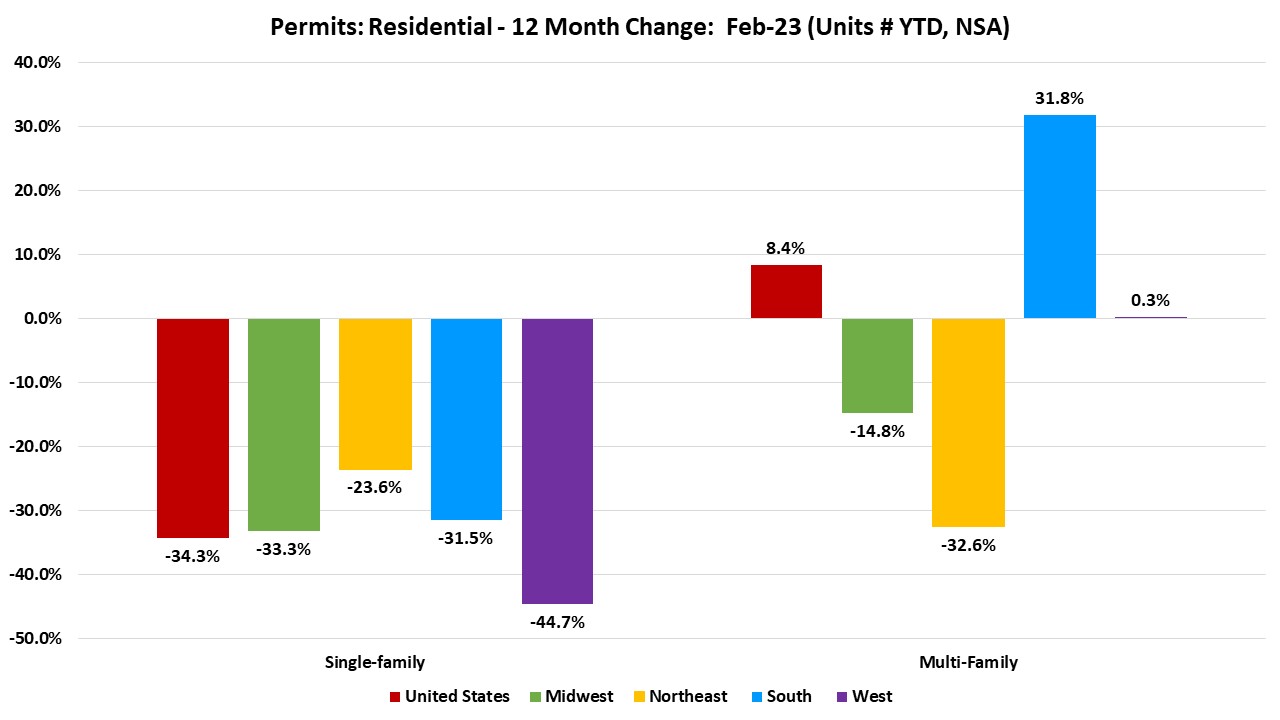

Over the first two months of 2023, the total number of single-family permits issued year-to-date (YTD) nationwide reached 112,131. On a year-over-year (YoY) basis, this is 34.3% below the February 2022 level of 170,716.

Year-to-date ending in February, single-family permits declined in all four regions. The Northeast posted a decline of 23.6%, while the West region reported the steepest decline of 44.7%. The Midwest declined by 33.3% and the South declined by 31.5% in single-family permits during this time. The South posted an increase of 31.8% in multifamily permits and the West increased by a small margin. Multifamily permits in the Northeast were down 32.6% and down in the Midwest 14.8%.

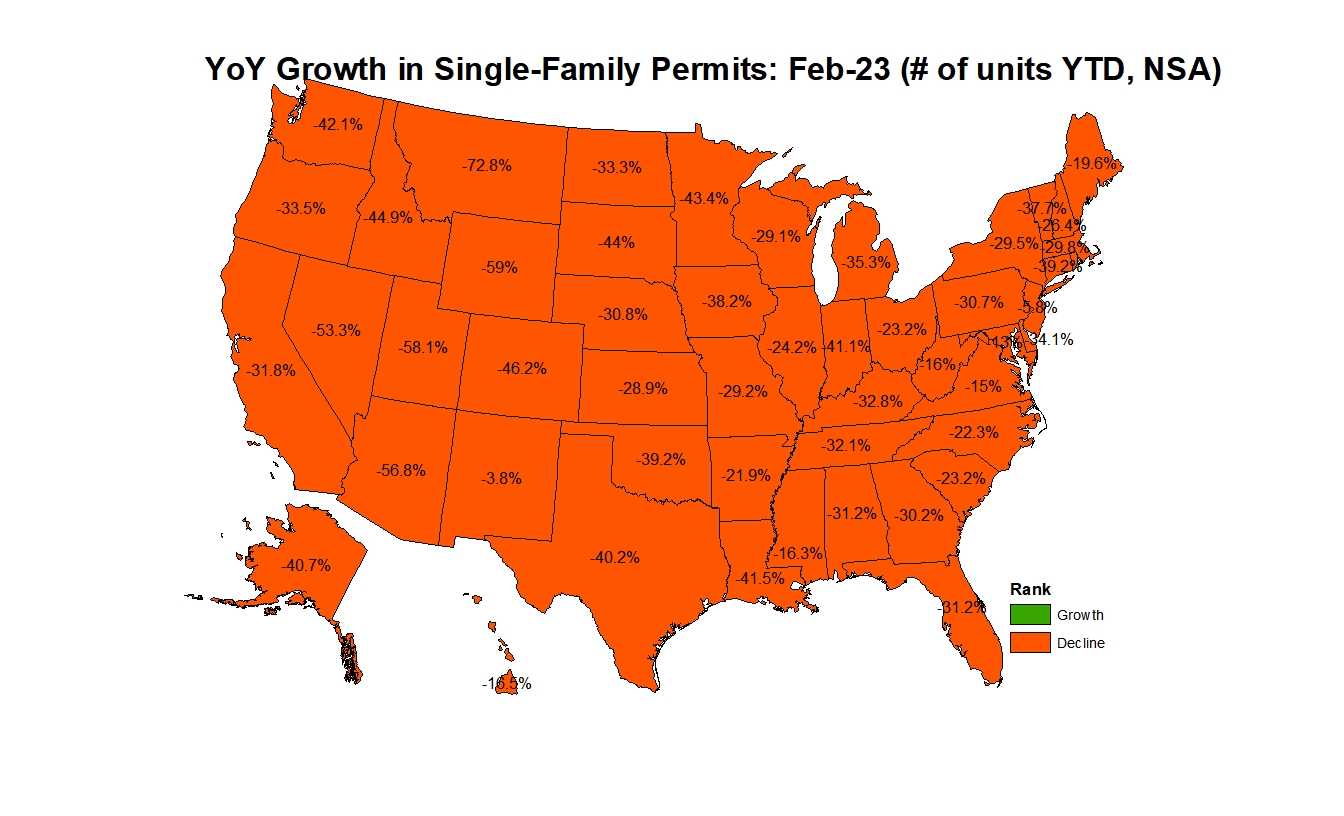

Between February 2022 YTD and February 2023 YTD, all the states and the District of Columbia reported declines in single-family permits ranging from 3.8% in New Mexico to 72.8% in Montana. The ten states issuing the highest number of single-family permits combined accounted for 66.3% of the total single-family permits issued. Texas, the state with the highest number of single-family permits declined 40.2% in the last 12 months while the next two highest states, Florida and North Carolina declined by 31.2% and 22.3% respectively.

Year-to-date, ending in February, the total number of multifamily permits issued nationwide reached 100,633. This is 8.4% above the February 2022 level of 92,818.

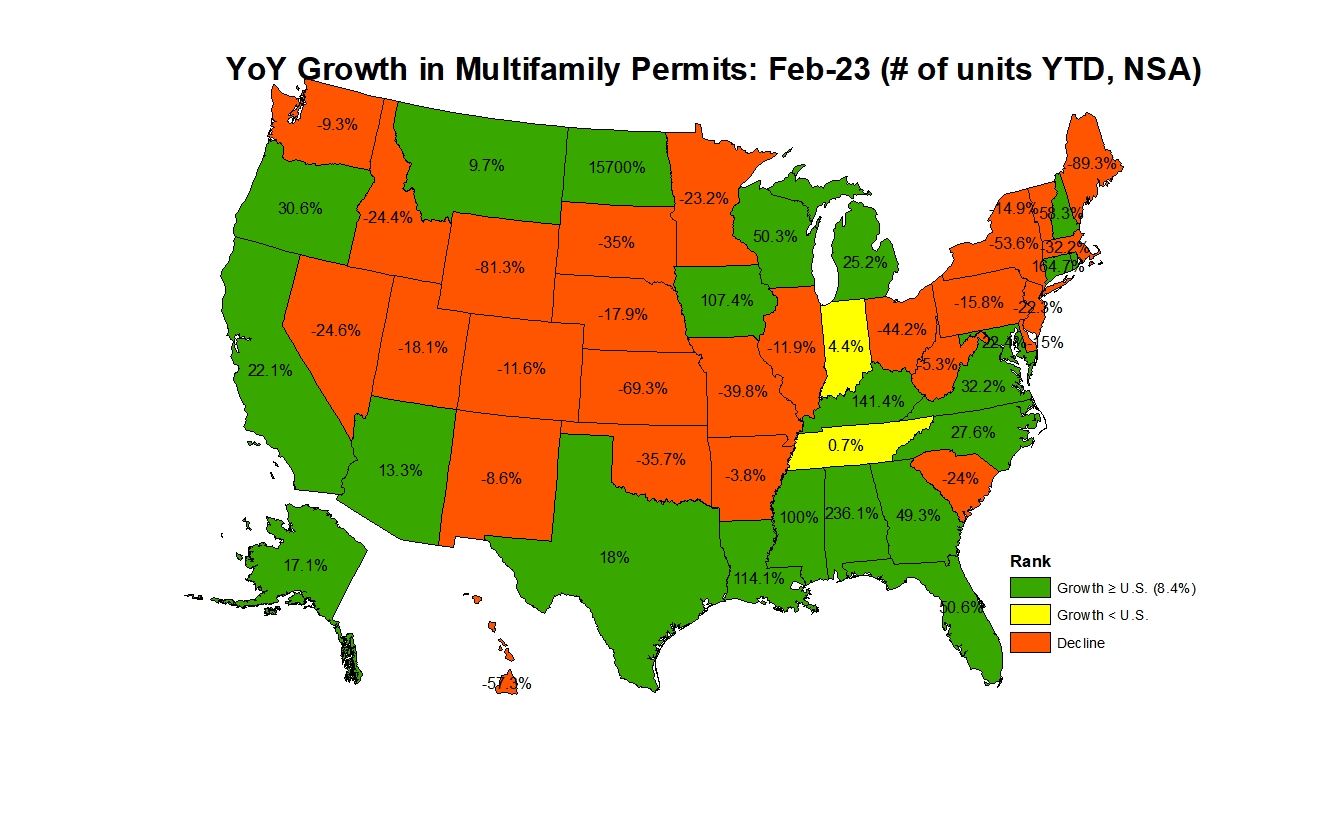

Between February 2022 YTD and February 2023 YTD, 24 states and the District of Columbia recorded growth, while 26 states recorded a decline in multifamily permits. North Dakota led the way with a sharp rise in multifamily permits from two to 316 while Maine had the largest decline of 89.3% from 748 to 80. The ten states issuing the highest number of multifamily permits combined accounted for 67.4% of the multifamily permits issued.

At the local level, below are the top ten metro areas that issued the highest number of single-family permits.

| Top 10 Largest SF Markets | Feb-23 (# of units YTD, NSA) | YTD % Change (compared to Feb-22) |

| Houston-The Woodlands-Sugar Land, TX | 6,269 | -34% |

| Dallas-Fort Worth-Arlington, TX | 4,867 | -38% |

| Atlanta-Sandy Springs-Roswell, GA | 2,945 | -39% |

| Charlotte-Concord-Gastonia, NC-SC | 2,745 | -23% |

| Phoenix-Mesa-Scottsdale, AZ | 2,455 | -60% |

| Orlando-Kissimmee-Sanford, FL | 2,293 | -24% |

| Tampa-St. Petersburg-Clearwater, FL | 1,926 | -26% |

| Austin-Round Rock, TX | 1,908 | -52% |

| Nashville-Davidson–Murfreesboro–Franklin, TN | 1,845 | -34% |

| New York-Newark-Jersey City, NY-NJ-PA | 1,808 | -12% |

For multifamily permits, below are the top ten local areas that issued the highest number of permits.

| Top 10 Largest MF Markets | Feb-23 (# of units YTD, NSA) | YTD % Change (compared to Feb-22) |

| Dallas-Fort Worth-Arlington, TX | 5,364 | 10% |

| Houston-The Woodlands-Sugar Land, TX | 4,910 | 57% |

| Atlanta-Sandy Springs-Roswell, GA | 4,162 | 83% |

| New York-Newark-Jersey City, NY-NJ-PA | 4,047 | -38% |

| Miami-Fort Lauderdale-West Palm Beach, FL | 3,762 | 113% |

| Los Angeles-Long Beach-Anaheim, CA | 2,793 | 0% |

| Denver-Aurora-Lakewood, CO | 2,749 | 35% |

| Phoenix-Mesa-Scottsdale, AZ | 2,698 | 18% |

| Austin-Round Rock, TX | 2,565 | -14% |

| Seattle-Tacoma-Bellevue, WA | 2,404 | -21% |

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.