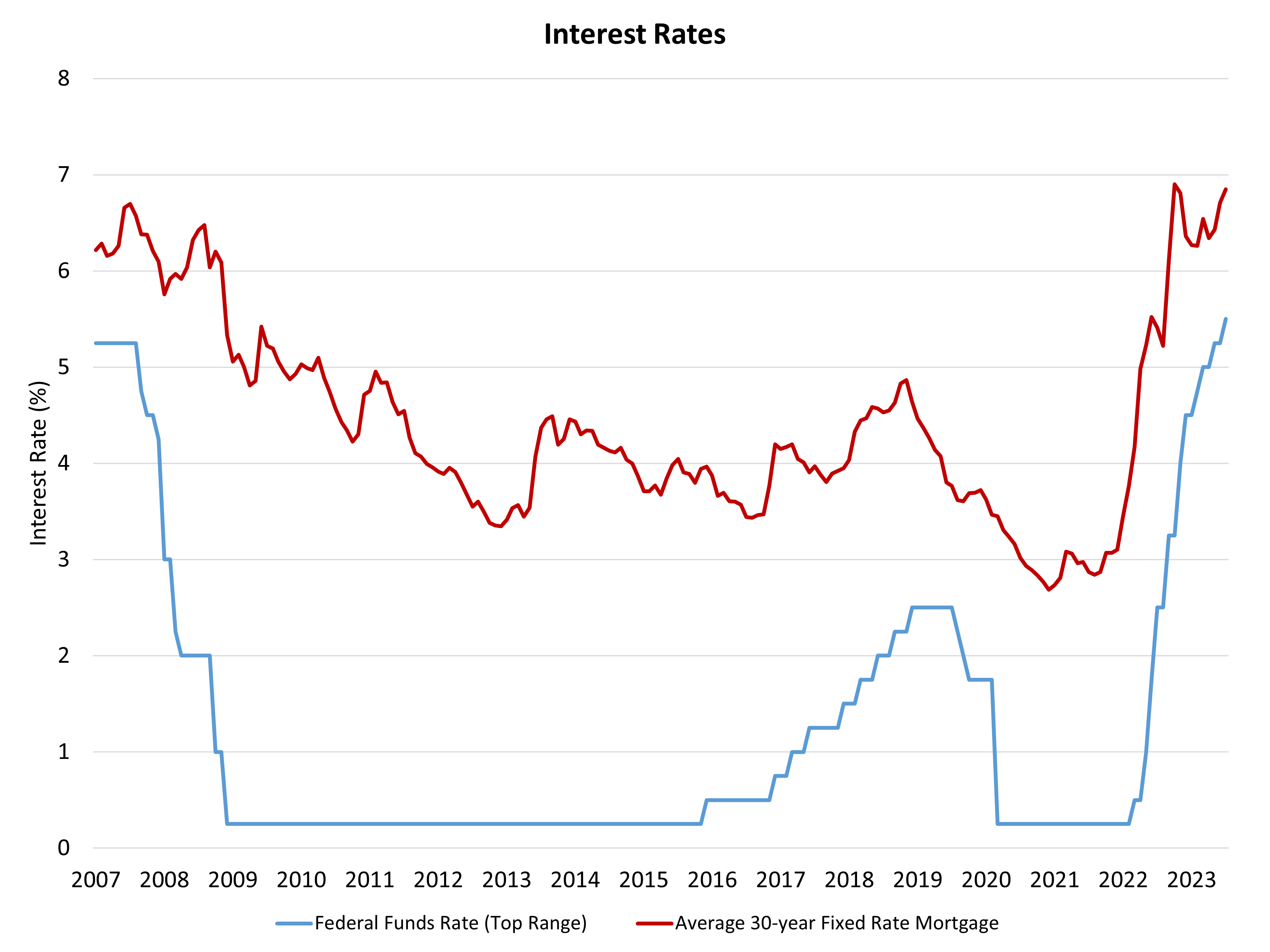

The Federal Reserve’s monetary policy committee increased the federal funds rate to a top target of 5.5% at the conclusion of its July meeting. The Fed will also continue to reduce its balance sheet holdings of Treasuries and mortgage-backed securities as part of quantitative tightening. These actions are intended to slow the economy and bring inflation back to 2%.

After a June pause, the July increase is consistent with a measured hawkishness for the central bank. The Fed indicated: “In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” This suggests a bias toward additional tightening but under a data-dependent approach with respect to future inflation reports.

The Fed faces competing risks: elevated but trending lower inflation combined with ongoing risks to the banking system and macroeconomic slowing. Chair Powell has previously noted that near-term uncertainty is high due to these risks. Nonetheless, economic data is solid. The Fed stated today: “…economic activity has been expanding at a moderate pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated. The U.S. banking system is sound and resilient.”

Despite this positive assessment from the Fed, there are ongoing challenges for regional banks, as well weakness for commercial real estate. Going from near zero to 5.5% on the federal funds rate is a dramatic policy move with possible unintended consequences. More caution seems prudent. In fact, prior risks for smaller banks will result in tighter credit conditions, which will slow the economy and reduce inflation. Thus, these financial challenges act as additional surrogate rate hikes in terms of tightening credit availability, doing some of the work for the Fed.

It is also surprising that the Fed gave only limited detail on inflation. “Inflation remains elevated,” was all that was stated in the July announcement. If the Fed is in a data-dependent mode, more detail on the state of inflation is warranted. Namely, the Fed should specify that Consumer Price Index (CPI) has decreased from 9% to 3%. However, Chair Powell did indicate that progress had been made during his press conference and the full effects of enacted tightening have not yet been fully felt.

Approximately 40% of overall inflation is generated from shelter inflation, which can only be tamed by additional affordable attainable housing supply. Higher interest rates for developer and construction loans move the ball in the wrong direction with respect to this objective. Nonetheless, shelter inflation will improve going forward as rent growth is slowing now. This data suggests the Fed should cease increasing and let, what Chair Powell characterized as currently “restrictive,” rates operate on inflation.

The 10-year Treasury rate, which determines in part mortgage rates, remained below 3.9% upon the Fed announcement. Mortgage rates will remain in the high 6% range in the wake of this policy move.

Looking forward by looking back, the Fed’s June projections indicated perhaps two more rate hikes were in store in the coming months. One happened here in July. It seems reasonable under a “measured hawkish” approach, a skip could happen in September and a final rate hike at the end of October. Or a final rate hike in September could occur with no skip if additional progress is not made on CPI in the next report.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

The Fed’s measured hawkishness with a July rate hike may impact the construction loan market, as borrowing costs could rise. That is why it’s important to have the right financial partner by your side that can make all the difference. Check out BuilderLoans.net