The Federal Reserve’s monetary policy committee raised the federal funds target rate by 25 basis points at the conclusion of its May meeting. Although the communication from the Fed did not explicitly indicate that they are done tightening, language used in their statement signals the Fed is moving toward a more data-dependent posture, albeit one that retains a hawkish bias. The Fed faces competing risks: elevated but trending lower inflation combined with emerging risks to the banking system and macroeconomic slowing. Chair Powell has previously noted that near-term uncertainty is high due to these risks.

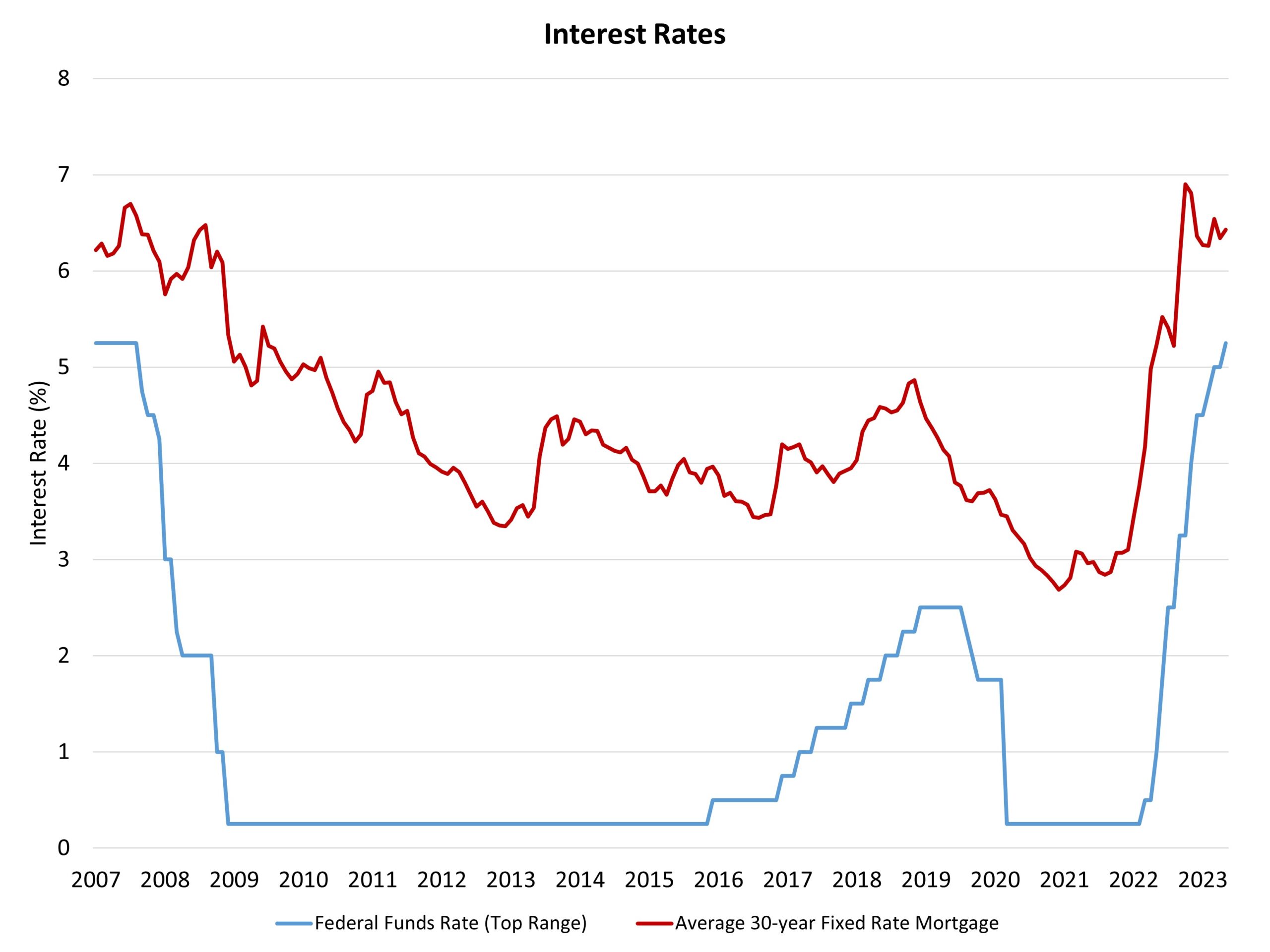

Today’s increase of the fed funds rate moved that target to an upper rate of 5.25%, the fastest increase for rates in decades. The Fed noted: “The Committee will closely monitor incoming information and assess the implications for monetary policy. In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” While not explicit, this language represents a pivot to a more data-dependent stance. Previously, the Fed had asserted that additional rate hikes would be required, it was only a matter of how large.

Nonetheless, the Fed left room to continue rate hikes, if needed. The Fed asserted: “The Committee is strongly committed to returning inflation to its 2 percent objective.” They also stated: “The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.” This means the bias for the Fed leans to the hawkish side if data suggest that inflation is not continuing to trend lower.

Nonetheless, ongoing challenges for regional banks, as well as sector weakness in real estate and manufacturing represent caution signals for the Fed. In fact, the risks for smaller banks will result in tighter credit conditions, which will slow the economy and reduce inflation. Thus, these financial challenges act as additional surrogate rate hikes in terms of tightening credit availability, doing some of the work for the Fed.

Caution would suggest the Fed pause and evaluate conditions in the coming months. As we noted with the release of the March NAHB/Wells Fargo Housing Market Index, the health of the regional and community bank system is critical to the availability of builder and developer financing, for for-sale, for-rent and affordable housing construction. We expect these conditions to tighten and will continue to monitor lending conditions via NAHB industry surveys.

Keep in mind that approximately 40% of overall inflation is generated from shelter inflation, which can only be tamed by additional affordable attainable housing supply. Higher rates for developer and construction loans move the ball in the wrong direction with respect to this objective. Moreover, financial market stress has increased the spread between the 10-year Treasury rate and the typical 30-year fixed rate mortgage. Last week, the spread widened to almost 300 basis points again, which is well above normalized levels.

Looking forward, the bond market appears to be expecting the Fed to cut rates during the second half of the year. However, this runs counter to communication from Fed leadership, who have suggested that higher rates need to remain in place over a longer period of time to successfully bring inflation lower. Indeed, the NAHB forecast does not include any Fed rate cuts until 2024.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Rates are on the rise, but it looks like the Fed is hinting at a halt. Construction loan rates may soon be more accessible for those looking to build! If you want to best guide, builderloans.net is the one to find!