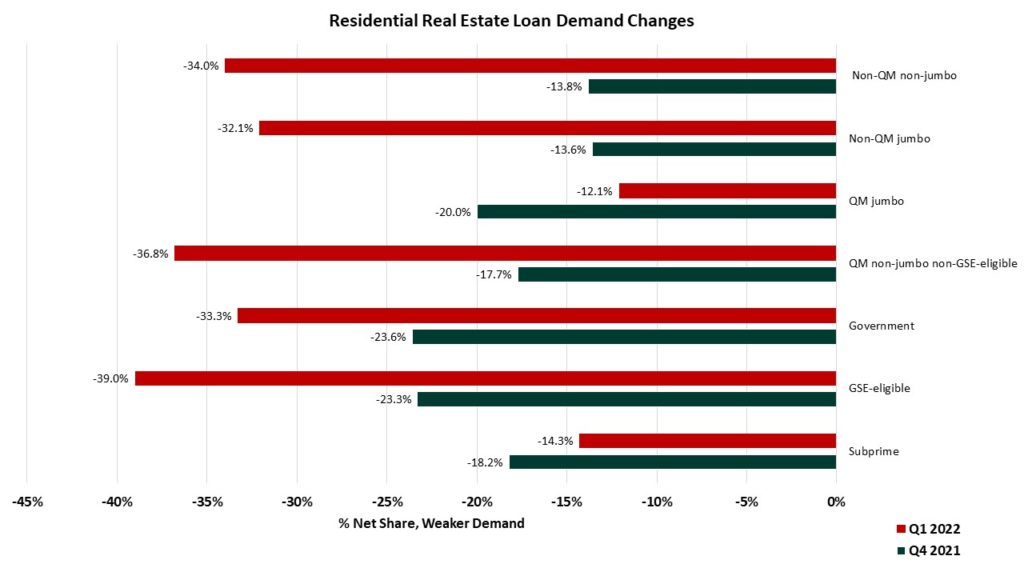

In the first quarter of 2022, the Federal Reserve Board’s Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices showed a significant net share of banks reporting more relaxed lending standards and weaker demand for most categories of residential real estate (RRE) loans. “Significant” net shares of banks reported weaker demand for all RRE loan categories other than subprime residential mortgages, for which only a “moderate” share on net reported weaker demand.

Meanwhile, lending standards and demand for all Commercial Real Estate (CRE) loan categories, except for multifamily loans, remained unchanged. For loans secured by multifamily residential properties, banks reported eased lending standards and reported stronger demand. In Q1 2022, multifamily loans’ demand, on net, was 18.5 percent stronger. In the survey, 26.6 percent of banks reported moderately stronger demand and 66.2 percent of banks reported unchanged demand. The questions were subdivided between large commercial banks and other commercial banks.

Banks’ lending standards for loans secured by nonfarm nonresidential properties remained unchanged from the prior quarter and demand for such loans also were unchanged.

Residential real estate loan demand was weakest for qualified mortgage (QM) jumbo loans, with 51.9 percent of banks reporting weaker demand. 17.6 percent of banks reported stronger demand for revolving home equity lines of credit, exceeding the shares of banks’ reporting stronger demand in the the other RRE categories. Banks’ lending standards eased most visibly for QM jumbo and non-QM jumbo loans, the segment that is pricing out many first-time homebuyers.

Through the first quarter, moderate and modest net shares of banks eased standards for credit card and auto loans, respectively, while banks reported having left lending standards unchanged for other consumer loans. Auto and credit card loans are components of nonrevolving and revolving debt, respectively, as covered in the Federal Reserve’s G.19 Consumer Credit report.

This iteration of the SLOOS contained a specialized set of questions about changes in lending policies and demand for CRE loans over the past year. One question, which asked about banks’ lending coverage, found 16.9 percent of banks reporting expanded market areas served for loans secured by multifamily residential properties, 80 percent reporting unchanged standards, and 3.1 percent reporting somewhat reduced market areas.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.