Per the Mortgage Bankers Association’s (MBA) latest month’s surveys (the week ending May 6), the 30-year fixed-rate mortgage (FRM) rate rapidly grew to 5.53%, marking the steepest interest rate increase on record. The Market Composite Index, a measure of mortgage loan application volume, increased by 2% on a seasonally adjusted basis from one week earlier, despite a general downward trend. Prospective buyers are showing some resiliency to higher rates, partly due to utilization of adjustable-rate mortgages (ARMs), per the MBA.

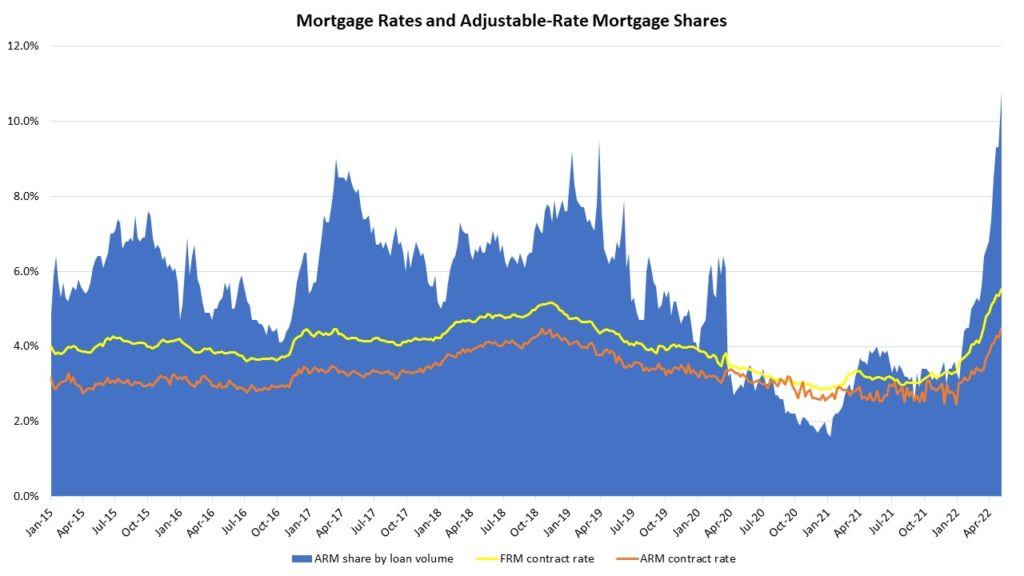

ARMs typically have lower rates than their fixed-rate counterparts but more volatility following a predetermined period (usually 5 years) after which the rate becomes variable. ARMs’ lower rates also reduce a mortgage’s monthly payment. In the latest week, the percentage of ARM originations, in terms of loan volume, was 10.8%. This figure is nearly double what it was one month ago. On dollar terms, ARM originations made up 19.4% of new mortgage debt.

Total mortgage activity has been trending downward, but the last two weeks have shown an uptick in Purchasing, which increased by 0.5% on a seasonally adjusted basis. It still has been exhibiting monthly declines. Refinancing, on the other hand, has continued trending downward through the latest week. The latest week’s FRM rate was 17 basis points higher than the previous week.

The ARM interest rate used above represents that of a “5/1 ARM”, i.e., a 5-year period of a predetermined interest rate followed by a variable rate that changes every year, subject to market conditions. Its weekly changes also trail behind those of the FRM’s interest rate. All figures above are not seasonally adjusted. In the latest week, the average contract interest rate for 5/1 ARMs increased to 4.47 percent from 4.25 percent.

On an unadjusted basis, the Purchasing Index showed an 8% year-over-year decline and the Refinancing Index showed a 72% year-over-year decline.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.