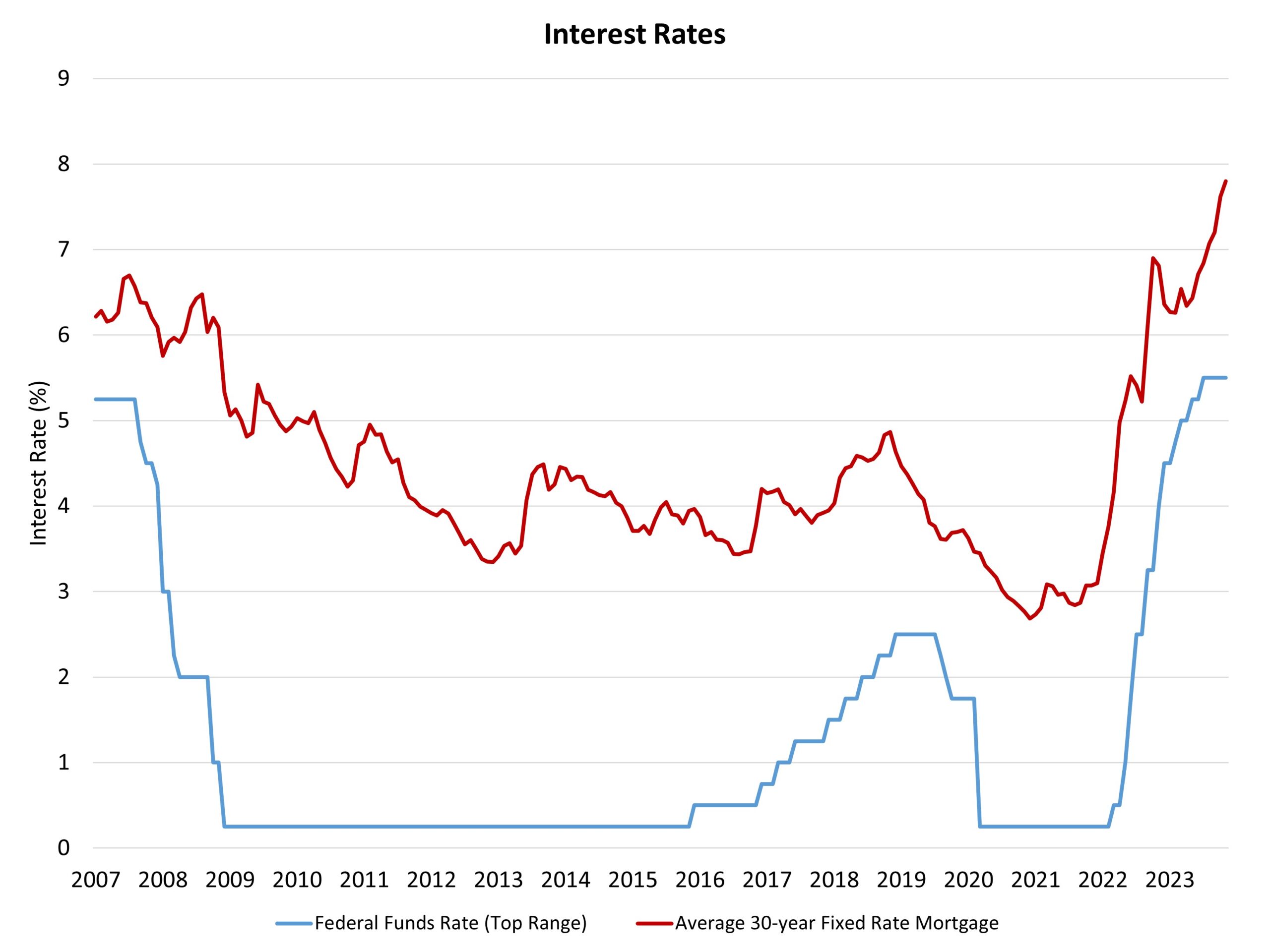

The Federal Reserve’s monetary policy committee held the federal funds rate at a top target rate of 5.5% at the conclusion of its November meeting. While noting that the Fed was “strongly” committed to reducing inflation to its target rate, this marked the second meeting in a row of no increase as the central bank examines incoming data.

The Fed’s statement acknowledged that it would be guided by future inflation and economic data in determining whether it would hold again at its December meeting. The Fed’s statement noted it, “…will continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

The Fed also stated that it will continue to reduce its balance sheet holdings of Treasuries and mortgage-backed securities (MBS) as part of quantitative tightening. This roll off for the central bank’s balance sheet is a key reason why the spread between the 10-year Treasury rate and the 30-year fixed rate mortgage is elevated. Compared to a 160-180 basis points spread after the Great Recession and before Covid, the difference between these long-term rates has recently been as a high as 300 basis points.

Due to this elevated spread, the major housing trade associations (MBA, NAR, and NAHB) submitted a letter to the Fed asking for a pause on rate hikes and, more specifically, to clarify that the Fed would not outright sell MBS as part of quantitative tightening. Such sales of MBS would add supply to the bond market and further increase long-term rates, including mortgage interest rates. Moreover, market uncertainty on whether the Fed might do this is currently adding to the spread. During his press conference, with respect to the overall quantitative tightening policy, Chair Powell did state: “The committee is not considering changing the pace of its balance sheet runoff. It’s not something we’re talking about considering.”

Chair Powell noted the effects that current restrictive monetary policy is having on the housing sector today. He stated in his press conference: “After picking up somewhat over the summer, activity in the housing sector has flattened out and remains well below levels of a year ago, largely reflecting higher mortgage rates.” He also noted that a (sustained) 8% mortgage rate would have “pretty significant effect” for housing, in one of several mentions for the housing sector during his press conference. He also noted analysts, and the Fed itself, may have underestimated household balance sheet strength, which has supported spending.

Higher rates for longer and quantitative tightening collectively are intended to slow the economy and bring inflation back to 2%. While the CPI has shown improvement, falling from an above a 9% rate of inflation in the summer of last year to just below 4% recently, many forecasters expect the final stages of inflation reduction to exhibit stickiness. The core PCE measure of inflation may not reach the Fed’s target until the first half of 2025 as a result. That expected duration is not, in our view, an argument for higher rates today, but rather a reminder that patience and caution are required for the Fed to avoid a macro policy mistake.

The Fed faces competing risks: elevated but trending lower inflation combined with ongoing risks to the banking system and macroeconomic slowing. Chair Powell has previously noted that near-term uncertainty is high due to these risks. Nonetheless, economic data remains better than forecasted. The Fed stated today: “… that economic activity expanded at a strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation remains elevated.” In September, the Fed noted that economic activity was “solid,” rather than “strong” as described today.

Despite this positive assessment from the Fed, there are ongoing challenges for regional banks, as well much discussed weakness for commercial real estate. Increasing rapidly from near zero to 5.5% for the federal funds rate is a dramatic policy move with possible unintended consequences. More caution and clarity seem prudent. In fact, such risks for financial institutions have resulted in tighter credit conditions, which will, with long and variable lags, slow the economy and bring inflation lower. The Fed stated as much today, declaring: “Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.”

All things considered, the Fed is certainly keeping the door open for another rate hike, even if the likelihood may have decreased. The 10-year Treasury rate was little changed upon the announcement, remaining near 4.8%. It is worth noting that recent increases for the 10-year rate had more to do with the “term premium,” or the higher rate needed for long-term debt by investors in the face of economic and financial uncertainty (including a large and persistent federal government deficit), than changes for Fed policy. With all of these factors in mind, mortgage rates will likely stay in the high 7% range, per the Freddie Mac measure, for the remaining months of 2023. This will weigh on housing affordability and home builder sentiment in the coming months.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

As the Fed pauses, the housing market comes into focus. Navigating uncertainties underscores the importance of flexible financing options, making construction loans a key consideration for those seeking stability in the ever-evolving landscape of the housing sector