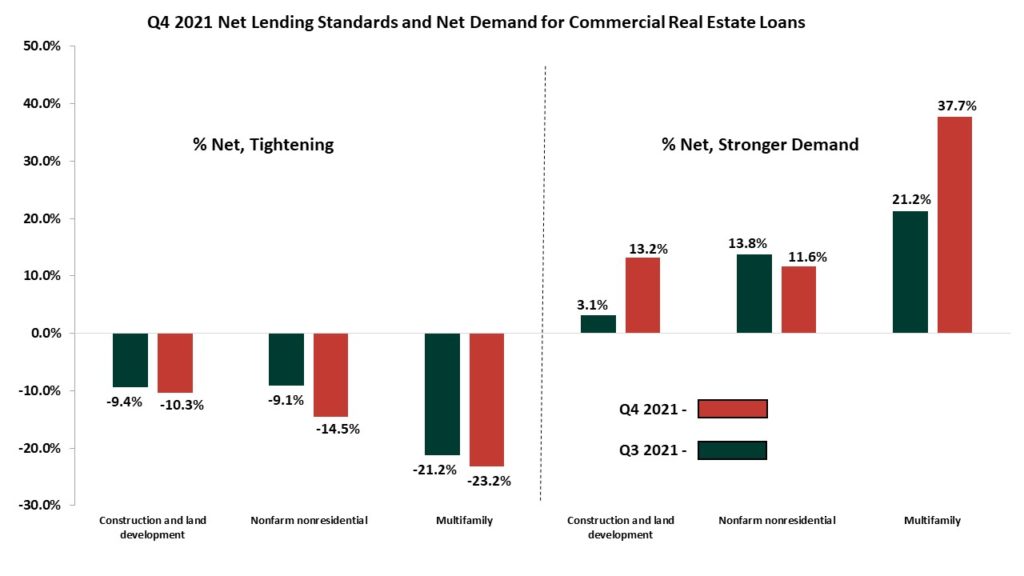

In the fourth quarter of 2021, the Federal Reserve’s Board’s Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices showed easing lending standards for Commercial Real Estate (CRE) loans, increased demand for multifamily loans, and moderately reduced demand for home loans (Residential Real Estate, RRE).

In Q4 2021, multifamily loans’ demand, on net, was 37.7 percent stronger. However, only 24.6 percent of banks reported lending standards on loans secured by multifamily properties to have eased “somewhat”. The rest remained unchanged. In a specialized set of questions asking banks’ outlook for 2022, 82.4 percent of respondents reported expectations of multifamily lending to be unchanged.

Meanwhile, in RRE, banks reported easier lending standards for jumbo and non-qualified mortgage (QM) non-jumbo loans. Jumbo loans are home mortgages that exceed the FHFA-defined conforming loan limits for one-unit properties, which in 2021 was $548,250. For 2022, the FHFA has increased the limit to $647,200. Survey respondents reported weaker demand in all mortgage categories, except for home equity lines of credits (HELOCs), a form of revolving debt, which remained unchanged. The SLOOS results for RRE were consistent with the Mortgage Bankers Association’s weekly application surveys over the fourth quarter.

In the set of specialized questions referenced above, 27.7 percent of banks reported that more favorable terms other than interest rates to increase loan demand were “somewhat important” while 10 percent reported that they were “very important”. The question concerned four loan categories, which, in addition to CRE and RRE loans, included consumer loans and Commercial & Industrial (C&I) loans.

Eight out of the sixty-nine banks surveyed responded that they did not originate non-QM jumbo loans and 10 banks did not originate non-QM, non-jumbo loans. A qualified mortgage has more stable standards that make borrowers’ ability to afford them easier, such as setting maximum debt-to-income ratios and restricting negative amortization or balloon payments.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.