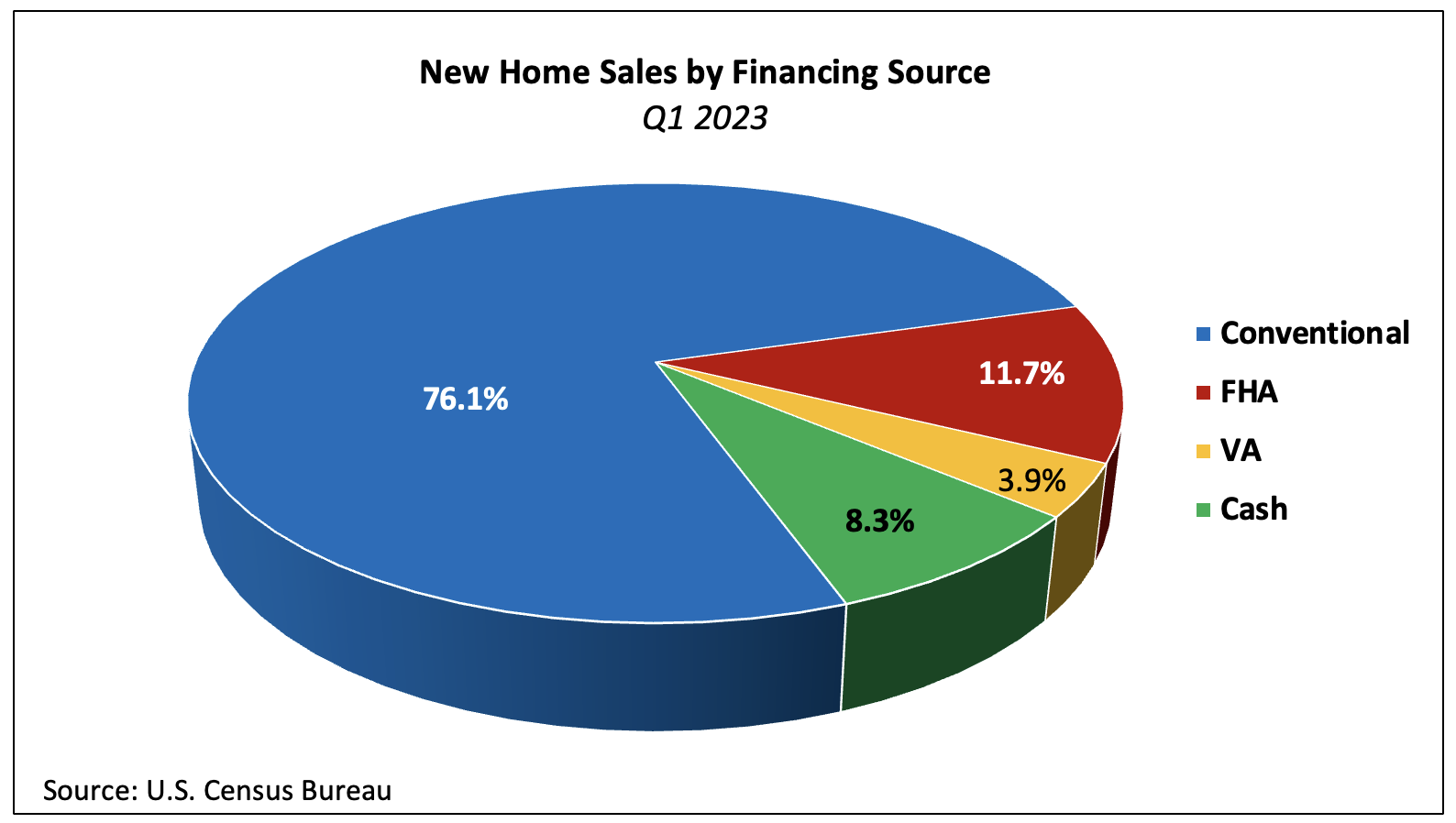

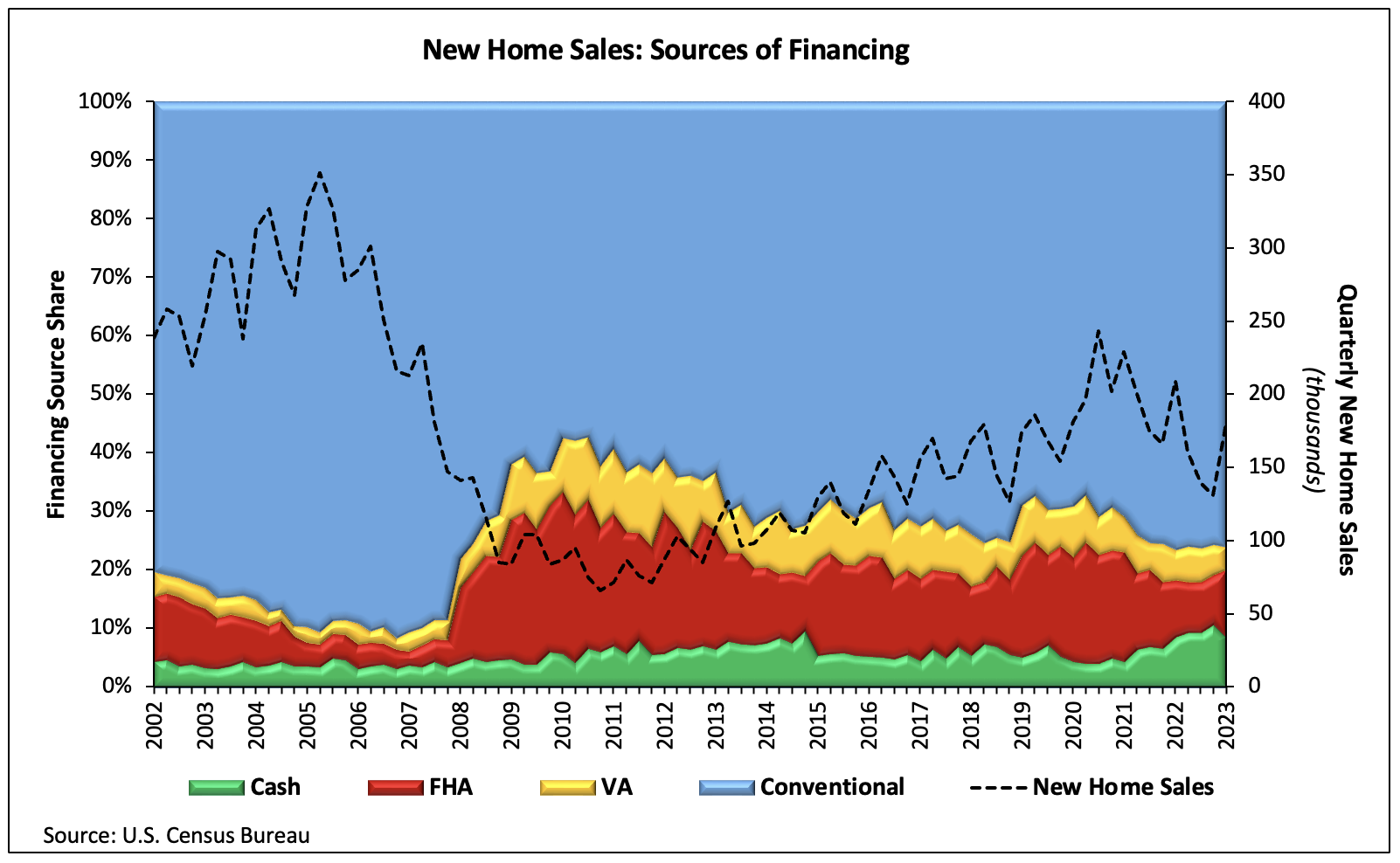

NAHB analysis of the most recent Quarterly Sales by Price and Financing report published by the U.S. Census Bureau reveals that the share of new home sales backed by FHA loans jumped from 8.4% to 11.7% in the first quarter of 2023. It is the largest share since 2007 but remains 30% lower than the post-Great Recession average.

Conventional loans financed 76.1% of new home sales, up 0.5 percentage point and near a 15-year high. The share of VA-backed sales fell 1.4 percentage points to 3.9%, the lowest since Q4 2007.

After accounting for 10.7% of sales in the fourth quarter of 2022, cash purchases made up 8.3% of new home sales in the first quarter of 2023. Although the share of cash purchases was roughly unchanged from one year ago, it remains elevated in historical terms and is nearly twice as large as it was in Q1 2021.

Although cash sales make up a small portion of new home sales, they constitute a larger share of existing home sales. According to estimates from the National Association of Realtors, 27% of existing home transactions were all-cash sales in March 2023, down from 28.0% in February and one year ago.

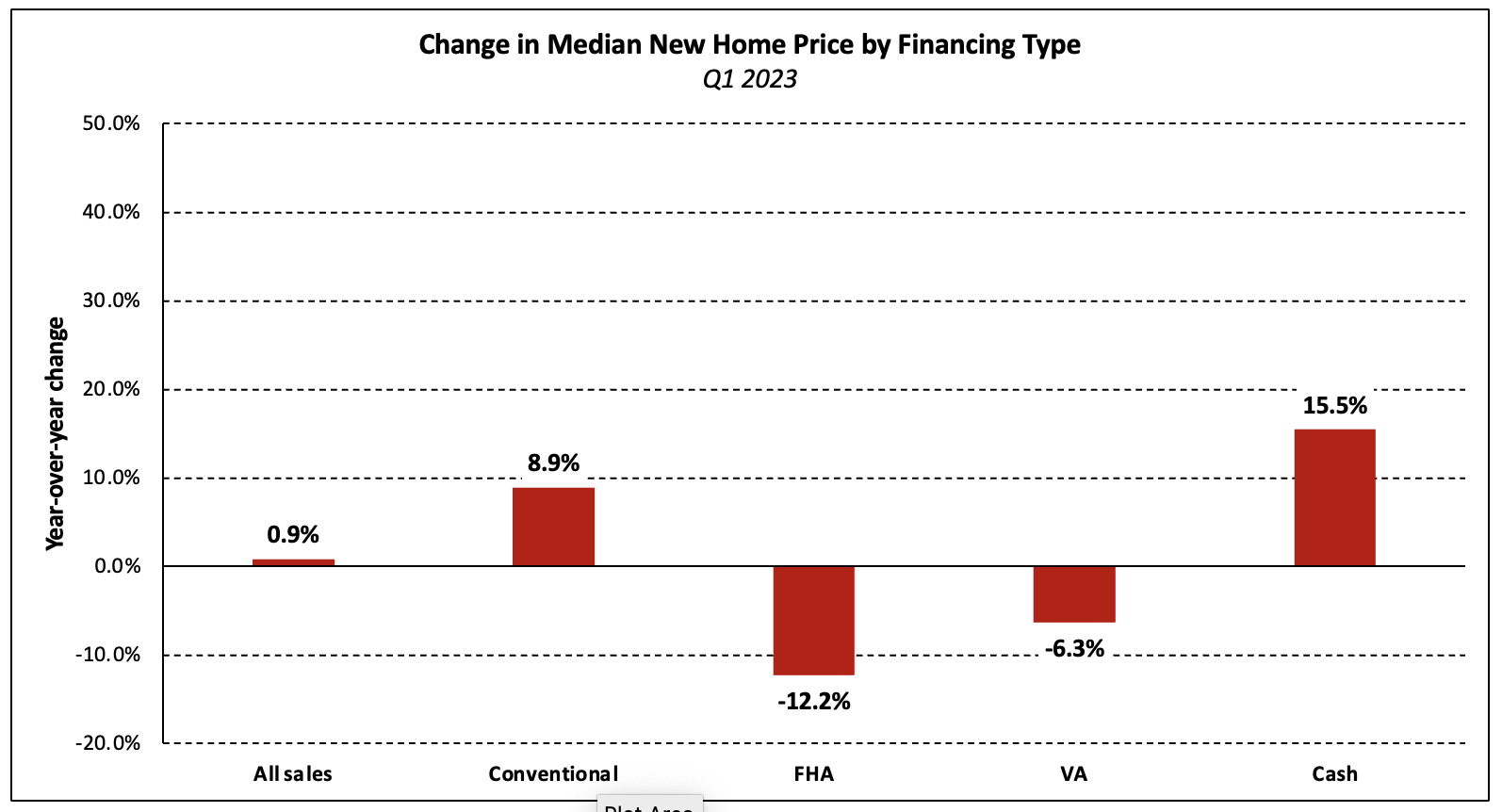

Price by Type of Financing

Different sources of financing also serve distinct market segments, which is revealed in part by the median new home price associated with each. In the fourth quarter, the national median sales price of a new home was $436,800. Split by types of financing, the median prices of new homes financed with conventional loans, FHA loans, VA loans, and cash were $515,900, $323,300, $392,500, and $448,300, respectively.

Over the past year, the price of homes bought with FHA and VA loans fell 12.2% and 6.3%, respectively. The median price of a home purchased with a conventional loan (+8.9%) and cash (+15.5%) both increased.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.