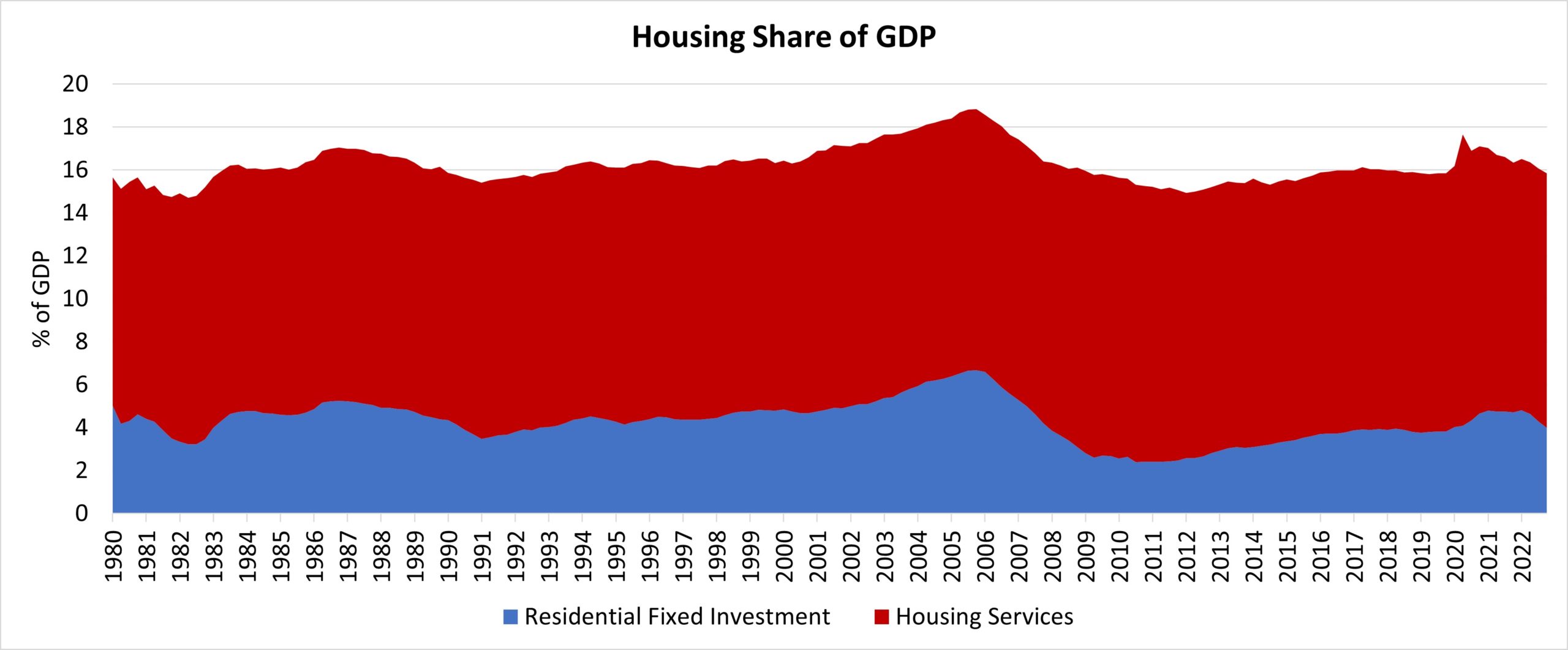

Housing’s share of the economy edged lower at the end of the fourth quarter of 2022. This is the second straight quarter where GDP increased in 2022, with overall GDP increasing at a 2.9% annual rate, following a 3.2% increase in the third quarter and 0.6% decrease in the second quarter. However, due to higher interest rates, housing’s share of GDP decreased to 15.9%, below the third quarter share of 16.1%.

In the fourth quarter, the more cyclical home building and remodeling component – residential fixed investment (RFI) – decreased to 4.0% of GDP. Home construction continues to face challenges such as higher interest rates and decreased housing affordability. RFI subtracted 129 basis points from the headline GDP growth rate in the fourth quarter of 2022.

In 2022, RFI made up 4.4% of GDP which is down from 4.8% in 2021. Housing services made up 11.8%, down from 11.9% in 2021. Housing’s share was 16.2% over the year, down from 16.7% in 2021.

Housing-related activities contribute to GDP in two basic ways.

The first is through residential fixed investment (RFI). RFI is effectively the measure of the home building, multifamily development, and remodeling contributions to GDP. It includes construction of new single-family and multifamily structures, residential remodeling, production of manufactured homes and brokers’ fees.

For the fourth quarter, RFI was 4.0% of the economy, recording a $1.0 trillion seasonally adjusted annual pace.

The second impact of housing on GDP is the measure of housing services, which includes gross rents (including utilities) paid by renters, and owners’ imputed rent (an estimate of how much it would cost to rent owner-occupied units) and utility payments. The inclusion of owners’ imputed rent is necessary from a national income accounting approach, because without this measure, increases in homeownership would result in declines for GDP.

For the fourth quarter, housing services represented 11.9% of the economy or $3.1 trillion on seasonally adjusted annual basis.

Taken together, housing’s share of GDP was 15.9% for the fourth quarter.

Historically, RFI has averaged roughly 5% of GDP while housing services have averaged between 12% and 13%, for a combined 17% to 18% of GDP. These shares tend to vary over the business cycle. However, the housing share of GDP lagged during the post-Great Recession period due to underbuilding, particularly for the single-family sector. The recent expansion in housing activity has increased these shares to near historic norms.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.