The Federal Reserve’s monetary policy committee raised the federal funds target rate by 25 basis points but indicated that it was moving to a more data dependent mode as markets digest incoming risks for banks. The Fed is balancing two economic risks: ongoing elevated inflation and emerging risks to the banking system. Chair Powell noted that near-term uncertainty is high due to these risks, as well as impacts from policy actions taken to shore up liquidity.

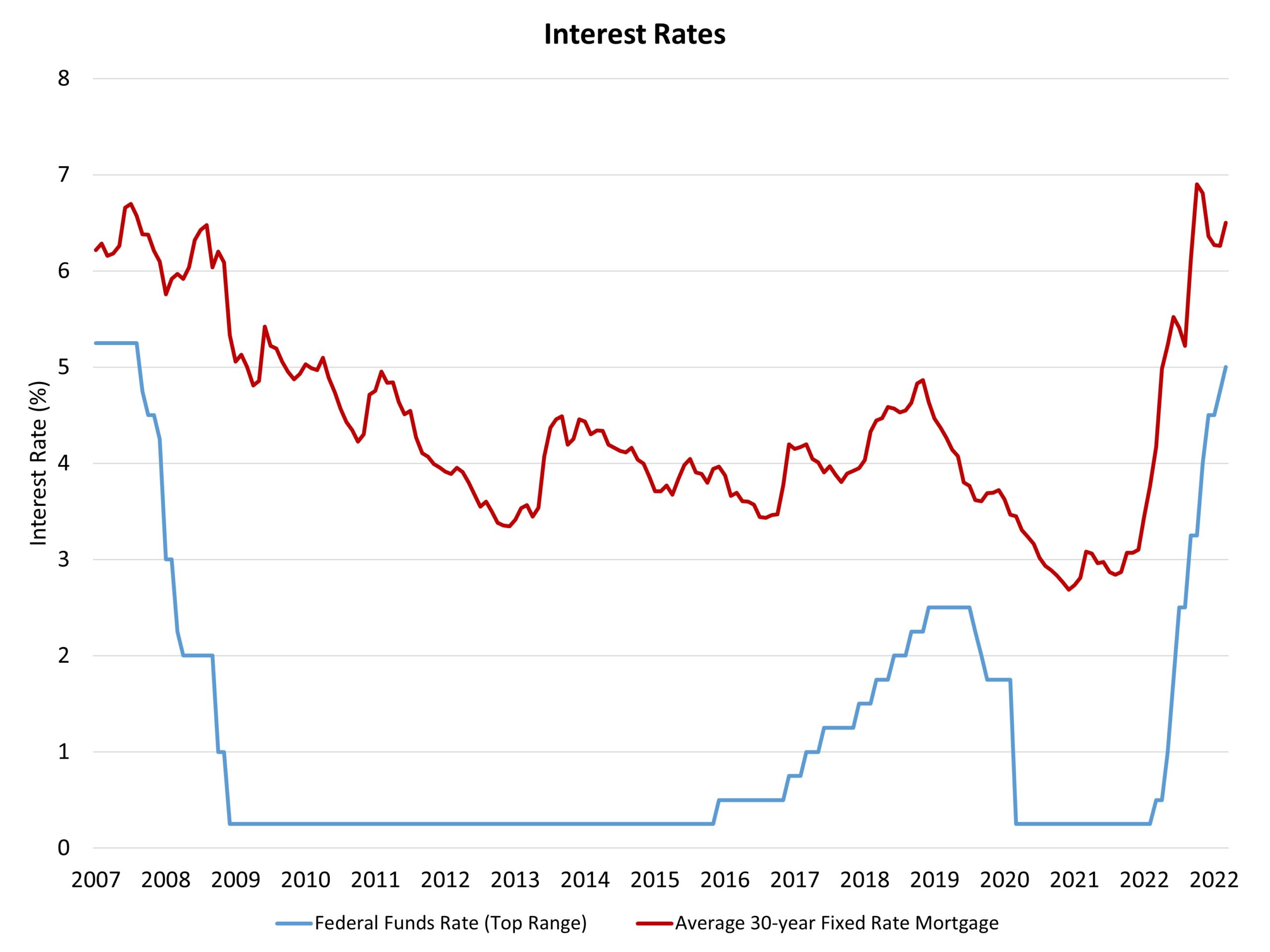

Today’s increase of the fed funds rate moved that target to an upper rate of 5%. The Fed’s projections indicate that additional increases may be in store to achieve the level of tightening necessary to ultimately bring inflation back, over time, to the Fed’s target of 2%. The “may” in the prior sentence is intentional, as the more dovish tone of the Fed’s communication moves away from prior statements that additional firming of monetary policy is required without question.

The Fed noted: “The Committee will closely monitor incoming information and assess the implications for monetary policy. The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

Acknowledging the issues affecting a few regional banks, the Committee wrote: “The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks.” These challenges will result in tighter credit conditions, which will slow the economy and reduce inflation.

The bond market appears to be expecting the Fed to cut rates during the second half of the year. However, this runs counter to communication from Fed leadership, who have suggested that higher rates need to remain in place over a longer period of time to successfully bring inflation lower.

As we noted with the release of the March NAHB/Wells Fargo Housing Market Index, the health of the regional and community bank system is critical to the availability of builder and developer financing, for for-sale, for-rent and affordable housing construction. We expect these conditions to tighten and will continue to monitor lending conditions via NAHB industry surveys. Additionally, financial market stress, and possible sales of mortgage-backed securities (MBS) by some smaller banks, are likely to increase the spread between the 10-year Treasury rate and the typical 30-year fixed rate mortgage. Last week, the spread widened to approximately 300 basis points, which is well above more normalized levels. It is worth noting that the Fed did not provide any guidance indicating that it would accelerate its balance sheet roll off (after a nearly $300 billion increase for the balance sheet last week), which is good news for housing markets. We still forecast that the top interest rates for mortgages this cycle were experienced last October, and that mortgage rates will trend lower from current levels later in 2023.

The Fed also issued its new summary of economic projections. The Fed is projecting only 0.4% GDP growth in 2023 and just 1.2% for 2024. The unemployment rate is expected to increase only to 4.6% by 2024, which is below the NAHB economic outlook for labor markets given ongoing tightening of financial conditions. The Fed sees the core PCE measure of inflation of 3.6% in 2023, and then declining to 2.6% in 2024 and 2.1% in 2025 as inflation, grudgingly, returns to the Fed’s target. Slowing rent growth will be an important element of this slowing of inflation pressure. The Fed’s projected top federal funds rate is 5.1% for 2023 and then falling as the Fed eases to 4.3% to 2024 and 3.1% in 2025. The long-term rate is projected to be 2.5% suggesting easing will occur from 2024 through 2026 as markets normalize. This suggests a good runway for home building growth during the second half of the 2020s, a period of time when the structural housing deficit will be reduced.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.