Median square foot prices (excluding record-high improved lot values) for new for-sale single-family detached (SFD) homes started in 2022 increased 18%, according to NAHB’s analysis of the latest Survey of Construction data. Increases for square foot prices in new custom SFD homes were similarly high, averaging 19%, more than double the US inflation of 8% registered by the CPI the same year. Median contract prices per square foot of floor area went up across all US regions, undoubtedly, reflecting fast rising construction and labor costs that pummeled home building in the post-pandemic environment.

Contract prices of custom, or contractor-built, homes do not include value of improved lot as these homes are built on owner’s land (with either the owner or a contractor acting as a general contractor). Consequently, contract prices are typically lower than sale prices of spec homes. To make comparison more meaningful, the cost of lot development is excluded from sale prices in this analysis.

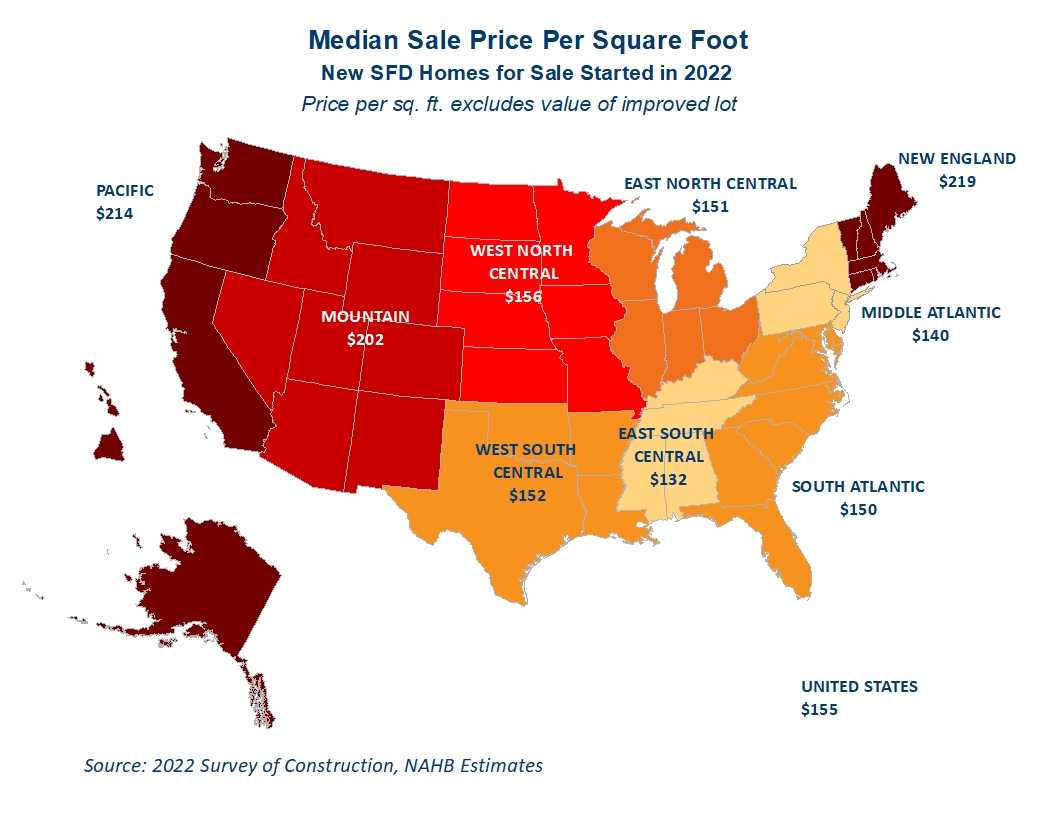

In the for-sale market, the Pacific and New England divisions registered the highest median prices. Half of new for-sale single-family detached homes started in these divisions in 2022 were sold at prices exceeding $214 and $219 per square foot of floor area, respectively, paid on top of the most expensive lot values in the nation. The most economical SFD spec homes were started in the South region, where the median sale prices per square foot were at or below the national median.

The East South Central division is home to the least expensive for-sale homes. Half of all for-sale SFD homes started here in 2022 registered square foot prices of $132 or lower, paid on top of the most economical lot values in the country. The other two divisions in the South – West South Central and South Atlantic – also registered median prices below the national median of $155 per square foot of floor area. Their corresponding prices are $152 and $150 per square foot, excluding improved lot values.

Because square foot prices in this analysis exclude the cost of developed lot, highly variant land values cannot explain the regional differences in square foot prices. However, overly restrictive zoning practices, more stringent construction codes and higher other regulatory costs undoubtedly contribute to higher per square foot prices. Regional differences in the types of homes, prevalent features and materials used in construction also contribute to price differences. In the South, for example, lower square foot prices partially reflect less frequent regional occurrence of such costly new home features as basements.

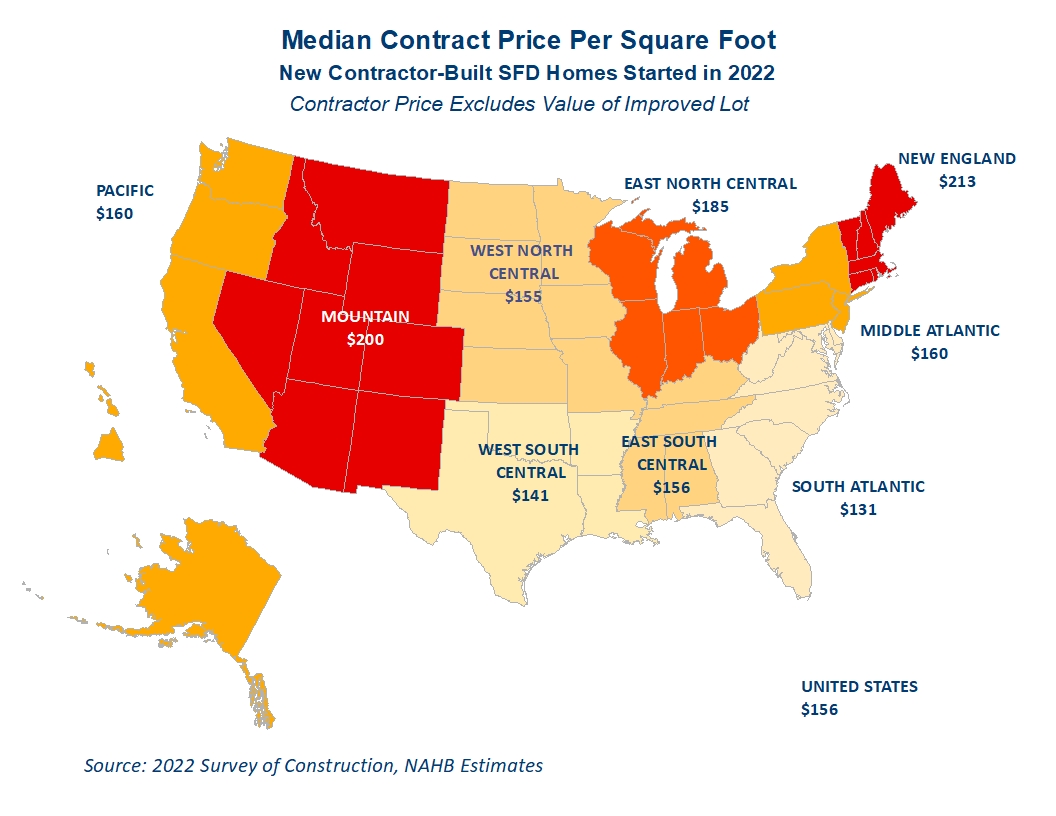

In the custom home market, new contractor-built SFD homes in the New England are by far most expensive to build. Half of custom SFD homes started in New England in 2022 registered prices in excess of $213 per square foot of floor area. The Mountain division came in second with the median of $200 per square foot of floor space. After showing strong appreciation of 23%, median prices in the East North Central division reached $185 per square foot– third highest in the nation. The median custom square foot prices in the neighboring Mid Atlantic division were $160 per square foot.

The Pacific division had similarly high custom square foot prices. Half of custom SFD started in the Pacific in 2022 had prices of $160 per square foot or higher. The corresponding median price in the West North Central was $155.

The South Atlantic division is where most economical custom homes were started in 2022 with half of new custom homes registering prices at or below $131 per square foot of floor space. The remaining two divisions in the South – East South Central and West South Central – recorded slightly higher median square foot contract prices of $156 and $141 – all at or below the national median of $156.

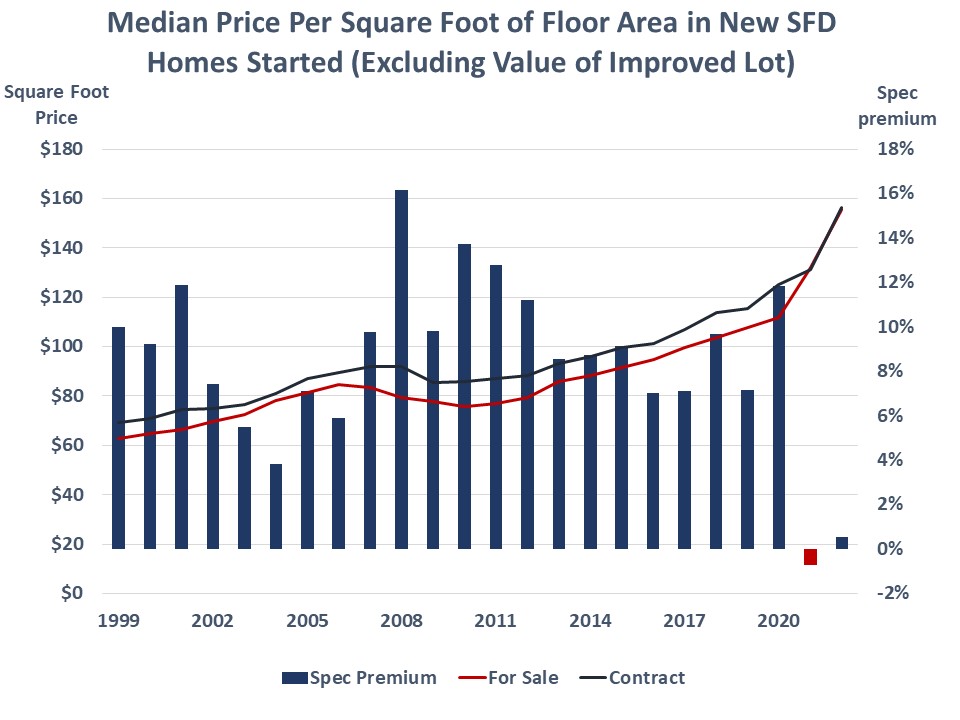

Typically, contractor-built custom homes have been more expensive per square foot than for-sale homes after excluding improved lot values. Over the last two decades, this custom home premium averaged slightly above 9%, suggesting that new custom home buyers were not only willing to wait longer to move into a new home but also pay extra for pricier features and materials. However, these custom home premiums largely disappeared since 2021 when median square foot prices for new for-sale homes caught up and, in five divisions, exceeded divisional custom homes square foot prices.

Pandemic-induced supply chain disruptions, skyrocketing building materials costs and home prices setting new records on a monthly basis, combined with shorter build times for spec homes and more flexibility that spec builders have in delaying sales to keep up with the production pace – all likely contributed to a faster appreciation of spec home prices per square foot in 2021. As of 2022, the custom home premium per square foot returned into a positive territory but remains well below the historic norms, suggesting that custom home buyers now less likely to pay for pricier features and materials than before the pandemic.

The NAHB estimates in this post are based on the Survey of Construction (SOC) data. The survey information comes from interviews of builders and owners of the selected new houses. The reported prices are medians, meaning that half of all builders reported higher per square foot prices and the other half reported prices lower than the median. While the reported median prices cannot reflect the price variability within a division, and even less so within a metro area, they, nevertheless, highlight the regional differences in square foot prices.

For the square footage statistics, the SOC uses all completely finished floor space, including space in basements and attics with finished walls, floors, and ceilings. This does not include a garage, carport, porch, unfinished attic or utility room, or any unfinished area of the basement.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Not quite sure how the data is collected in the Pacific Northwest, especially the Western side – Seattle/Portland. The custom home prices quoted are below our actual costs. Generally speaking, myself and other builders in the area, tell clients to start your budget at 300 per sqft and then it goes up from there.

I would like to see a more comprehensive breakdown of areas and data on labor and materials.

It would be really interesting to see the regional differences in products like Hardi Plank and other nationally distributed materials; I get the feeling that we are getting gouged out here.

The data come from Census Bureau’s Survey of Construction (SOC). The estimates reflect the price in the sales contract (excluding lot values) or contract to build. The SOC does not have a large enough sample size to make state or local area estimates. The reported square foot prices are medians for the whole division.

Appreciate the charting here. An additional phenomenon we are seeing (I am construction lender-ground up true construction loan) is that “appraised values” (this is specific to the “as-built” appraisal we get before closing a construction loan) have not caught up with the trajectory of building costs. I am thinking that the chart showing the contract price per sq ft data is not specifically accurate for the custom home market. Maybe these numbers are accurate for a subdivision builder with a contractor-grade design and build?

Many factors influence “SQUARE FOOT price/cost. You’d have to go thru the entire schedule of values line-by-line and compare.

Do these prices factor in site development variables i.e. septic vs sewer, structural, civil, soil engineering, hard pan demolition and clearance, permitting variables, etc? San Diego as an example starts at about $350/sf and goes way north of $500-$1000sf depending on the location i.e Rancho Santa Fe vs, Linda Vista or National City, etc. This information is very broad, general, and open-ended.

Lot values, including land development costs, are not included in the reported square foot prices to make comparison between custom and for-sale prices more meaningful.

The significant rise in square foot prices, outpacing inflation in 2022, underscores the escalating costs in the construction industry. Builders navigating these challenges might find construction loans a crucial resource, helping them manage increased expenses and ensuring the successful completion of projects in a competitive market.