A small rise in mortgage rates in February led to a flat reading for new home sales.

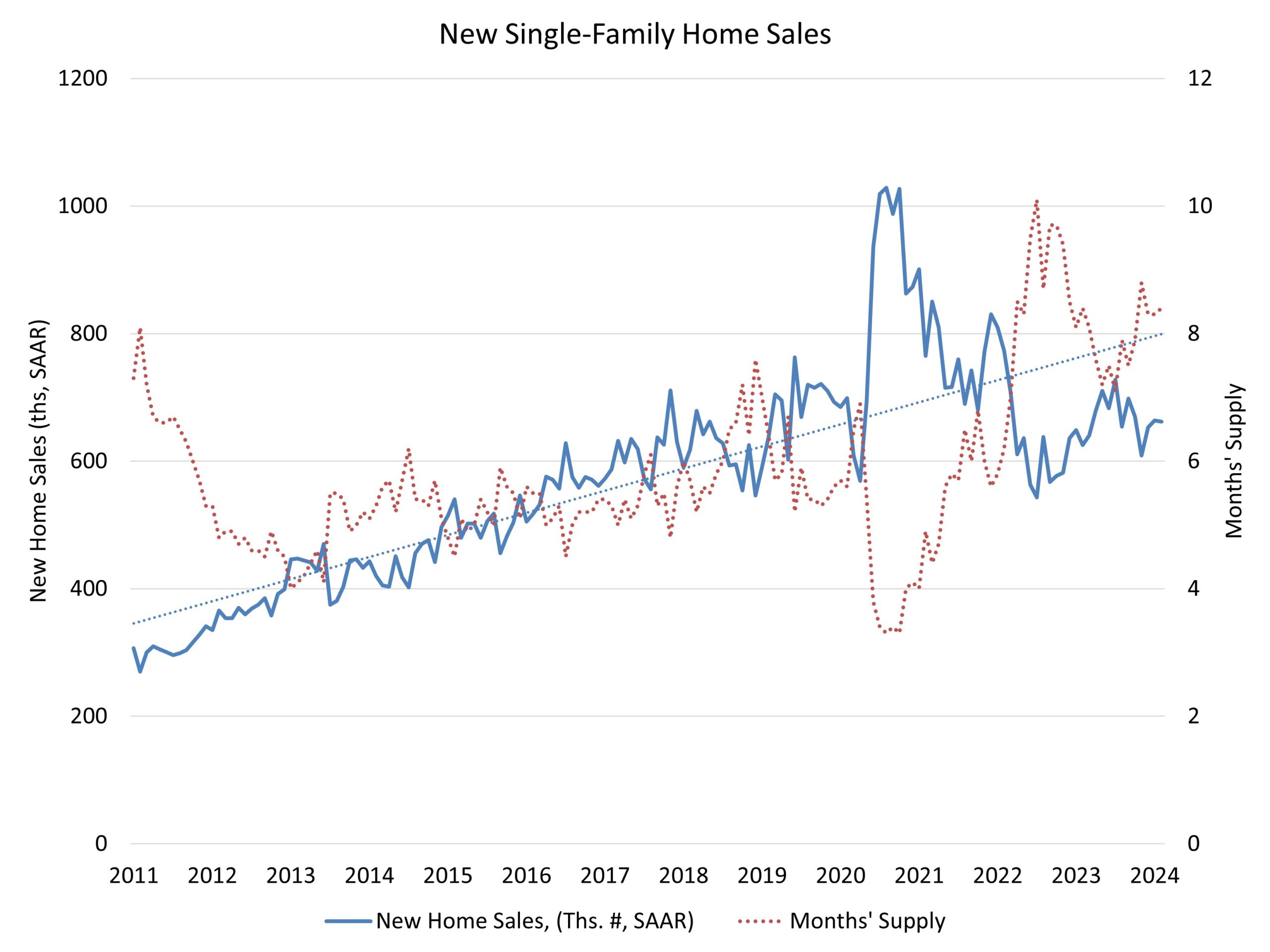

Sales of newly built, single-family homes in February edged 0.3% lower to a 662,000 seasonally adjusted annual rate, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The pace of new home sales in February is up 5.9% from a year earlier.

Mortgage rates averaged 6.78% in February compared to 6.64% in January, according to Freddie Mac.

A new home sale occurs when a sales contract is signed, or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the February reading of 662,000 units is the number of homes that would sell if this pace continued for the next 12 months.

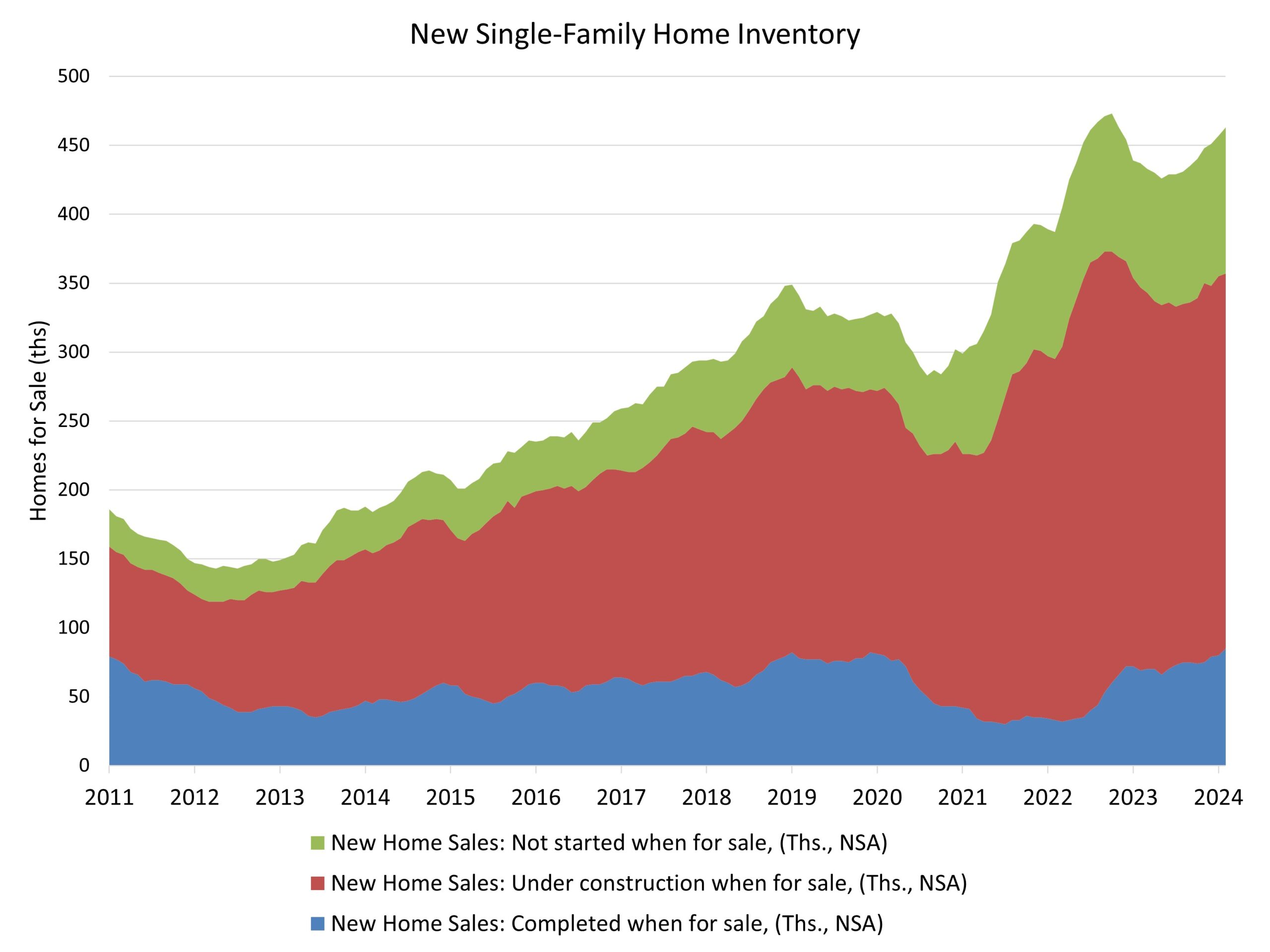

New single-family home inventory in February remained elevated at a level of 463,000, up 1.3% from January. This represents an 8.4 months’ supply at the current building pace. A measure near a 6 months’ supply is considered balanced. However, with only a 2.9 months’ supply of existing homes for sale, new home inventory can remain above this balanced measure. As interest rates subside over the course of 2024, additional home buyers will be priced into the market and new construction will be needed to meet this demand. Nonetheless, as existing home inventory is expected to rise this year, watching new home inventory will be key during the second half of this year.

With respect to the types of inventory, completed and ready-to-occupy inventory has increased 23% over the last year, rising to 85,000 homes. Homes advertised for sale but not started construction have increased almost 18% over the last year to 106,000. In contrast, homes available for sale that are under construction have declined 2% to 272,000.

The median new home sale price in February was $400,500, edging down 3.5% from January, and down 7.6% compared to a year ago. The NAHB/Wells Fargo HMI reported that approximately one-quarter of builders reduced prices in March. Combined with slightly smaller home sizes, these factors are reflected in the year-over-year price decline.

Regionally, on a year-to-date basis, new home sales are up 47.0% in the Northeast, 29.7% in the Midwest and 41.0% in the West. New home sales are down 13.4% in the South.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

My biggest takeaway based on my own analysis of the Census’ data:

1. The median sold price fell to the lowest level since June 2021 (nearly a 3yr low) and down 19% from the peak set in Oct 2022 ($497k). The decrease in prices is partially from rise of inventory, increase in mortgage rates this February and mix in sales (lower share of sales in the range of $500k-749k and higher share of sales less than $400k compared to Feb 2023).

2. Completed homes for sale rising to 85k. That’s the highest level seen since Sept 2010!