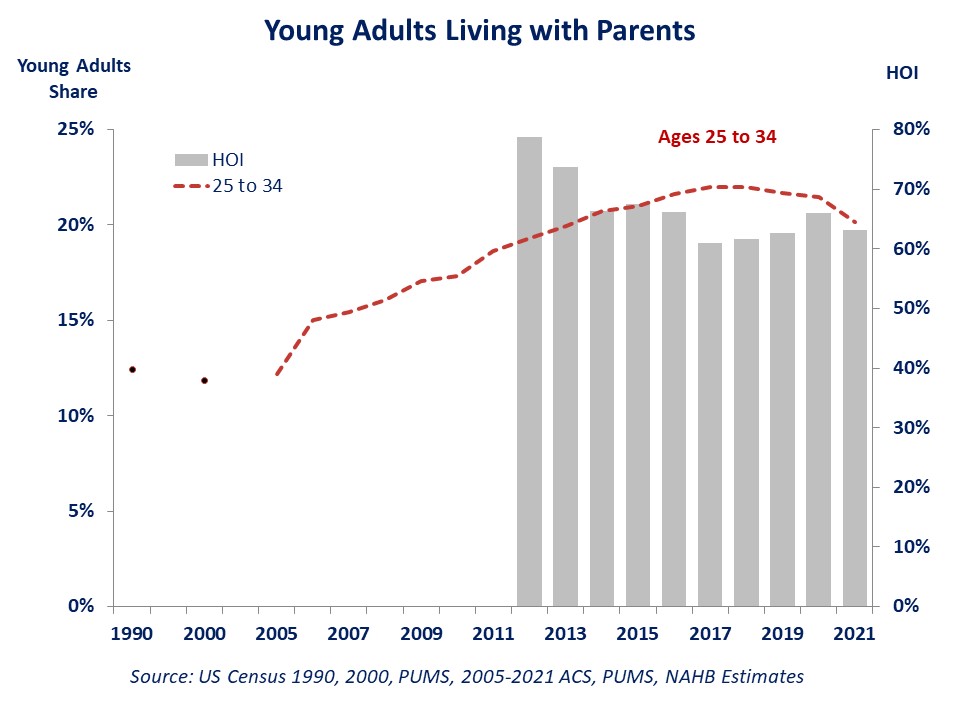

Spurred by elevated savings early in the pandemic and encouraged by lower interest rates, rising numbers of young adults left parental homes in 2021. As a result, the share of young adults ages 25-34 living with parents or parents-in-law declined and now stands at 20.2%, according to NAHB’s analysis of the 2021 American Community Survey (ACS) Public Use Microdata Sample (PUMS). This is a substantial change and welcome reversal of the troublesome trend we have been tracking since the housing boom and bust of the mid-2000s.

Traditionally, young adults ages 25 to 34 make up around half of all first-time homebuyers. Consequently, the number and share of young adults in this age group that choose to stay with their parents or parents-in-law has profound implications for household formation, housing demand and the housing market.

The share of adults ages 25 to 34 living with parents reached its peak of 22% in 2017-2018. Even though an almost 2 percentage point drop in the share since then is a welcome development that the housing market has been waiting for, the share remains elevated by historical standards, with one in five young adults remaining in the parental homes. Two decades ago, less than 12% of young adults ages 25 to 34, or 4.6 million, lived with parents. The current share of 20.2% translates into 8.9 million of young adults living in homes of their parents or parents-in-law.

Undoubtedly, the Covid-19 pandemic heightened the desire for more spacious, independent living. The “excess” savings accumulated early in the lockdown stages of the pandemic, when spending opportunities were limited, gave a financial boost to young adults who remained employed and helped with down payments for a house for those looking into homeownership. The low mortgage rate environment further helped making home ownership affordable.

Stacking our estimates of the share of young adults living with parents against NAHB/Wells Fargo’s HOI data confirms that the rising share of young adults living with parents is associated with worsening affordability while improving housing affordability coincides with the declining share of 25-34 year old adults continuing to live in parental homes.

Given the historically high nature of the recent interest rate hikes and inflation rates, it is doubtful the recent gains in independent living by adults ages 25-34 can be sustained in 2022 and near future.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.