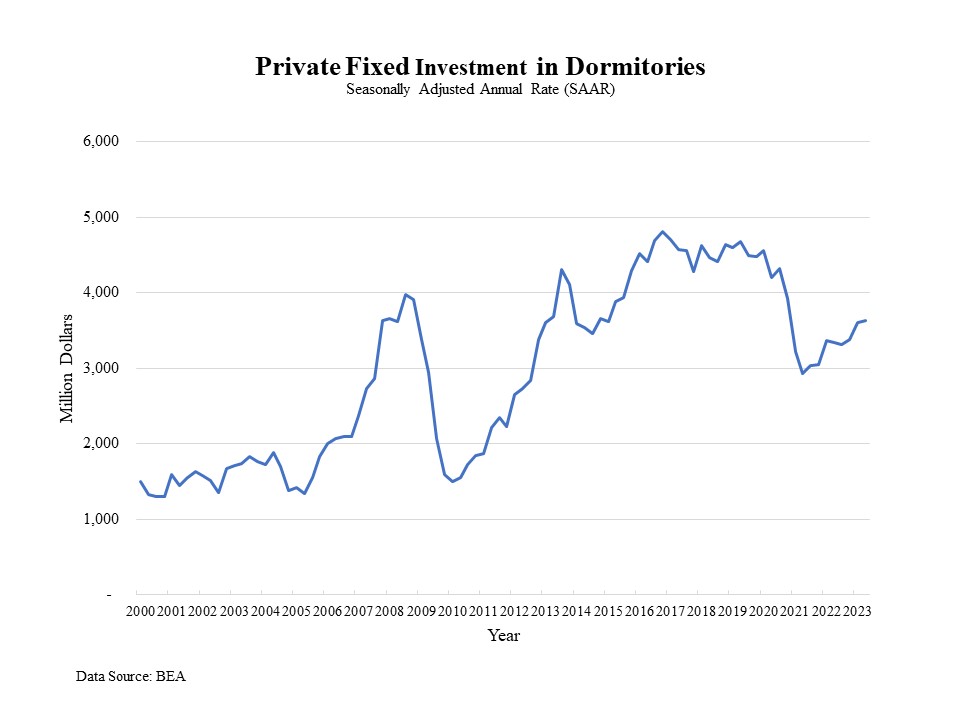

According to the data released by Bureau of Economic Analysis (BEA), private fixed investment in student dormitories inched up 1% to a seasonally adjusted annual rate (SAAR) of $3.6 billion in the second quarter of 2022, after a 6.4% increase in the first quarter. Private fixed investment in dorms was 8.7% higher than a year ago, but still below the pre-pandemic level.

Private fixed investment in student housing experienced a surge after the Great Recession, as college enrollment increased from 17.2 million in 2006 to reach 20.4 million in 2011. However, during the pandemic, private fixed investment in student housing declined drastically from $4.47 billion (SAAR) in the last quarter of 2019 to a lower annual pace of $2.93 billion in the second quarter of 2021, as COVID-19 interrupted normal in-person on campus learning modes. College enrollment fell by 3.6% in the fall of 2020 and by 3.1% in the fall of 2021, according to the National Student Clearinghouse Research Center.

Student housing private investment is on the road to the recovery as the pandemic is officially over. In-person learning requires college students to return to campuses, booting the student housing sector.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

The slight gain in student housing investment highlighted in this article may impact the demand for construction loans in this sector. Builders eyeing student housing projects should keep an eye on this trend and consider tailored financing solutions to capitalize on potential growth opportunities while ensuring favorable construction loan terms.