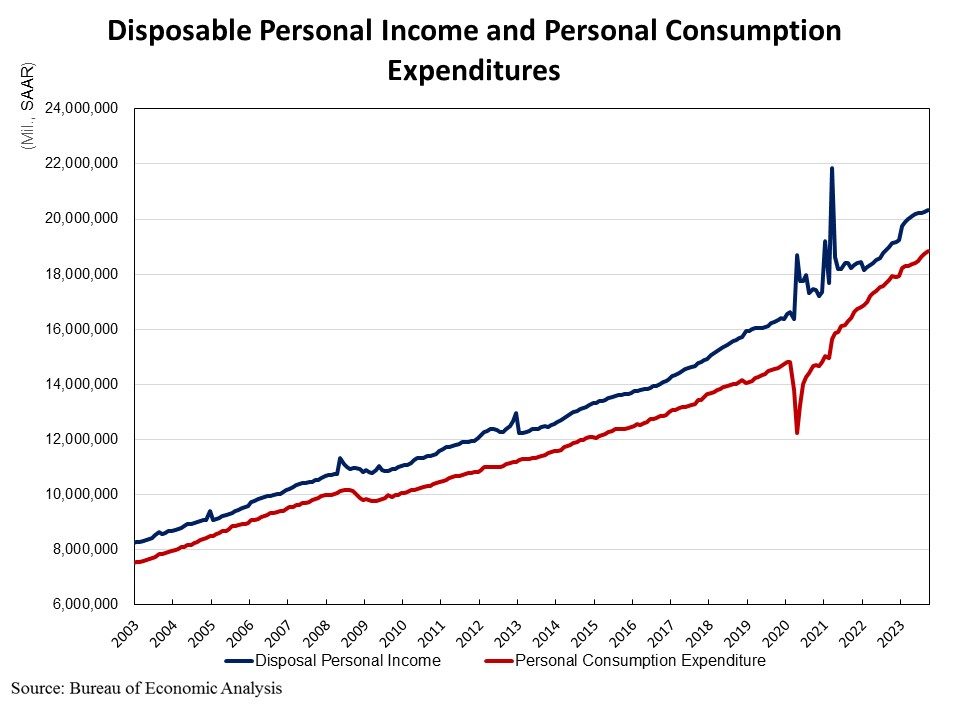

The most recent data release from the Bureau of Economic Analysis (BEA) showed that personal income increased 0.3% in September. The pace of personal income growth slowed after reaching a 1% monthly gain in January 2023. Gains in personal income are largely driven by increases in wages and salaries.

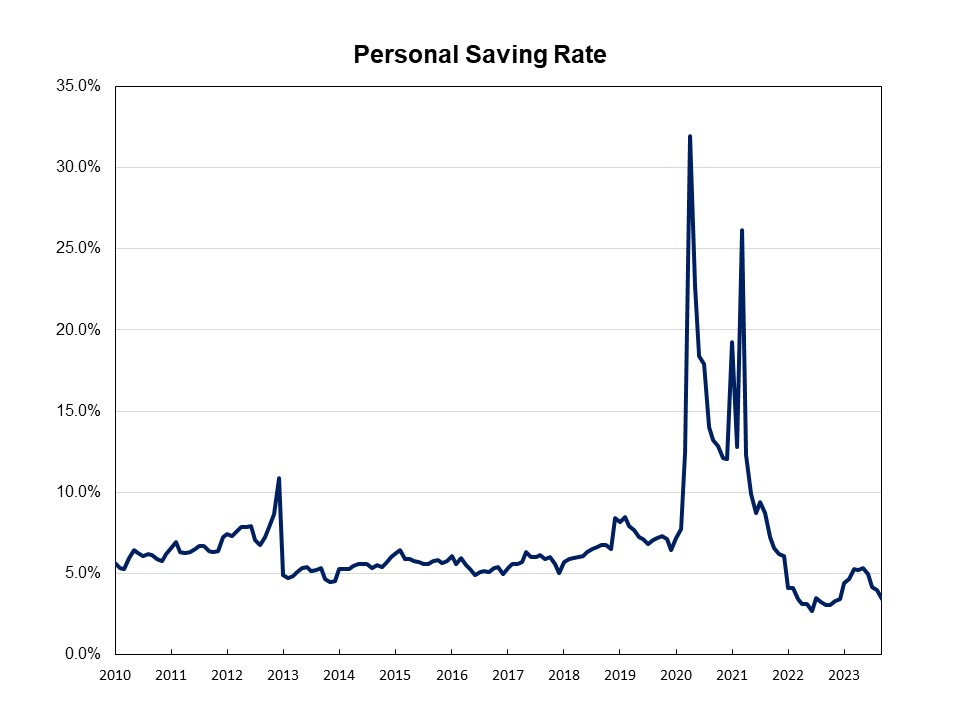

With spending increasing faster than personal income, the September personal savings rate dipped to 3.4% in June from 4.0% in August. As inflation has almost eliminated compensation gains, people are dipping into savings to support spending.

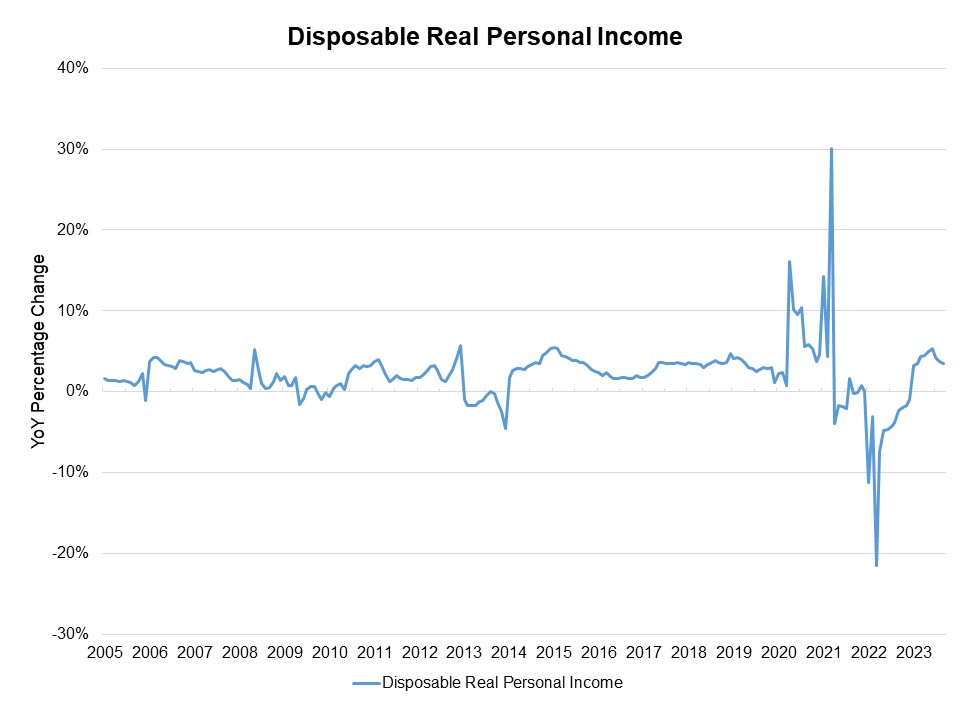

Real disposable income, income remaining after adjusted for taxes and inflation, dipped 0.1% in September. It was the third consecutive decrease since June 2022. On a year-over-year basis, real (inflation adjusted) disposable income rose 3.5%, after experiencing negative year-over-year growth in 2022.

Personal consumption expenditures (PCE) rose 0.7% in September after a 0.4% increase in August. Real spending, adjusted to remove inflation, increased 0.4% in September, with spending on goods rising 0.5% and on services up 0.3%.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

As personal saving rates decrease, individuals might be more inclined to explore financing options, such as construction loans, when considering new projects. This change underscores the importance of monitoring economic indicators for those involved in the construction industry. A potential uptick in demand for construction loans may arise as people seek external funding to embark on construction endeavors in a lower-saving environment, making it essential for lenders to adapt to evolving economic conditions.