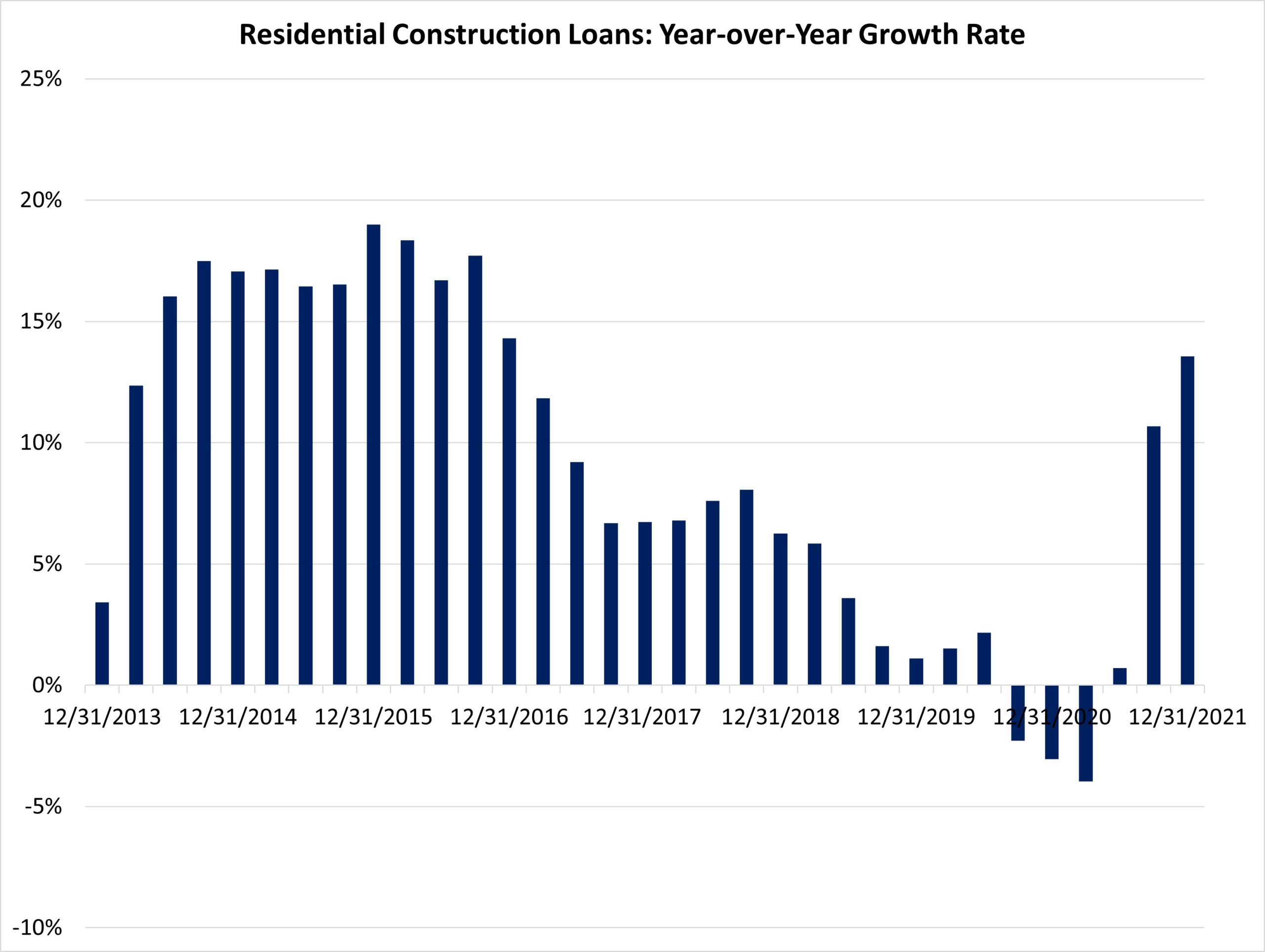

Residential construction loan volume reached a post-Great Recession high during the fourth quarter of 2021, as home building activity posted gains for the year.

The volume of 1-4 unit residential construction loans made by FDIC-insured institutions increased 1% during the fourth quarter. The volume of loans increased by $977 million on a quarterly basis. This loan volume expansion placed the total stock of home building construction loans at $87.9 billion, a post-Great Recession high.

On a year-over-year basis, the stock of residential construction loans is up 13.6%. Since the first quarter of 2013, the stock of outstanding home building construction loans has grown by 116%, an increase of almost $47.1 billion.

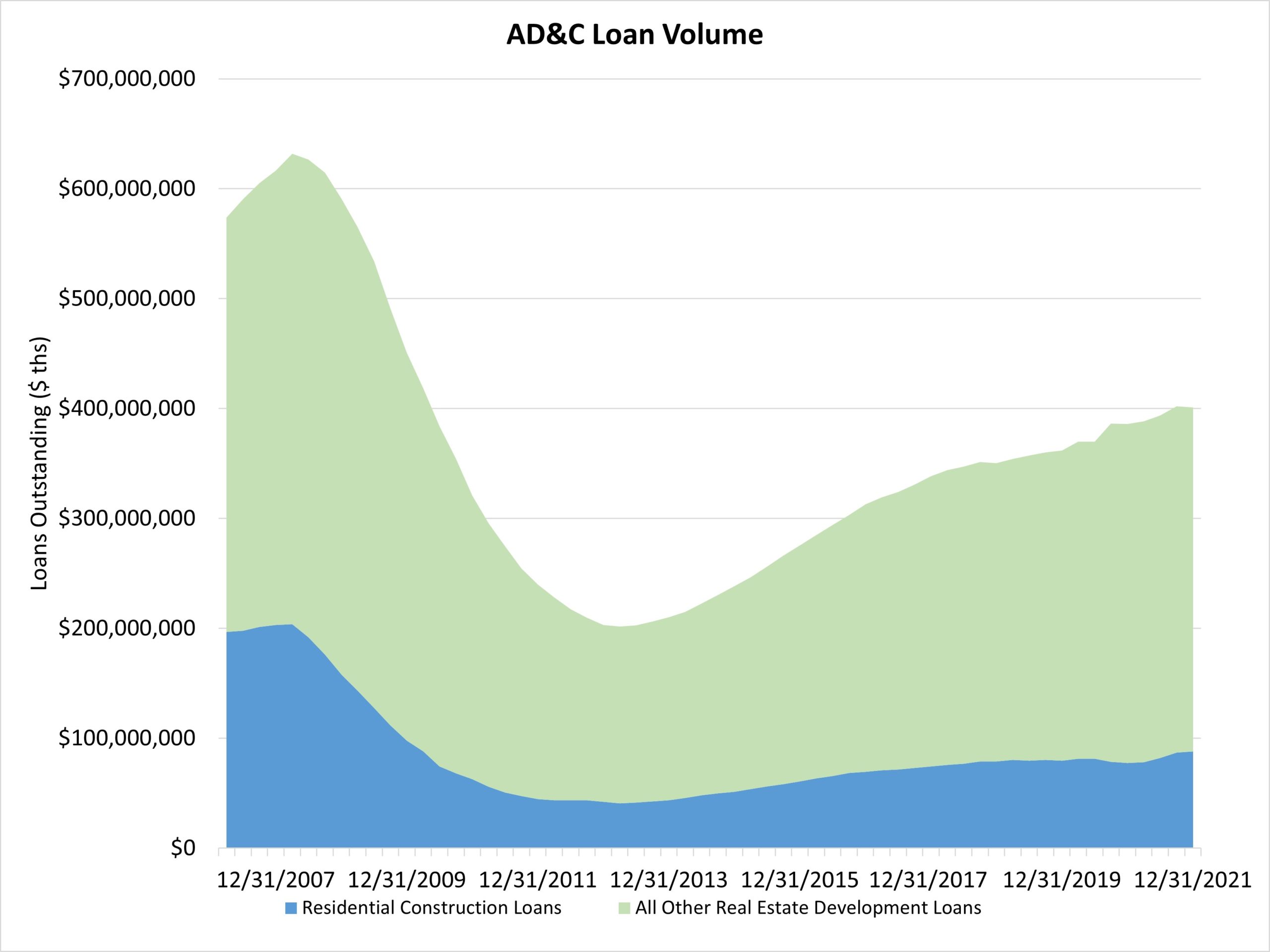

It is worth noting the FDIC data represent only the stock of loans, not changes in the underlying flows, so it is an imperfect data source. Lending remains much reduced from years past. The current amount of existing residential AD&C loans now stands 57% lower than the peak level of residential construction lending of $204 billion reached during the first quarter of 2008. Alternative sources of financing, including equity partners, have supplemented this capital market in recent years.

The FDIC data reveal that the total decline from peak lending for home building construction loans continues to exceed that of other AD&C loans (nonresidential, land development, and multifamily). Such forms of AD&C lending are off a smaller 28% from peak lending. For the fourth quarter, these loans posted a 0.6% decline.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

More and more people are getting interested in getting construction loans. The reason why the volume of loans continues to increase. Check out builderloans.net to find out why and how we can get a clean and easy construction loan for you.