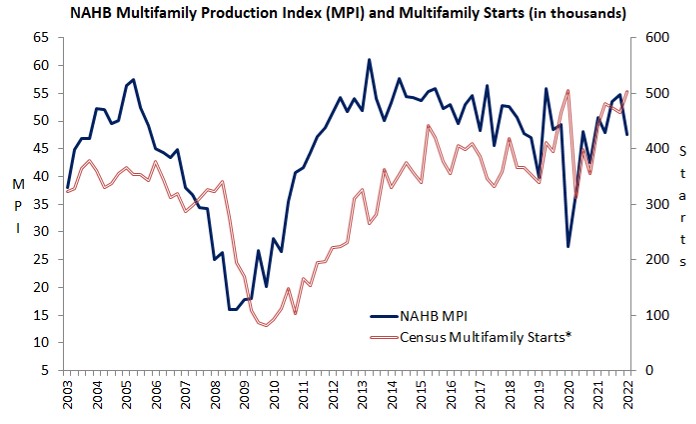

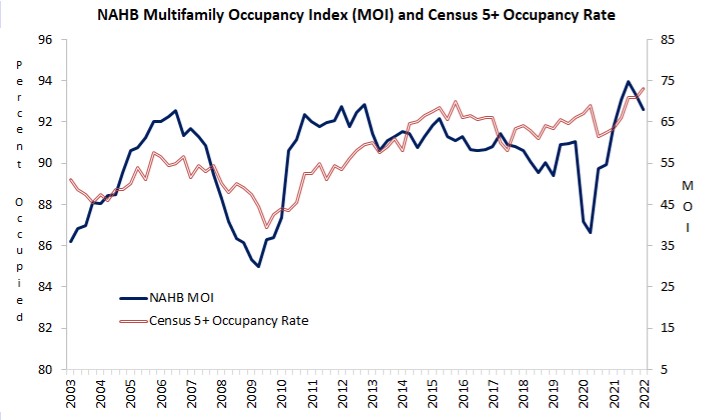

Confidence in the market for new multifamily housing turned downward in the first quarter of 2022, according to the latest results from NAHB’s Multifamily Market Survey (MMS). The MMS produces two main indices. The survey’s Multifamily Production Index (MPI) decreased six points to 48 in the first quarter, dipping below the break-even mark of 50 for the first time in three quarters. Meanwhile, the Multifamily Occupancy Index (MOI) inched down one point to 68.

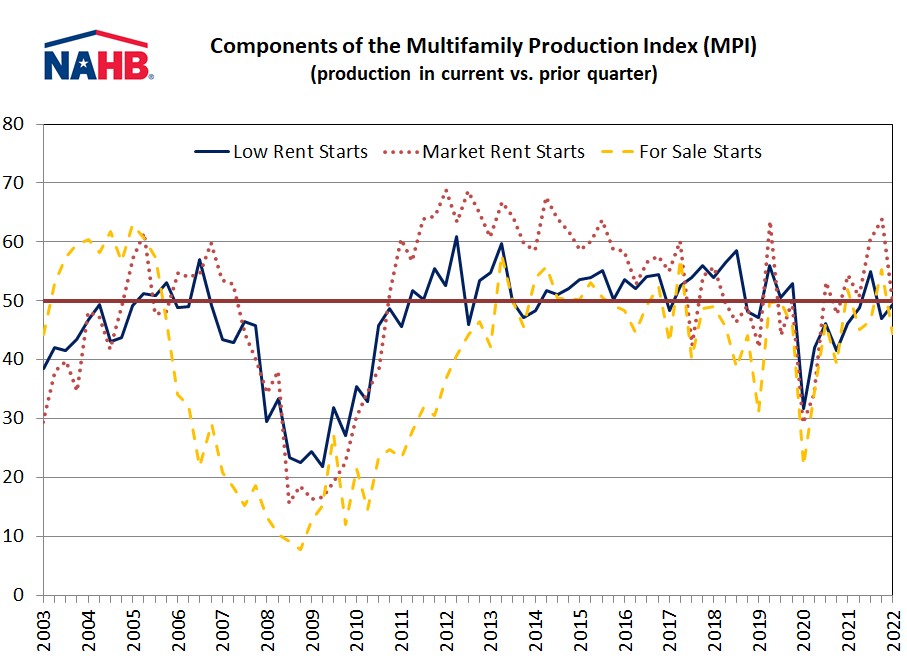

The MPI is a weighted average of three component indices measuring developer sentiment about production in different segments of the multifamily market: low-rent apartments supported by low-income tax credits or other government subsidy programs; market-rate rental apartments built to be rented at an unsubsidized market-clearing price; and for-sale units (i.e., multifamily condominiums). Each component index lies on a scale on of 0 to 100, where a number above 50 indicates that more respondents report conditions are improving than report conditions are getting worse. Two of the three components decreased from the fourth to the first quarter: The component measuring low-rent units increased one point to 49, the component measuring market rate rental units dropped 12 points to 49 and the component measuring for-sale units fell nine points to 44.

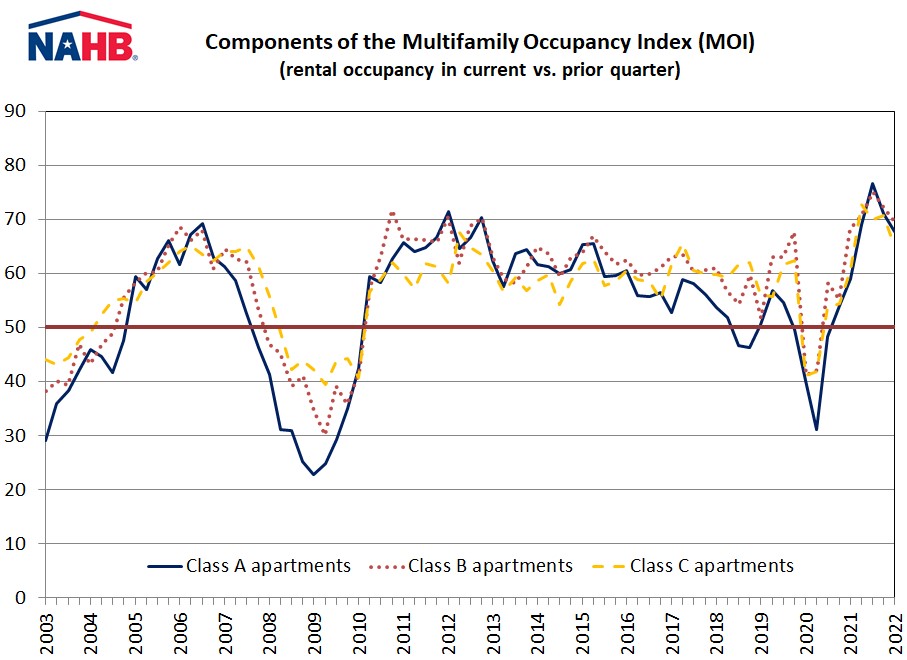

Similarly, the MOI measures the multifamily housing industry’s sentiment about occupancy rates in existing apartments. The MOI is also a weighted average of three components, for occupancy in class A, B, and C apartments. Again, each component index lies on a scale from 0 to 100, with a break-even point at 50, where numbers above 50 indicate rising occupancy. Although the overall MOI inched down one point to 68, which is still well above 50 and is consistent with the recent high rates of occupancy reported by the Census Bureau.

Results for the MOI’s components were mixed in the first quarter, although all three remained well above 50. The index for occupancy in class A apartments declined four points to 68, and the index for class declined by four points to 65; while the index for class B apartments increased two points to 69.

Strong demand is still keeping multifamily developers fairly optimistic in many parts of the country, but high construction costs and their impact on affordability are starting to make some developers cautious. The caution has not shown up yet in the multifamily starts rate, which remains quite strong, but the MPI typically leads changes in starts by one to three quarters.

For complete results from the Multifamily Market Survey, including the history of each index and its components back to the survey’s inception in 2003, please visit NAHB’s MMS web page.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.