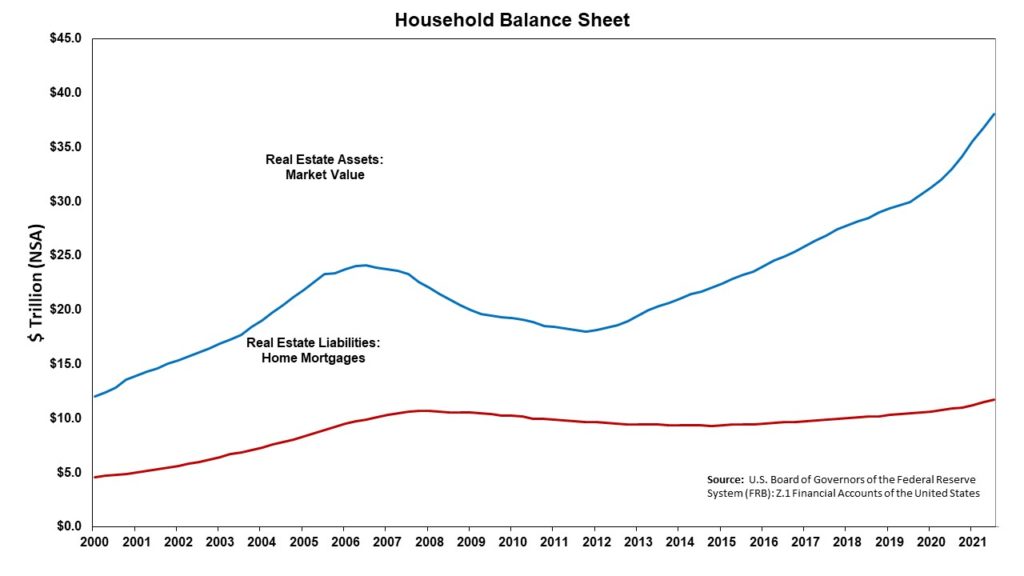

The latest results from the Federal Reserve’s Z.1 Financial Accounts of the United States, i.e., the Flow of Funds, show that in 2021, the aggregate market value of all owner-occupied real estate in the United States experienced the largest quarterly increases on record.

From $36.8 trillion in the third quarter of 2021, the value of owner-occupied real estate increased by $1.3 trillion to $38.1 trillion in the fourth quarter. Households’ real estate’s year-over-year gain in the fourth quarter was 15.5%, the largest post-Great Recession increase of its kind. The rise in market value owes to the record-breaking pace of home price appreciation throughout the nation.

On the liabilities side of households’ balance sheets, home mortgages increased by $245 billion in the last quarter to $11.7 trillion. In terms of the scale of increases, real estate assets are increasing much faster than real estate liabilities. The change in the value of total home mortgages owes to a combination of new loans taken out for home purchases and the aggregate unpaid principal balance of all existing mortgages. In the fourth quarter, the United States added 222,000 loans to the number of loans being serviced for a total of 39.6 million loans1. The loans added and the loans serviced are on a seasonally-adjusted basis.

Aggregate owners’ equity, the difference between the market value of all owner-occupied real estate and the aggregate value of home mortgages increased in the latest quarter to $26.3 trillion, or 69% of all household real estate, the highest share since 1987. Many homeowners have used the equity to finance remodeling projects, often by taking home equity lines of credit (HELOCs) or home equity loans. This trend applies today as much as it did in the past.

Notes:

- From the Mortgage Bankers Association’s Q4 2021 National Delinquency Survey

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

The change in the value of total home mortgages owes to a combination of new loans and the unpaid principal balance of all existing mortgages. At builderloans.net, you may find the perfect loan to match your construction financing needs. Check it out.