NAHB analysis of the Census Bureau’s quarterly state and local tax data shows that $132 billion in taxes were paid by property owners in the second quarter of 2023 (not seasonally adjusted).[1] In the four quarters ending Q2 2023, state and local governments collected $727 billion of property tax revenue—a 7.4% increase over Q2 2022.

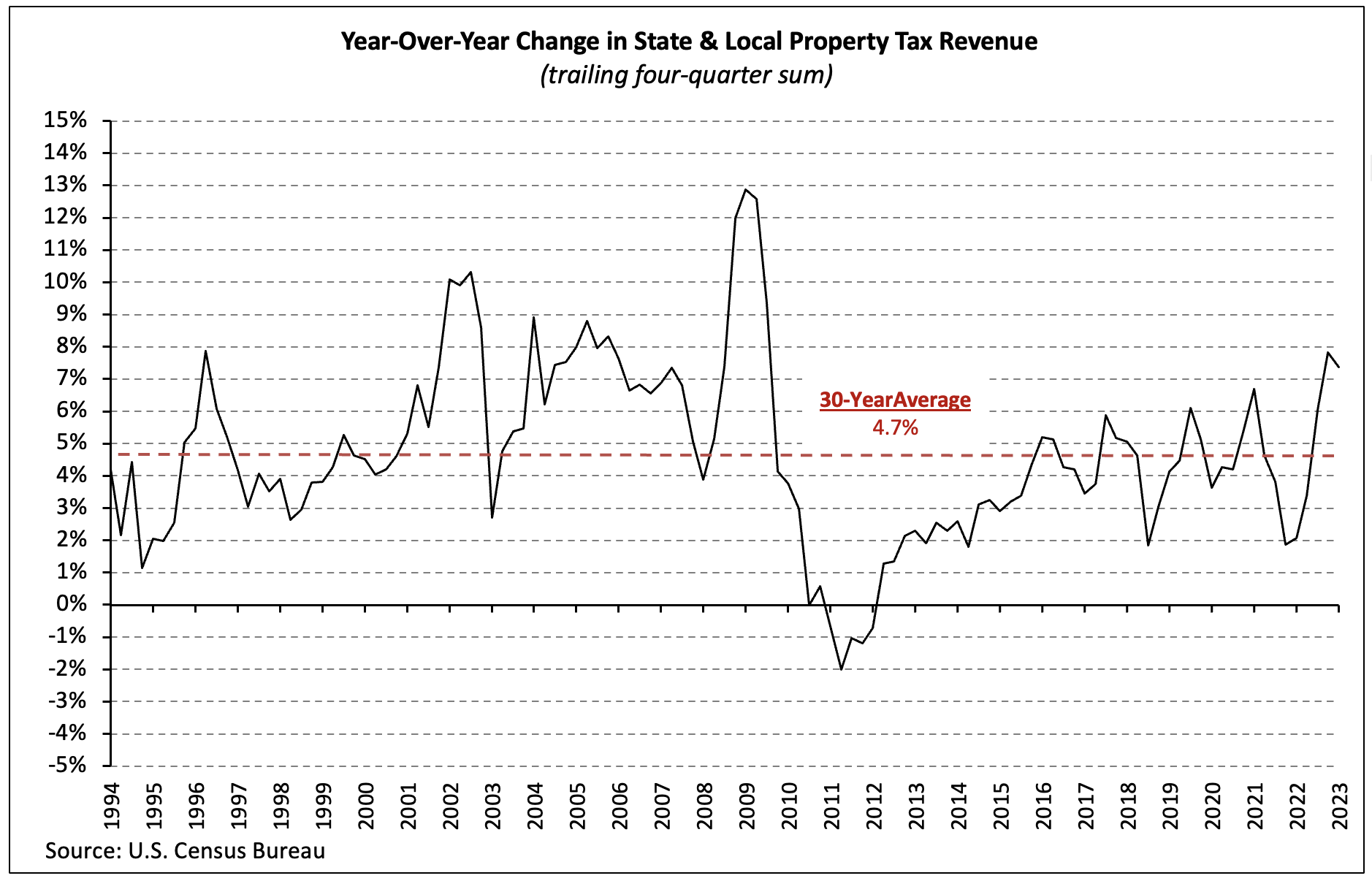

The year-over-year growth rate of property tax revenue (trailing four-quarter total) has climbed from 1.6% to 7.4% over the past four quarters. Additionally, year-over-year growth for the first quarter was revised from 6.9% to 7.8%. Gains have been driven by rising home value assessments, which can lag market prices by one to two years.

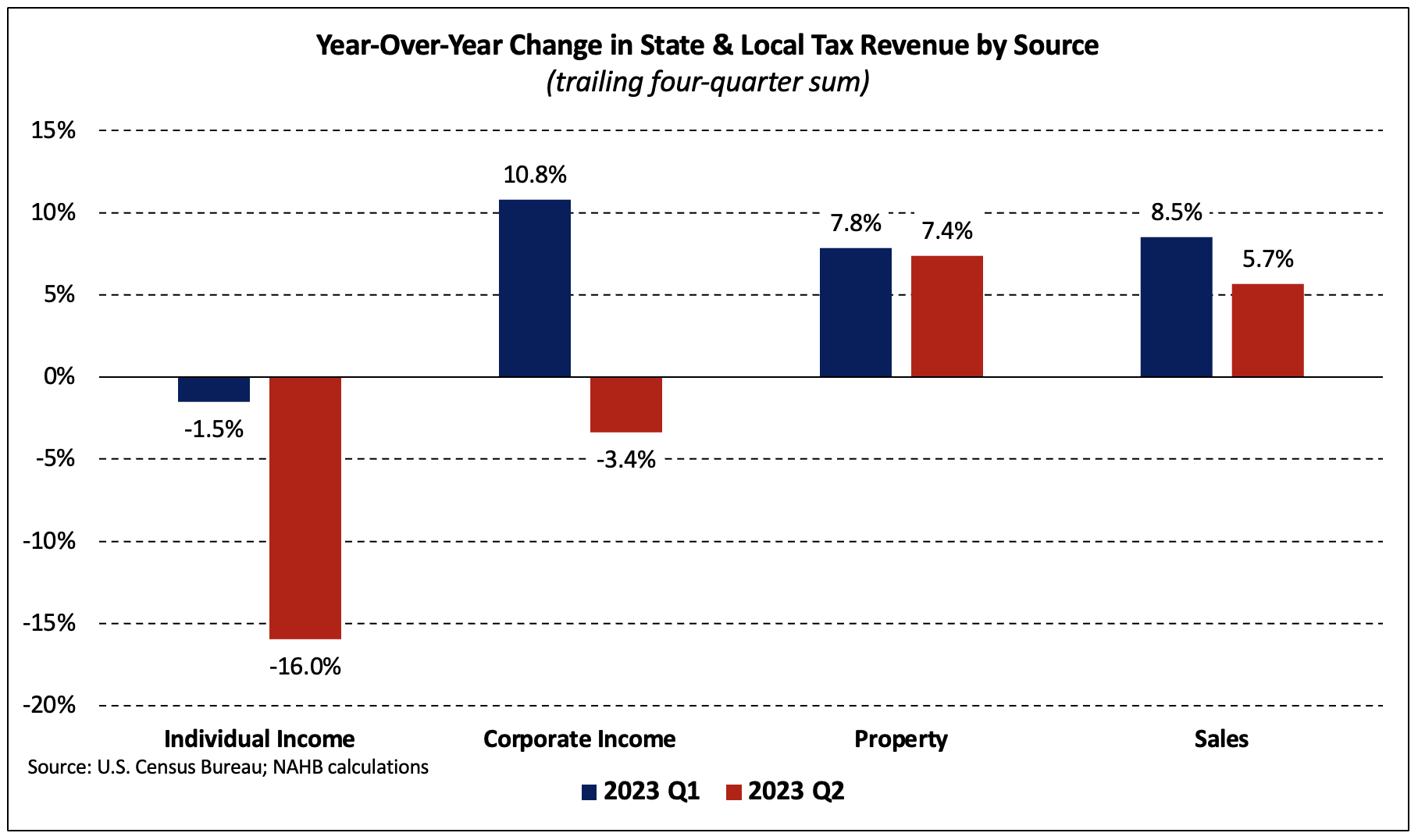

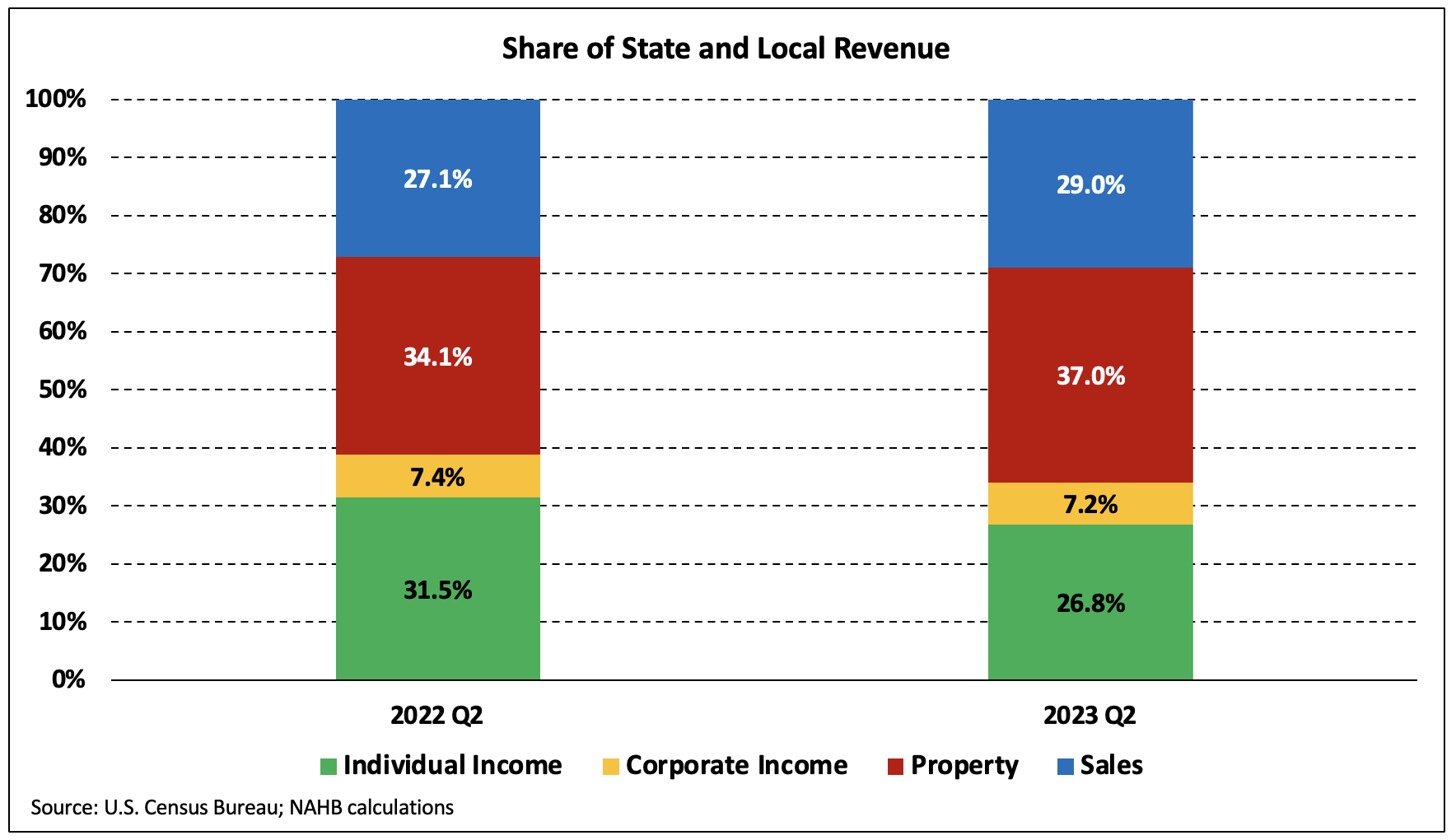

Property taxes accounted for 37.0% of state and local tax receipts in the four quarters ending Q2 2023, up from 35.6% the prior quarter. The increase resulted from the combination of higher property and sales tax receipts with a 16.0% drop in individual income tax revenue and a 3.4% decline in corporate income tax collections.

In terms of the share of total receipts, property taxes were followed by sales taxes (29.0%), individual income taxes (26.8%), and corporate taxes (7.2%).

The share of property tax receipts among the four major tax revenue sources naturally changes with fluctuations in non-property tax collections. Non-property tax receipts including individual income, corporate income, and sales tax revenues, by nature, are much more sensitive to fluctuations in the business cycle and the accompanying changes in consumer spending (affecting sales tax revenues) and job availability (affecting aggregate income). In contrast, property tax collections have proven relatively stable, reflecting the long-run stability of tangible property values as well as the effects of lagging assessments and annual adjustments.

[1] Census data for property tax collections include taxes paid for all real estate assets (as well as personal property), including owner-occupied homes, rental housing, commercial real estate, and agriculture. Owner-occupied and rental housing units combine to make housing’s share the largest among these subgroups.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Increasing property tax revenue might indicate a stable real estate market, potentially encouraging lenders to offer favorable terms for construction loans. However, the sharp decline in income tax receipts could signify economic challenges, leading to cautious lending practices. Lenders might assess borrowers more rigorously, affecting approval rates and terms for construction loans in response to the changing economic landscape.