The Mortgage Bankers Association’s (MBA) latest weekly application surveys show average loan sizes reaching consecutive record highs each week for the latest month, with a record high of $446,000 for the week ending February 4. Accompanying the increase was a similar dramatic rise in the 30-year fixed-rate mortgage rates, reaching 3.83 percent in the latest week. These factors are obstacles for entry-level homebuyers.

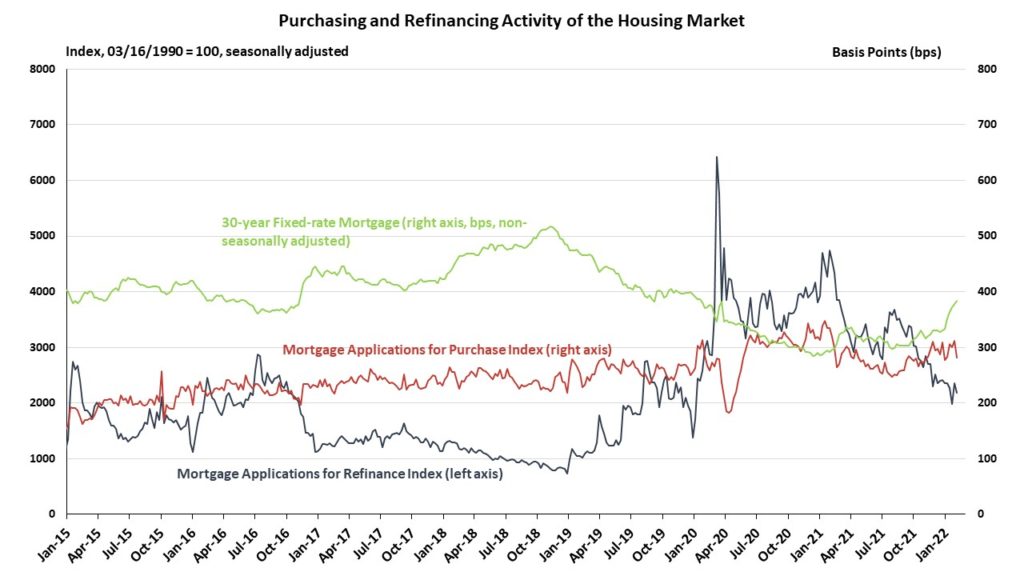

The 30-year fixed-rate mortgage averaged 3.7 percent for the current month, compared to 3.4 percent the previous month. The MBA’s seasonally adjusted Market Composite Index showed total mortgage activity decreasing in the latest week by 8.1 percent, consisting of a 9.6 percent decrease in Purchasing and 7.3 percent decrease in Refinancing.

The climbing rates have provided borrowers little incentive to refinance, which had been trending downward since late 2020.

Purchasing activity showed minor gains, relative to the previous month. The gains owed more to conventional loan purchases. The MBA cites slower growth in government purchase activity as being partly responsible for loan size appreciation.

On an unadjusted basis, the Purchasing Index in the latest week was 12 percent lower than what it was one year ago (year-over-year percent change for the same week) and its refinancing counterpart was 52 percent lower.

The refinance share of mortgage activity decreased to 56.2 percent of total applications from 57.3 percent the previous week. The adjustable-rate mortgage (ARM) share of activity remained unchanged at 4.5 percent of total applications.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.