In November of 2022, 36 percent of single-family home builders reported reducing their prices, and 59 percent were offering special sales incentives. These percentages may seem relatively high—and in fact they have increased significantly since July of this year—but they are nowhere near as high as they were during the 2007-2008 financial crisis.

Questions on sales incentives have been a regular topic on the monthly survey for the NAHB/Wells Fargo Housing Market Index (HMI) since the 1990s. The questions on price reductions were introduced during the financial crisis and have been revisited several times since then.

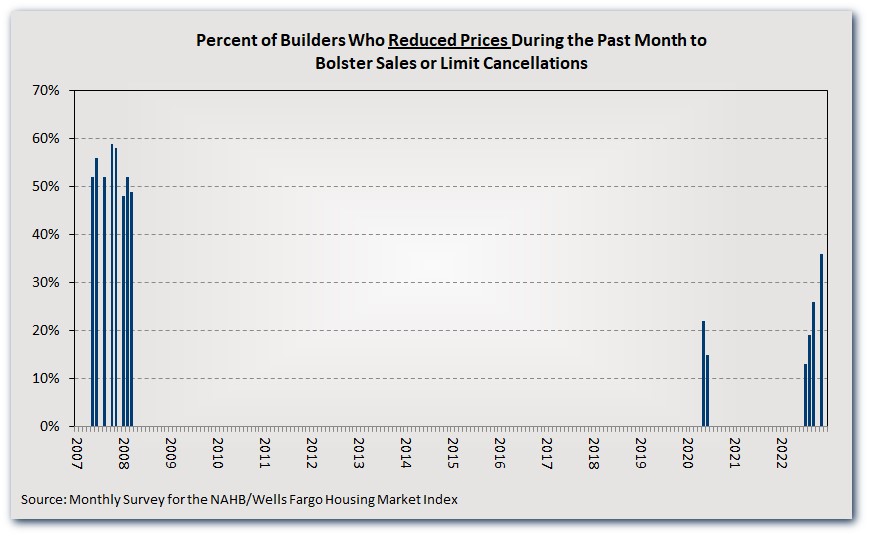

In July of 2022, 13 percent of builders reported that they had reduced home prices during the past month to bolster sales volume and/or limit cancellations. This subsequently increased to 19 percent in August, 26 percent in September, and 36 percent in November. Even at 36 percent, however, the current percentage doesn’t seem terribly high compared to May 2007 through March of 2008, when the share of builders cutting prices was consistently 48 percent of higher—as high as 59 percent in October of 2007.

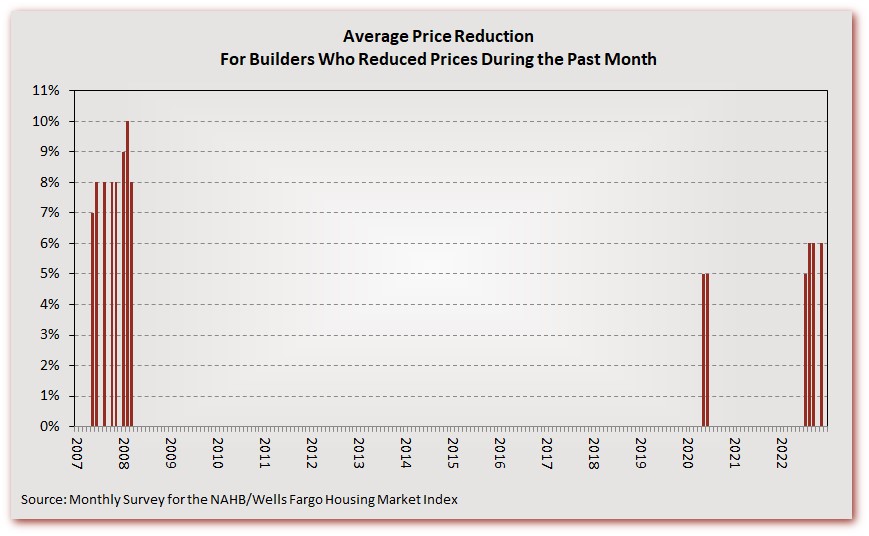

Among builders who did reduce their home prices, the average reduction was 5 percent in July of 2022, and 6 percent in the three surveys conducted since then. In the 2007-2008 crisis period, however, the average monthly reduction in house price was consistently 7 percent or higher—as high as 10 percent in February of 2008.

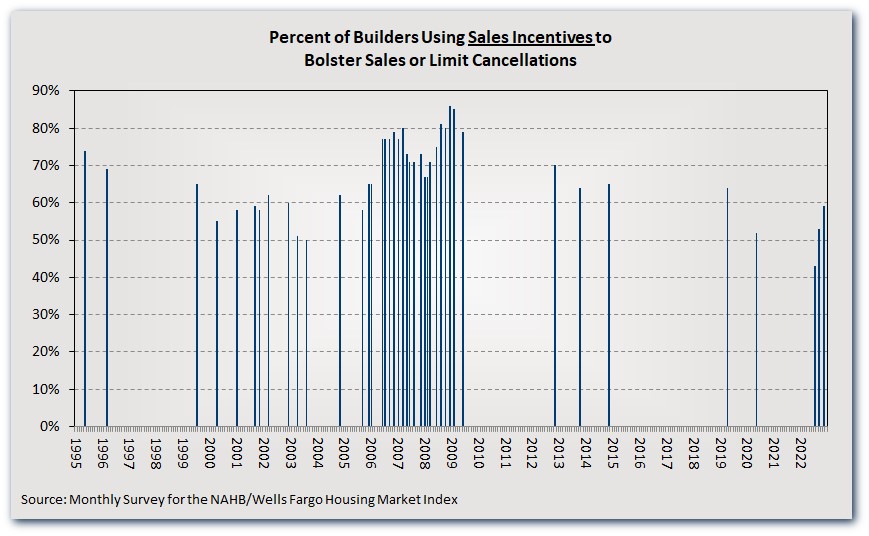

Sales incentives (price discounts, free upgrades, etc.) have long been a standard part of the business for some home builders. On the other hand, some builders never offer these types of incentives—either because they are pure custom builders, rely on word of mouth for marketing, prefer to let their customer make the first offer, or otherwise have business models they deem incompatible with incentives.

.When the question was first asked In May of 1995, 74 percent of builders reported offering sales incentives. The percentage never fell below 50 until July of 2022, when it dipped to 43. Although many builders offer incentives as a matter or routine, the share does fluctuate somewhat in response to market conditions. During the latter part of 2022, the share of builders offering incentives increased from 43 percent in July to 53 percent in September and 59 percent in November. In the 2007-2008 crisis period, however, the share offering incentives was usually well over 70 percent—as high as 86 percent in December of 2008.

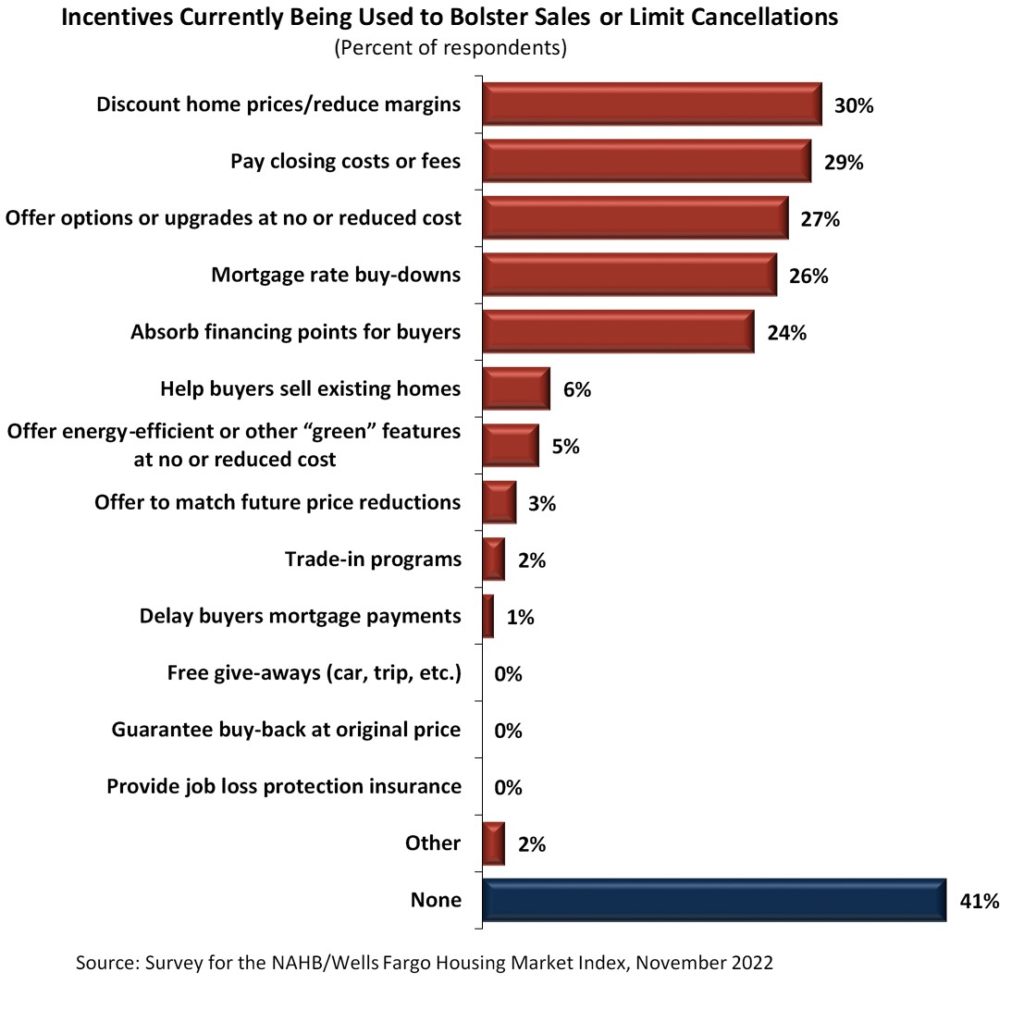

In November of 2022, five specific types of sales incentives were particularly common, several of them directly related to housing finance: discounting home prices/reducing margins, paying closing costs or fees, offering options or upgrades at no or reduced cost, mortgage rate buy-downs, and absorbing financing points for the buyers. The full list is shown below:

Some reduction in new home prices and increased use of incentives is what we would expect, given the current economic environment of rising interest rates, declining prices on existing homes, weakening builder confidence, and contracting production of new housing . However, many more builders were offering incentives and cutting house prices (and the cuts were deeper) during the severe housing downturn of 2007 and 2008.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.