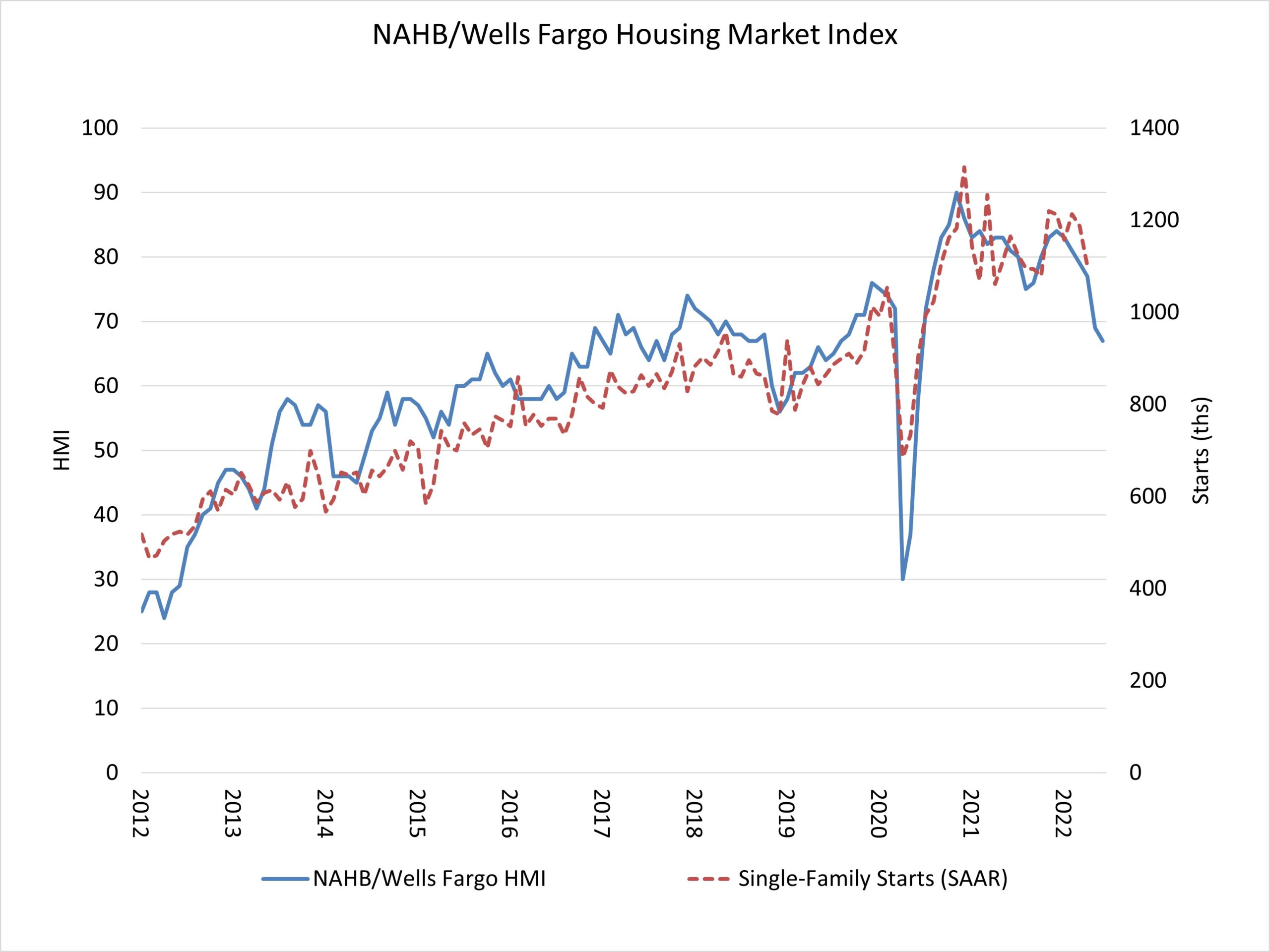

Rising inflation and higher mortgage rates are slowing traffic of prospective home buyers and putting a damper on builder sentiment. In a troubling sign for the housing market, builder confidence in the market for newly built single-family homes posted its sixth straight monthly decline in June, falling two points to 67, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This marks the lowest HMI reading since June 2020.

Six consecutive monthly declines for the HMI is a clear sign of a slowing housing market in a high inflation, slow growth economic environment. The entry-level market has been particularly affected by declines for housing affordability and builders are adopting a more cautious stance as demand softens with higher mortgage rates.

The housing market faces both demand-side and supply-side challenges. Residential construction material costs are up 19% year-over-year with cost increases for a variety of building inputs, except for lumber, which has experienced recent declines due to a housing slowdown. On the demand-side of the market, the increase for mortgage rates for the first half of 2022 has priced out a significant number of prospective home buyers, as reflected by the decline for the traffic measure of the HMI.

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI indices posted declines in June. The component charting traffic of prospective buyers fell five points to 48, marking the first time this gauge has fallen below the breakeven level of 50 since June 2020. The HMI index gauging current sales conditions fell one point to 77 and the gauge measuring sales expectations in the next six months fell two points to 61.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 71, the Midwest dropped six points to 56, the South fell two points to 78 and the West posted a nine-point decline to 74.

The HMI tables can be found at nahb.org/hmi.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

I believe that right now builders should be focused like a laser on protecting their sales backlog. In many cases high sales volume and slowdowns in production due to supply chain problems have left many with larger than normal sales backlogs.

Every effort should be made to determine which sales within the backlog may be threatened by the rapid increases in mortgage rates that have occured and that will be forthcoming. If you have sales in your backlog that have not locked in their interest rate, you have potential problems. If you have sales in your backlog that have made application with lenders that do not offer an extended rate lock or cap program, you have a serious problems.

While losing any sale where you have expended great effort and marketing expense is bad, losing a sale after completing a home, expending marketing, administration and construction expenses and getting the home back in inventory with less than popular selections in a slowing market is much worse.

Spending time monitoring the sales backlog will help avoid the worst. Close cordination to ensure that those in your backlog have mortgage rate locks/caps and that deliveries are made within the buyers’ rate lock period is critical.

Homebuilders should also be in place to offer assistance in buying down the mortgage rate if buyers hadn’t already locked it in, or if they did, for if/when the lock expires, owing to the build cycle. Buyers won’t stay in place if their projected payment is moving up.