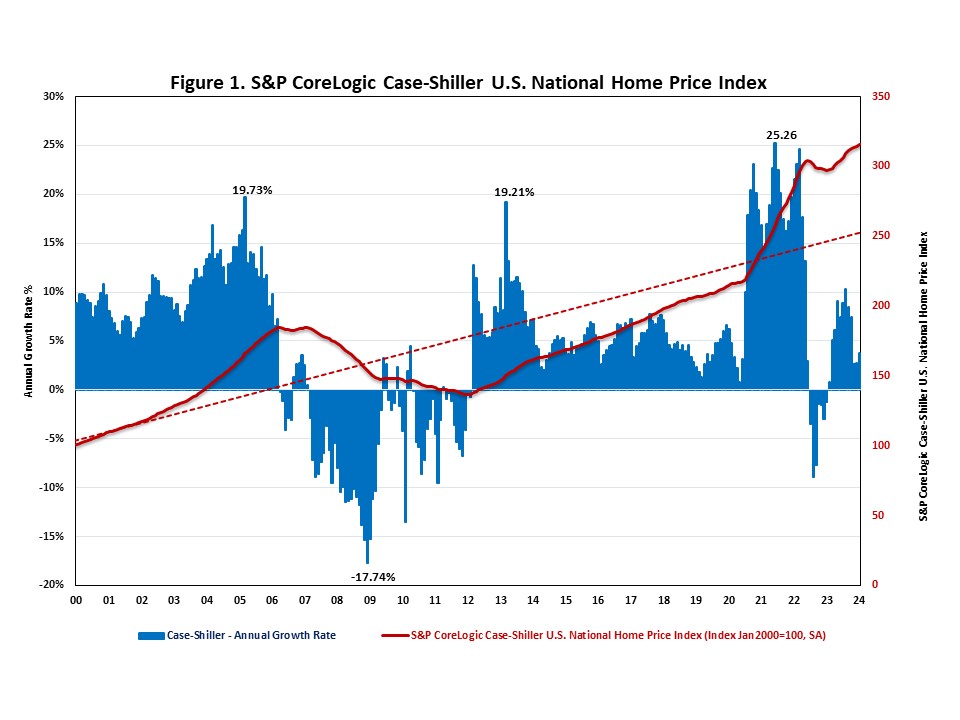

The S&P CoreLogic Case-Shiller U.S. National Home Price Index (HPI), reported by S&P Dow Jones Indices, rose at a seasonally adjusted annual rate of 4.98% for February. This was following an adjusted 3.73% rate for January. This marks the fourth consecutive monthly rate increase from November 2023.

On a year-over-year basis, the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index posted a 6.38% annual gain in February, following a 5.99% increase in January. The year-over-year rate has been increasing since June of 2023, and is at its highest since November of 2022.

Meanwhile, the Home Price Index released by the Federal Housing Finance Agency (FHFA), rose at a seasonally adjusted annual rate of 16.07% for February, the highest rate since April of 2022. This was succeeded by a 0.77% decline in January. On a year-over-year basis, the FHFA Home Price NSA Index rose 7.04% in February, up from 6.45% in the previous month.

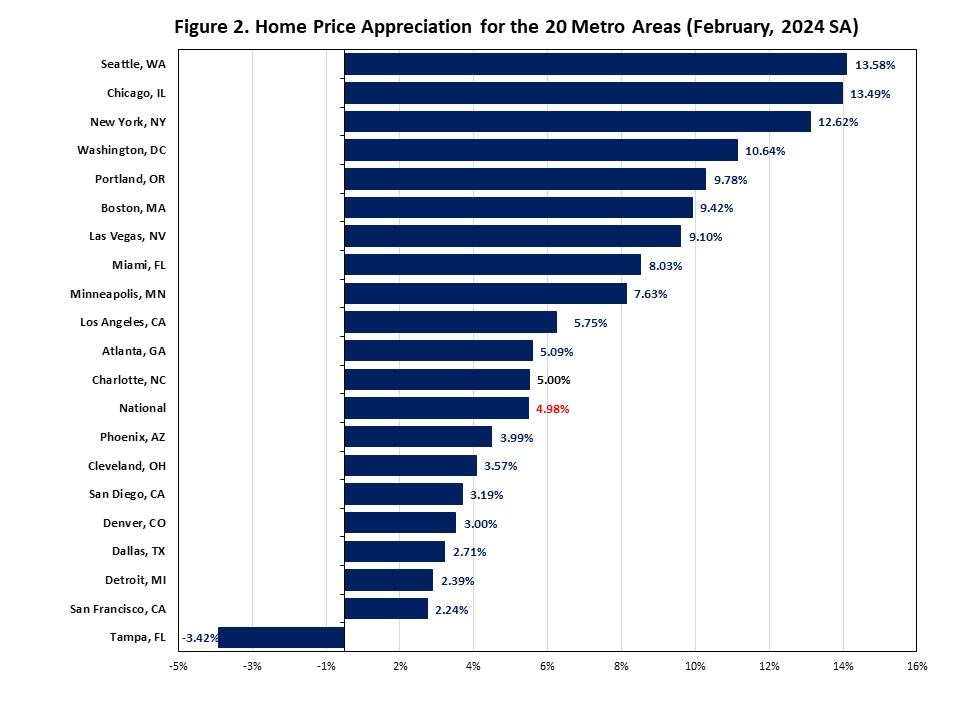

In addition to tracking national home price changes, S&P Dow Jones Indices also reported home price indexes across 20 metro areas in February on a seasonally adjusted basis. Only one out of 20 metro areas reported negative home price appreciation: Tampa at -3.42%. Among the 20 metro areas, 12 metro areas exceeded the national average of 4.98%. Seattle had the highest rate at 13.58%, followed by Chicago at 13.49%, and then New York with a 12.62% increase.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.