During the second quarter of 2022, credit became both tighter and more costly on loans for Acquisition, Development & Construction (AD&C) according to NAHB’s Survey on AD&C Financing.

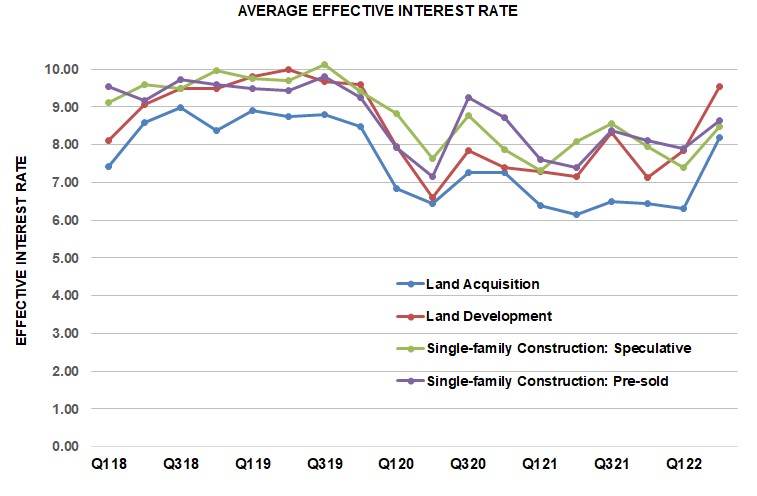

The average effective rate (based on rate of return to the lender over the assumed life of the loan taking both the contract interest rate and initial fee into account) increased substantially from the prior quarter on all four categories of loans tracked in the AD&C Survey: from 6.32 percent to 8.19 percent on loans for land acquisition, from 7.85 to 9.55 percent on loans for land development, from 7.38 to 8.48 percent on loans for speculative single-family construction, and from 7.90 to 8.63 percent on loans for pre-sold single-family construction.

Changes in the effective rate may be due to changes in either the contract interest rate, or in the initial points charged on the loans. In the second quarter, average points were unchanged from the previous quarter at 0.63 percent on loans for speculative single-family construction, and actually down slightly on the other three categories of AD&C loans: from 0.90 to 0.86 percent on loans for land acquisition, from 0.95 to 0.90 percent on loans for land development, and from 0.63 to 0.51 percent on loans for pre-sold single-family construction. However, these relatively small changes were overshadowed by strong surges in the average contract interest rate changed on the loans: from 4.36 to 6.19 percent on loans for land acquisition, from 4.60 to 6.27 percent on loans for land development, from 4.63 to 5.39 percent on loans for speculative single-family construction, and from 4.61 to 5.24 percent on loans for pre-sold single-family construction.

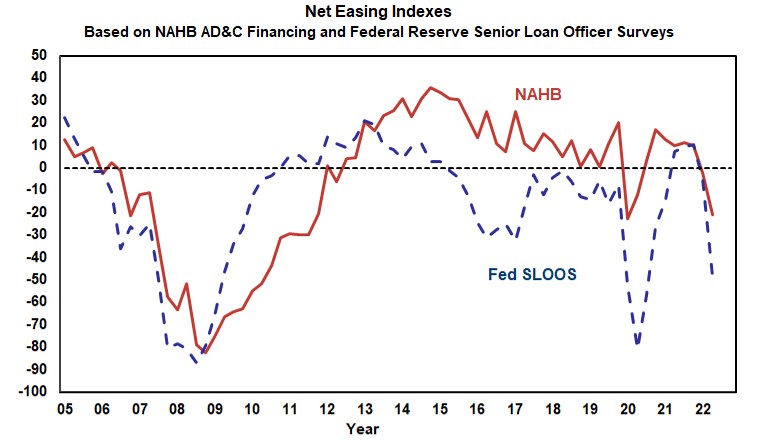

The NAHB survey also produces a net easing index that summarizes the change in credit conditions, similar to the net easing index constructed from the Federal Reserve’s survey of senior loan officers (SLOOS). The second quarter of 2022 was the second consecutive quarter during which both the NAHB and Fed indices were negative, indicating tightening credit conditions. Moreover, both indices were substantially more negative in the second quarter than they had been in the first. In the second quarter, the NAHB net easing index stood at -21.0 while the Fed index was -48.4—compared to -2.30 and -4.7, respectively, in the first quarter of 2022.

The most common ways in which the lenders tightened in the second quarter were by increasing the interest rate on the loans (cited by 68 percent of the builders and developers who reported tighter credit conditions), lowering the allowable Loan-to-Value or Loan-to-Cost ratio (65 percent) and reducing amount they are willing to lend (61 percent).

The results of the second quarter AD&C survey are consistent with the general tightening of financial conditions and rising interest rates reported in a previous post. More detail, including a complete history for every question in the survey, is available on NAHB’s AD&C Financing Survey web page.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.