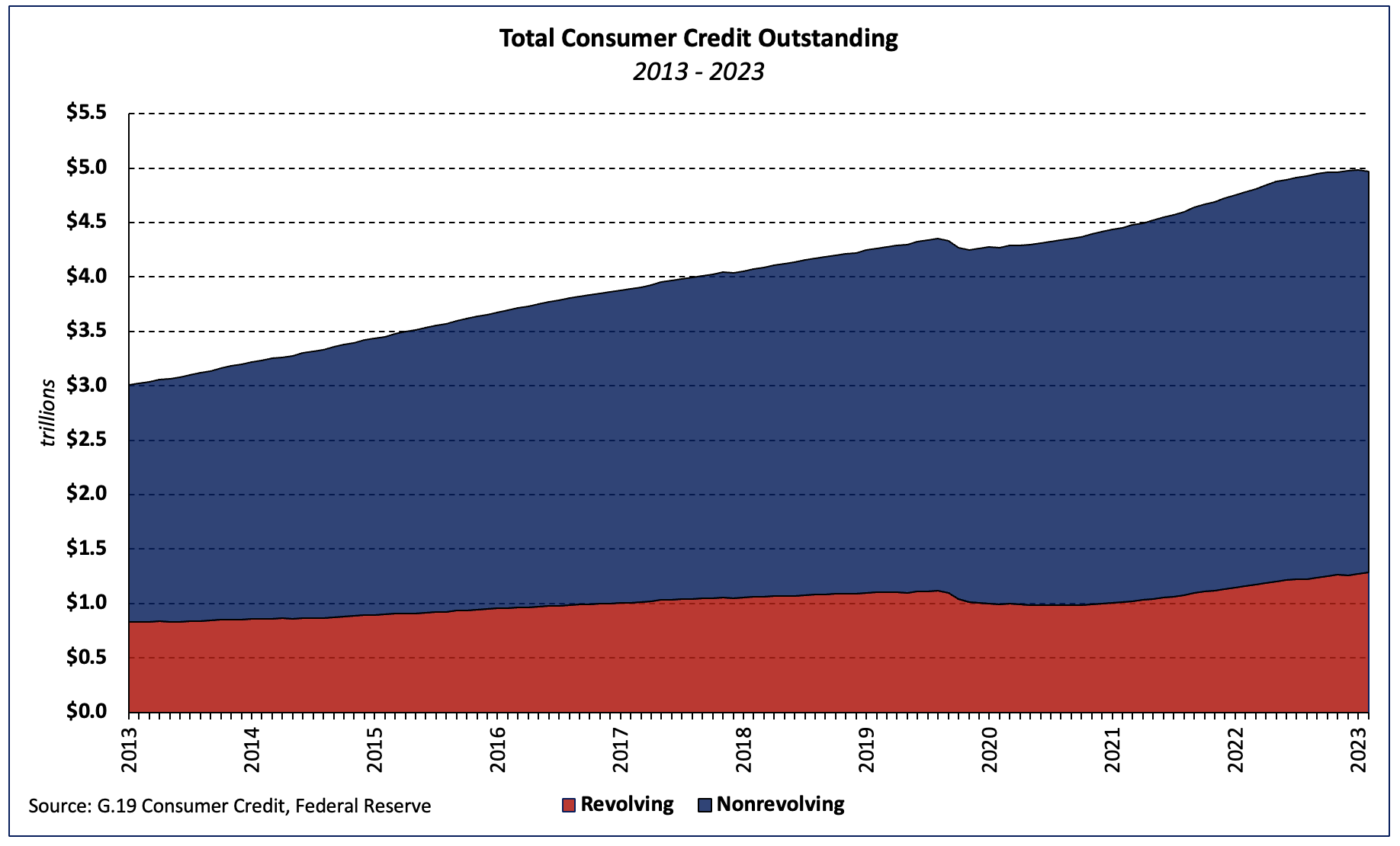

According to the Federal Reserve’s latest G.19 Consumer Credit report, total consumer credit outstanding totaled $4.97 trillion (seasonally adjusted annual rate) in August, a decrease of $15.6 billion over the month but $188.8 billion—or 3.9%–higher than August 2022. The monthly decline resulted from a 0.8% drop in nonrevolving credit outstanding that was partially offset by a 1.2% increase in revolving credit.

The level of revolving debt—primarily credit card debt—rose $14.7 billion over the month and $122.9 billion over the year (SAAR). Revolving debt outstanding has increased two consecutive months by a total of $24.3 billion (SAAR)—or 1.9%.

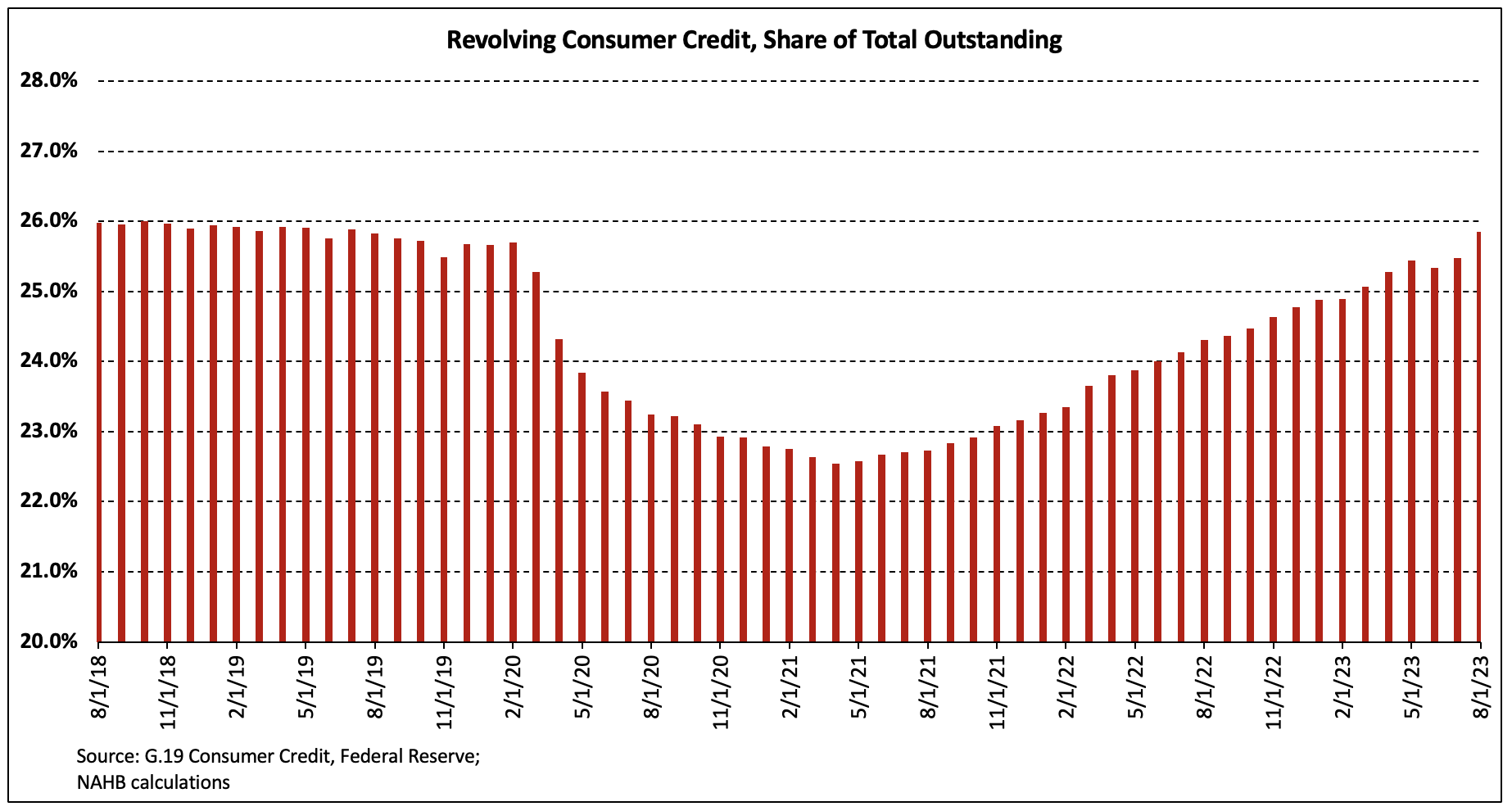

Revolving and nonrevolving debt accounted for 25.9% and 74.1% of total consumer debt, respectively. Since reaching a 32-year low in April 2021, revolving consumer credit outstanding as a share of the total has increased to a level not seen since July 2019.

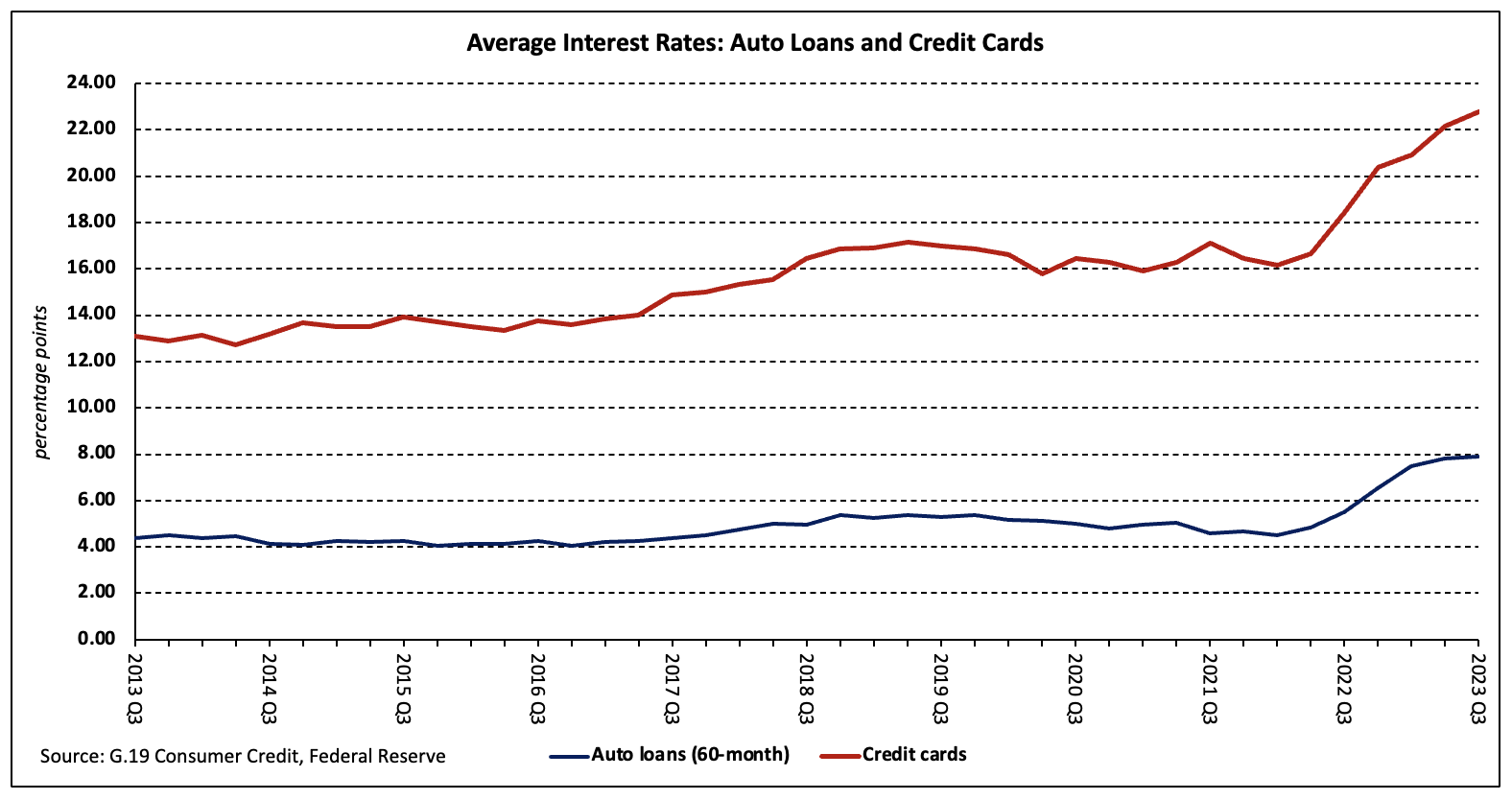

Credit card interest rates have climbed 61 basis points since May, reaching a record-high of 22.77% in August. The average credit card interest rate has increased 434 basis points–or 23.6%–over the past 12 months.

Interest rates for 60-month auto loans issued by commercial banks edged up seven basis points—from 7.81% to 7.88%–in August. Auto loan rates have surged 336 basis points, or 74.3%, since early 2022.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Higher interest rates may lead to increased borrowing costs for construction projects. Builders and developers seeking construction loans might face tighter financial constraints due to these rising rates, influencing project budgets and overall construction activity. Lenders might adjust their loan terms in response, making it crucial for borrowers to carefully consider the financial implications before securing construction financing.