New NAHB 2022 Priced-Out Estimates showed that 87.5 million households are not able to afford a median priced new home, and that additional 117,932 households would be priced out of the new home market if the price goes up by $1,000. This post presents how interest rates affect the number of households that would be priced out of the new home market.

For a new home with an estimated median price of $412,506 in 2022 and the recent 30-year fixed-rate mortgage rate of 3.5%, a quarter percentage point increase in the interest rate would price out approximately 1.1 million households. The monthly mortgage payments will increase as a result of rising mortgage interest rates, and therefore higher household income thresholds would be needed to qualify for a mortgage loan.

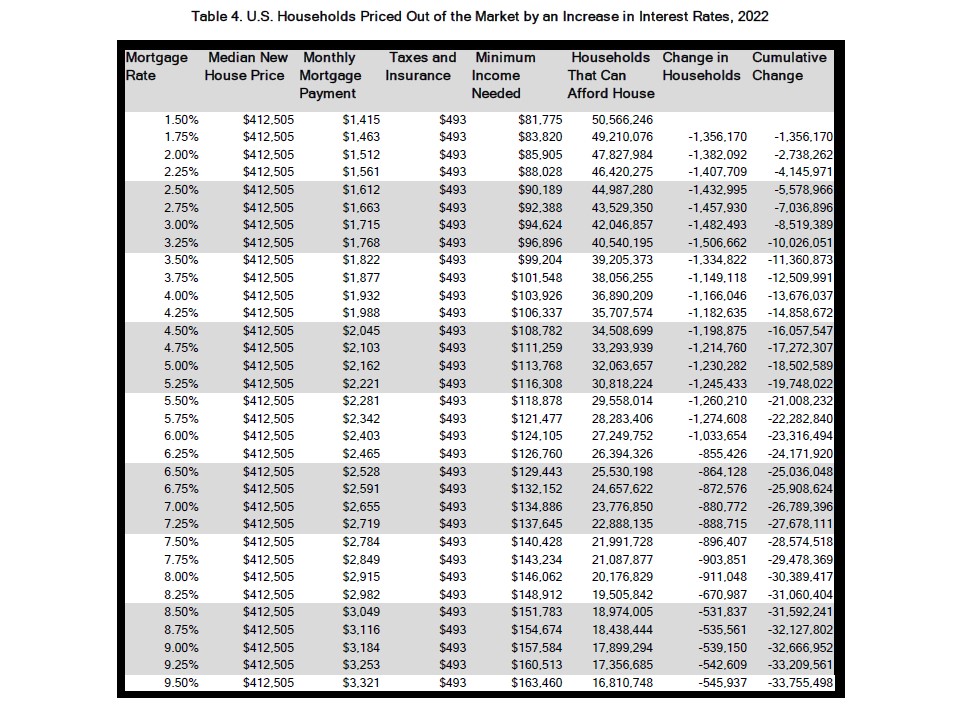

Table below shows the number of households priced out of the market for a new median priced home at $412,505 by each 25 basis-point increase in interest rates from 1.5% to 9.5%. When interest rates go up from 1.75% to 2.00%, around 1.4 million households could no longer afford buying median-priced new homes. An increase from 3.5% to 3.75% could price approximately 1.1 million households out of the market. However, at considerably higher rates this number tapers. For example, increasing from 6.25% to 6.5% mortgage rates prices out 0.86 million households. This diminishing effect happen because only a declining number households at the higher end of household income distribution will be affected. On the contrary, when interest rates are relatively low, a 25 basis-point increase would affect a larger number of households at the lower and more populous part of income distribution.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

When interest rates go up, many households can no longer buy median-priced new homes.

With more prospective buyers priced out as interest rates rise, one could argue that competition would decline and asking prices might cool to some degree.

Simply put, fewer qualified buyers competing for a given property might lead to a lower sales price.

And if you believe home prices go down when rates rise (which isn’t proven), there’s additional relief there as well.

The dynamics of the housing market is completely different than we’ve ever seen. With Covid changing the demographics and pushing people out of larger cities into smaller ones, people able to work from home, together with rising inflation, higher gas prices, supply chain constraints, etc. and now rising interest rates, it’s wreaking havoc!

Materials costs for new construction, lack of labor and available land on which to build are pushing new construction costs out of making any sense at all. With fewer new homes being built it puts more pressure on the existing inventory. Property owners seeing rising prices are choosing to remain in their homes as downsizing or upsizing would cost too much. Unless there’s something done to control regulations that push the costs of new construction downward again and make it easier to develop housing, we won’t see affordability. The people on the lower rung of the ladder will keep falling off.