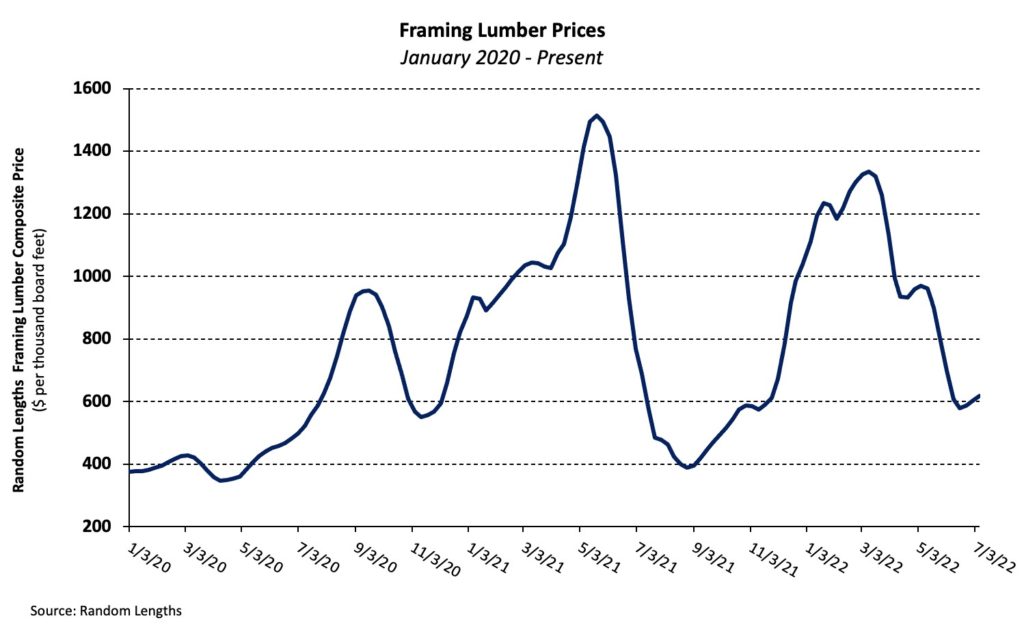

Since the relatively low point at the onset of the pandemic on April 17, 2020, lumber prices have been volatile, with record setting spikes interspersed with periods of substantial declines.

On balance over the entire period, however, softwood lumber prices have increased enough to add $14,345 to the price of an average new single-family home, and $5,511 to the market value of an average new multifamily home, according to NAHB’s latest estimates. The increase in multifamily value, in turn, translates to households paying $51 a month more to rent the new apartment.

In addition to narrowly defined framing lumber, these estimates include plywood, oriented OSB, particleboard, fiberboard, shakes and shingles—in short, any of the products sold by U.S. sawmills and tracked on a weekly basis by Random Lengths. Estimates developed from the Builder Practices Survey conducted by Home Innovation Research Labs show that the average new single-family home uses more than 2,200 square feet of softwood plywood, and more than 6,800 of OSB, in addition to roughly 15,000 board feet of framing lumber.

Builders do not in general buy lumber and other building products directly from sawmills, but from an intermediary like a lumber yard. For that reason, NAHB estimates mark up sawmill prices by gross margin as a percent of sales for the “lumber and other construction materials” industry, as reported in the U.S. Census Bureau’s Annual Wholesale Trade Tables,

Softwood lumber is also an input into certain manufactured products used in residential construction—especially cabinets, windows, doors and trusses. To account for the manufacturer’s margin, sawmill prices for the lumber embodied in these products are marked up by the percent difference between receipts and cost of goods in the “wood product manufacturing” industry, as reported in the IRS Returns of Active Corporations tables.

Taking all this into account, at the prices reported by Random Lengths on April 17, 2020, the total cost to a builder for softwood lumber was $16,927 for the products in an average single-family home, and $5,940 for the products in an average multifamily home.

More recently, based on Random Lengths prices reported on July 01, 2022, the costs have risen to $29,407 for the softwood lumber products in an average single-family, and $10,734 for the products in an average multifamily, home. These numbers represent a 74 percent ($12,480) and 81 percent ($4,795) increase in single-family and multifamily builders’ softwood lumber costs, respectively.

Prices to home buyers go up somewhat more than this, due to factors such as interest on construction loans, brokers’ fees, and margins required to attract capital and get construction loans underwritten. As explained in NAHB’s recent study on regulatory costs, for items used during the construction process, the final home price will increase by 14.94 percent above the builder’s cost.

The bottom line is that the changes in softwood lumber prices that occurred between April 2020 and July 2022 have added $14,345 to the price of an average new single-family home and $5,511 to the market value of an average new multifamily home. Based on the average rent-to-value ratio in most recent HUD/Census Rental Housing Finance Survey, the increase in builder cost and market value for a multifamily structure means tenants pay $51 more a month to rent the average new apartment due to the change in softwood lumber prices.

This, along with rising wages for construction workers and higher interest rates, is one of the reasons the housing market is experiencing declining affordability

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

The pandemic has affected the price of wood/lumber and the the market has been unpredictable. I found a site where you can buy quality and affordable wood/lumber and other services. Check ’em out https://www.rusticlumberco.com/our-products/