As rising mortgage rates continue to cool the housing market, the volume of existing home sales has declined for eight consecutive months as of September, according to the National Association of Realtors (NAR). The average 30-year fixed mortgage interest rate has increased from 3.11% at the start of the year to 6.9% this week, the highest level since April 2002, making housing less affordable. However, home price appreciation slowed for the third month after reaching a record high of $413,800 in June.

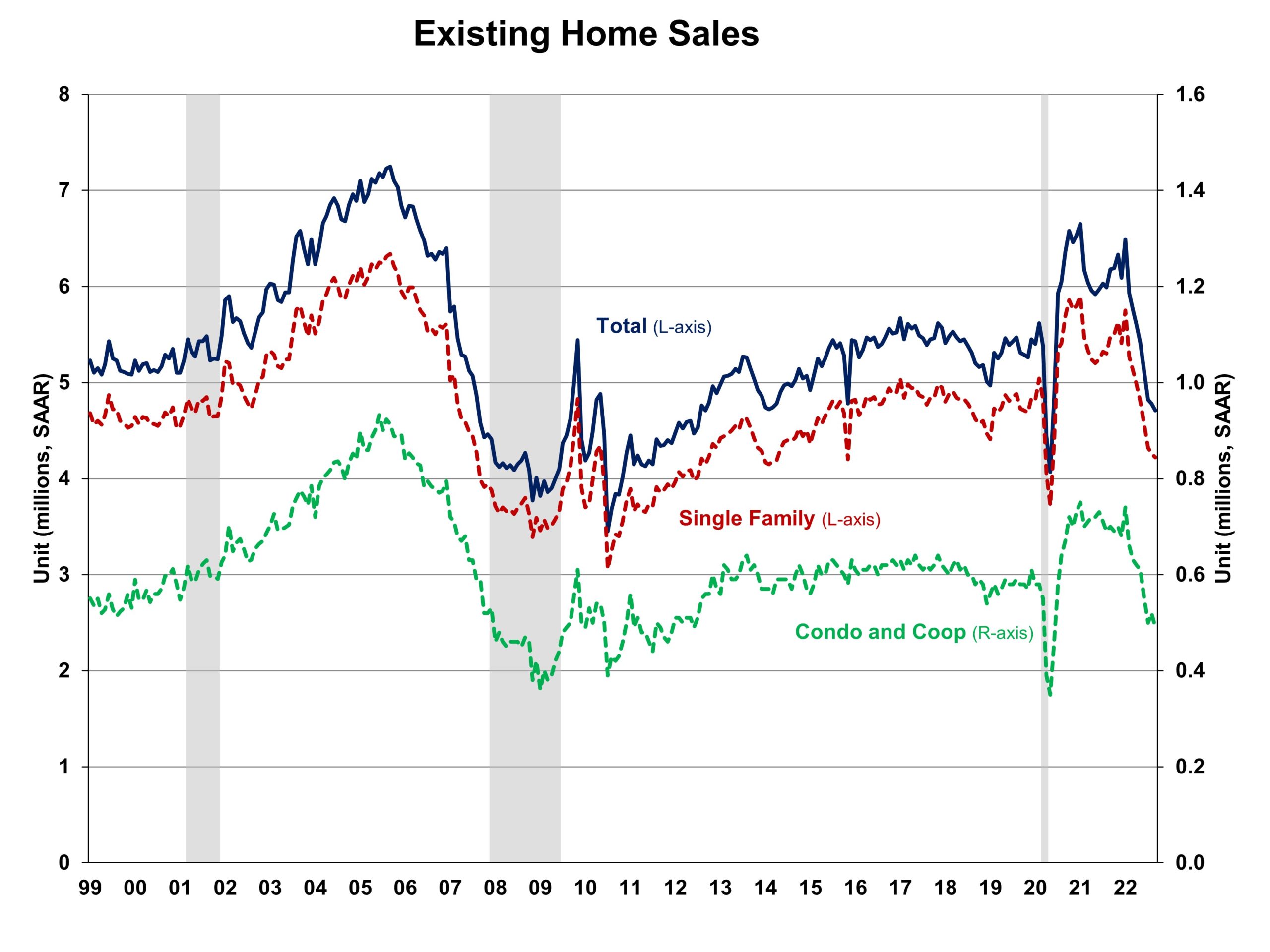

Total existing home sales, including single-family homes, townhomes, condominiums and co-ops, fell 1.5% to a seasonally adjusted annual rate of 4.71 million in September, the lowest pace since September 2012 with the exception of April and May 2020. On a year-over-year basis, sales were 23.8% lower than a year ago.

The first-time buyer share stayed at 29% in September, consistent with August 2022 and slightly higher than 28% from September 2021. The September inventory level fell from 1.28 to 1.25 million units and was lower than 1.26 million from a year ago.

At the current sales rate, September unsold inventory sits at a 3.2-month supply, unchanged from last month and higher than the 2.4-months reading from a year ago.

Homes stayed on the market for an average of just 19 days in September, up from 16 days in August and 17 days in September 2021. In September, 70% of homes sold were on the market for less than a month.

The September all-cash sales share was 22% of transactions, down from 24% last month and 23% a year ago.

The September median sales price of all existing homes was $384,800, up 8.4% from a year ago, representing the 127th consecutive month of year-over-year increases, the longest-running streak on record. The median existing condominium/co-op price of $331,700 in September was up 9.8% from a year ago.

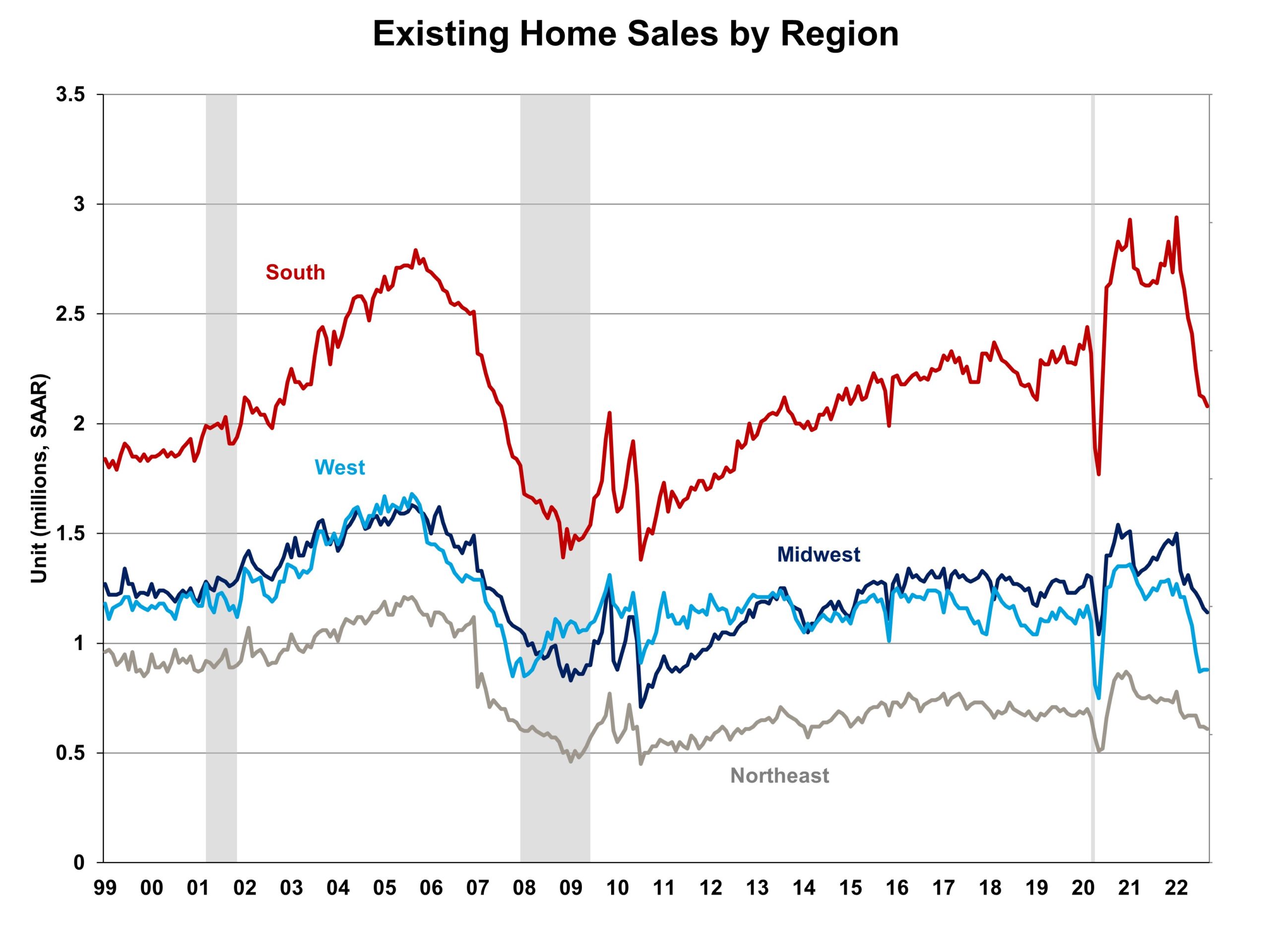

Geographically, three regions saw a decline in existing home sales in September, ranging from 1.6% in the Northeast to 1.9% in the South. Sales in the West remained unchanged in September. On a year-over-year basis, all four regions saw a double-digit decline in sales, ranging from 18.7% in the Northeast to 31.3% in the West.

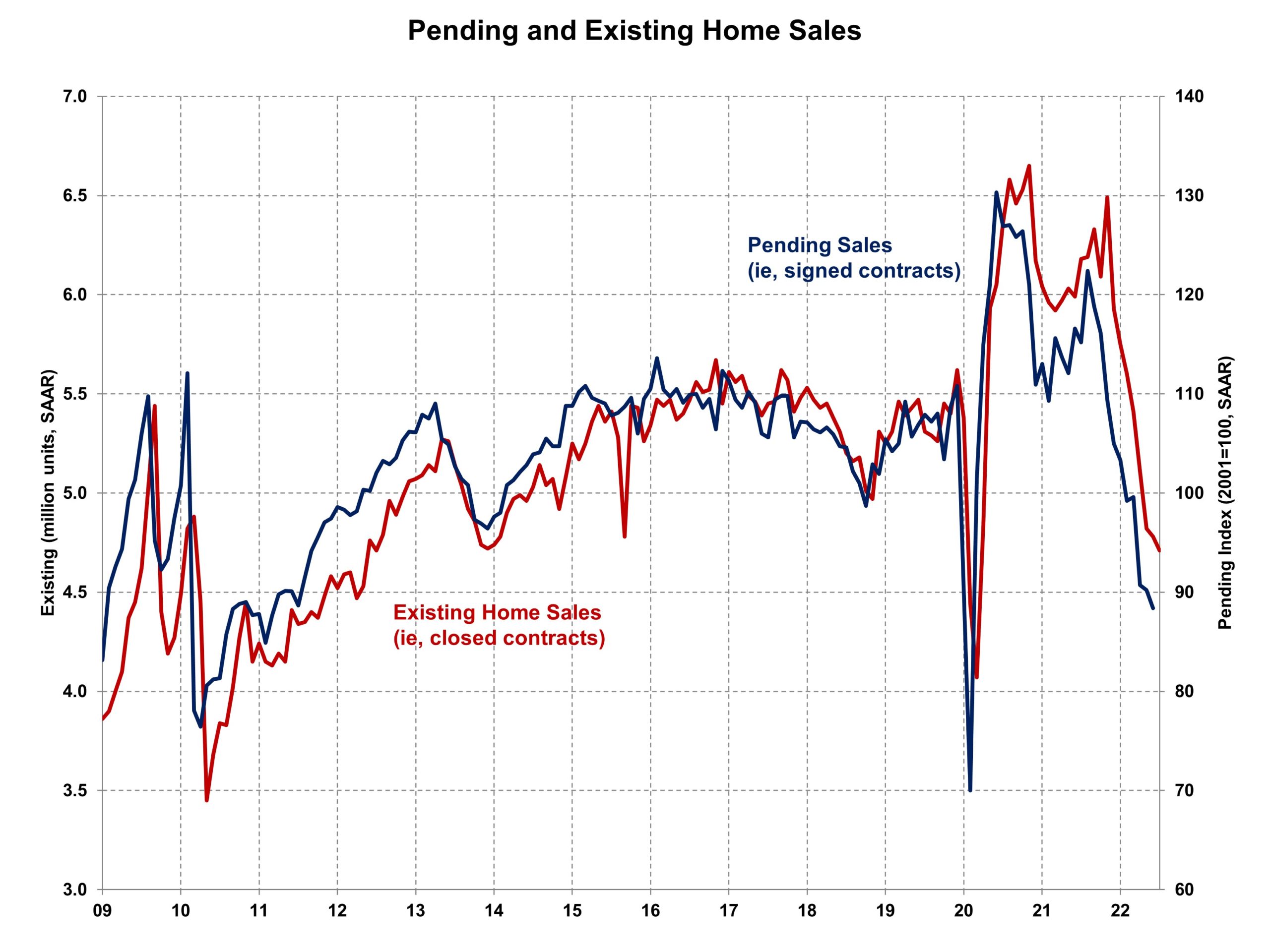

The Pending Home Sales Index (PHSI) is a forward-looking indicator based on signed contracts. The PHSI fell 2.0% from 90.2 to 88.4 in August. On a year-over-year basis, pending sales were 24.2% lower than a year ago per the NAR data.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.