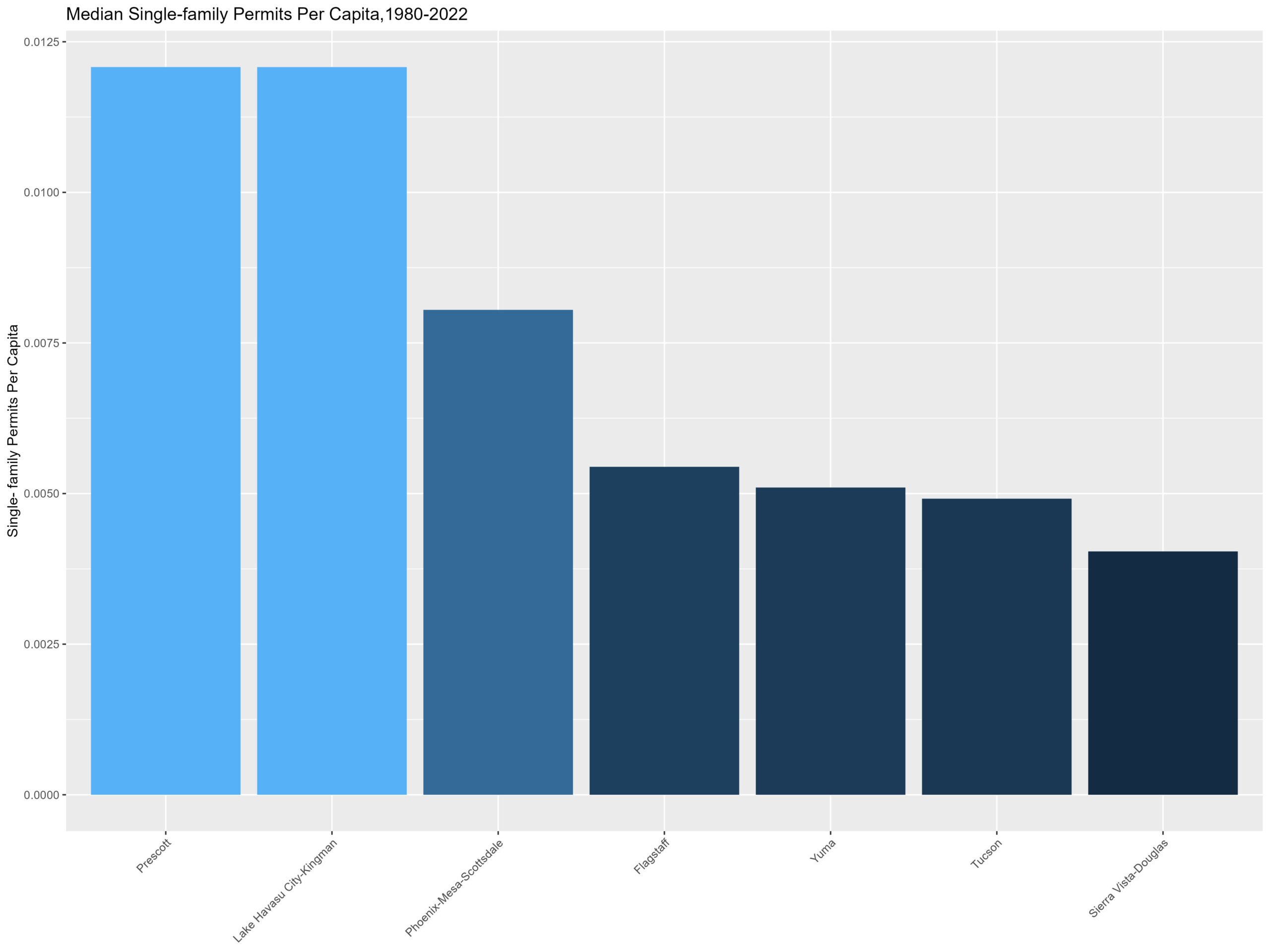

Single-family permits per capita is a statistic that we can use to compare the different MSAs of Arizona. With the total number of single-family permits, we are unable to compare MSAs on an equal level because areas with higher populations almost always have more single-family permits. In the section below, we take a closer look at the Arizona’s MSAs single-family permits per capita in 2022.

The MSAs of Arizona are displayed above. By hovering over each MSA, the population, permits and permits per capita in 2022 will be appear.

Looking at single-family permits per capita, Prescott had the highest median permits per capita at 0.012 just slightly higher than Lake Havasu City-Kingman. These two MSAs median permits per capita were much higher than the third highest in the Phoenix-Mesa-Scottsdale MSA at 0.008. Just as with the median population growth, the Sierra Vista-Douglas MSA had the lowest median permits per capita at 0.004.

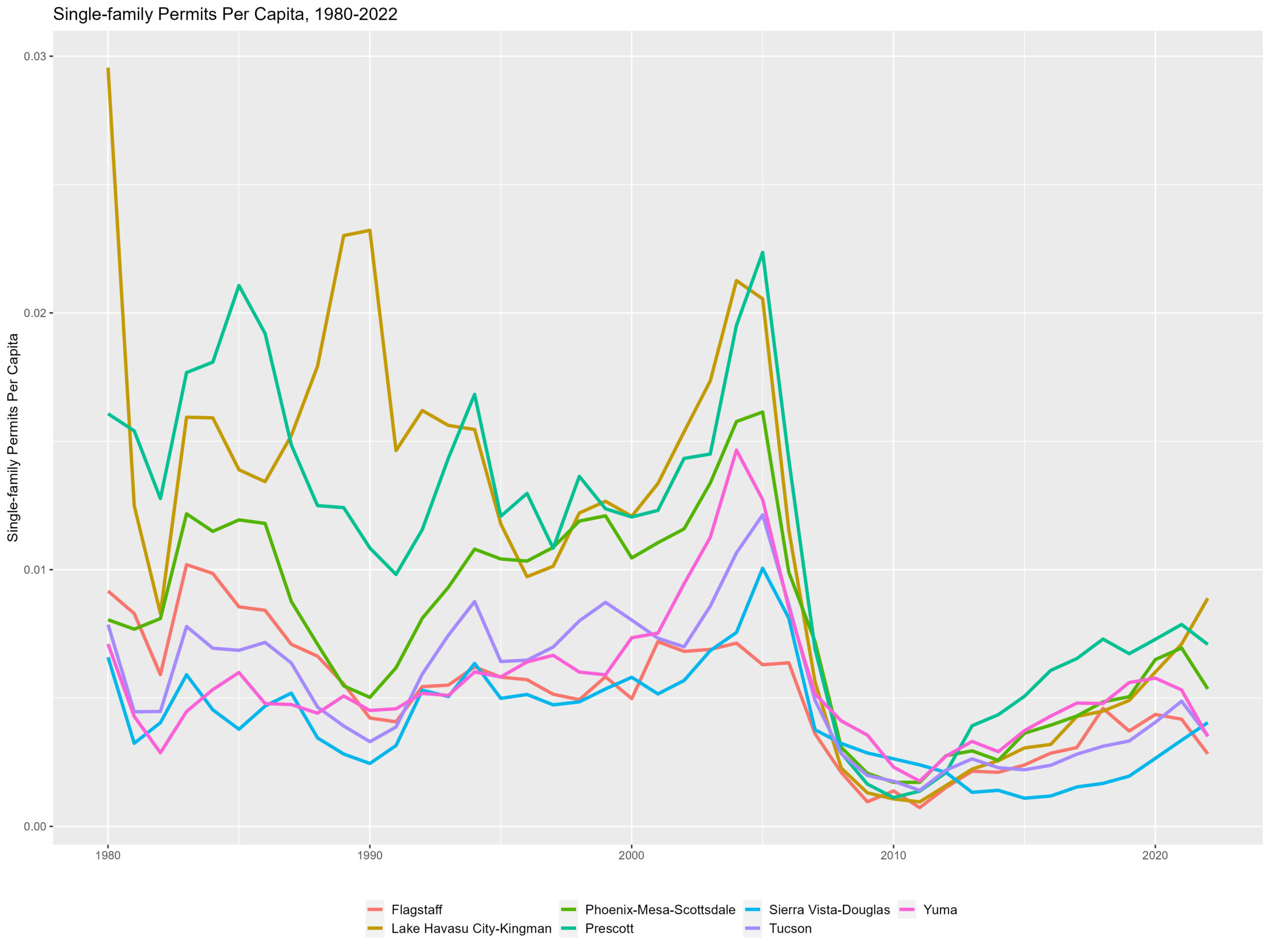

Historically, Prescott and Lake Havasu City-Kingman have held the top spots for yearly single-family permits per capita among the Arizona MSAs. Prior to the Great Recession declines that each MSA experienced, Prescott and Lake Havasu City-Kingman seemingly alternated between the top spot for permits per capita. The years following the Great Recession, Prescott held the highest level from 2013 to 2021 until Lake Havasu City-Kingman was higher in 2022. The Phoenix-Mesa-Scottsdale MSA had the third highest median permits per capita typically leading up to the Great Recession. It has rebounded to third among the Arizona MSAs but still remains well below the single-family permits per capita levels seen prior to the Great Recession.

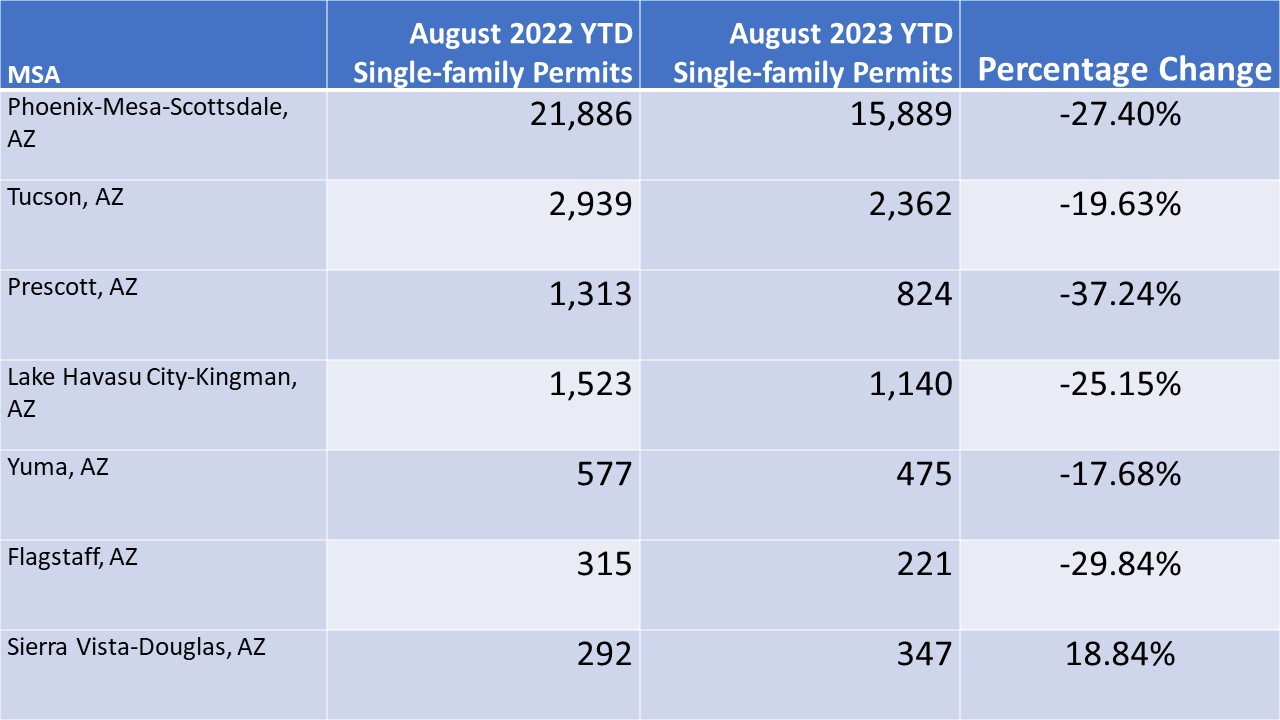

Currently, based on the Census Bureau’s August release of MSA year-to-date (YTD) single-family permit data, the only MSA in Arizona showing an increase in permits is Sierra Vista-Douglas, up 18.8% from August of 2022. All other MSAs in Arizona had a percentage decrease greater than 15%. Below is a table for each MSAs August 2022 YTD, August 2023 YTD, and percentage change between the years.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

The surge in demand for housing suggests potential opportunities for construction loans, as developers and homebuyers capitalize on the flourishing market. Lenders and investors should closely monitor this trend for strategic investments in the construction loan sector.