In June, national home prices continued to increase. Limited inventory and solid but weakened demand put upward pressure on home prices, despite rising mortgage rates. Locally, all 20 metro areas, reported by S&P Dow Jones Indices, had positive home price appreciation in June.

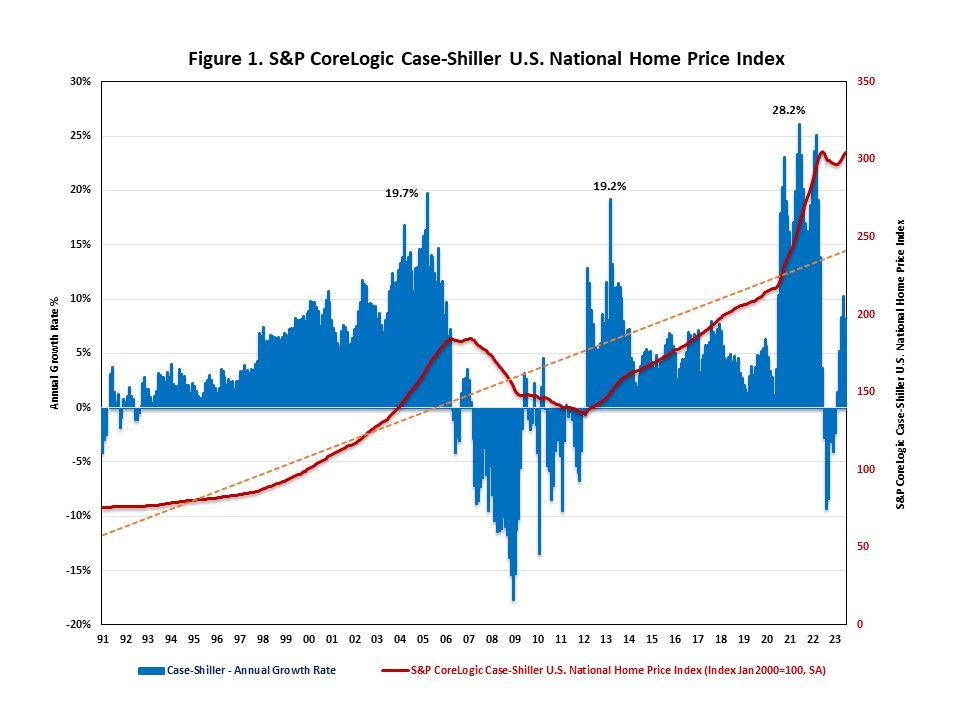

The S&P CoreLogic Case-Shiller U.S. National Home Price Index, reported by S&P Dow Jones Indices, rose at a seasonally adjusted annual growth rate of 8.1% in June, slightly slower than a 10.2% increase in May. After seven consecutive months of decline, home prices have increased for five consecutive months since February 2023. National home prices are now 65% higher than their last peak during the housing boom in March 2006.

On a year-over-year basis, the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index posted a 0.0% annual gain in June, following a 0.4% decrease in May and a 0.1% decrease in April.

Meanwhile, the Home Price Index, released by the Federal Housing Finance Agency (FHFA), rose at a seasonally adjusted annual rate of 4.2% in June, following a 9.2% increase in May. On a year-over-year basis, the FHFA Home Price NSA Index rose by 3.2% in June, up from 3.0% in the previous month.

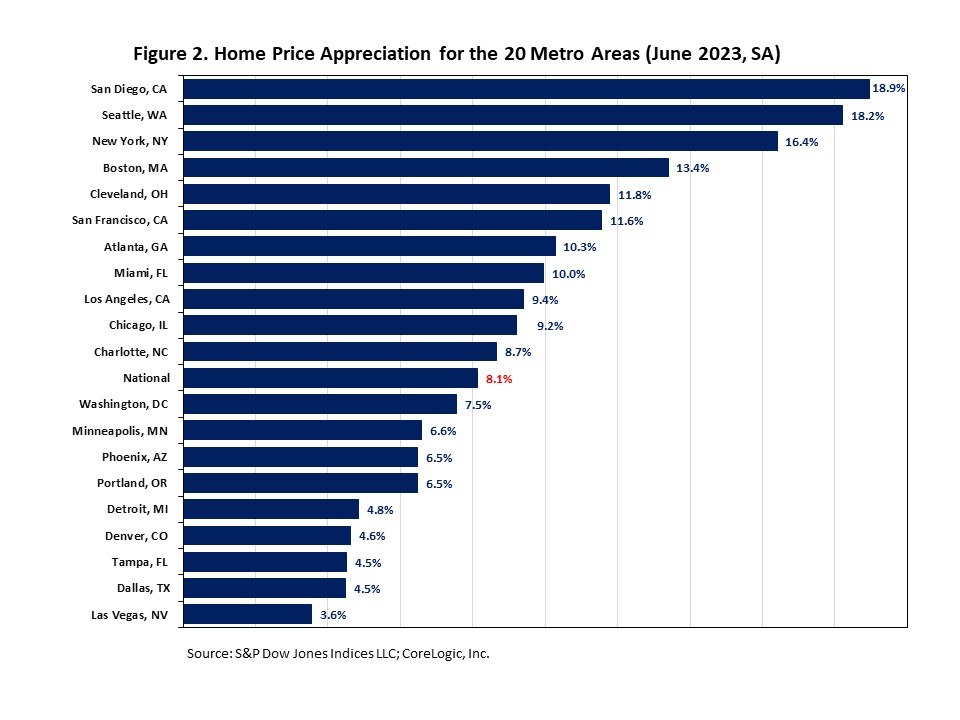

In addition to tracking national home price changes, S&P Dow Jones Indices reported home price indexes across 20 metro areas in June.

In June, all 20 metro areas reported positive annual growth rates ranged from 3.6% to 18.9%. Among the 20 metro areas, 11 metro areas exceeded the national average of 8.1%. San Diego, Seattle, and New York had the highest home price appreciation in June. San Diego led the way with an 18.9% increase, followed by Seattle with an 18.2% increase and New York with a 16.4% increase.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.