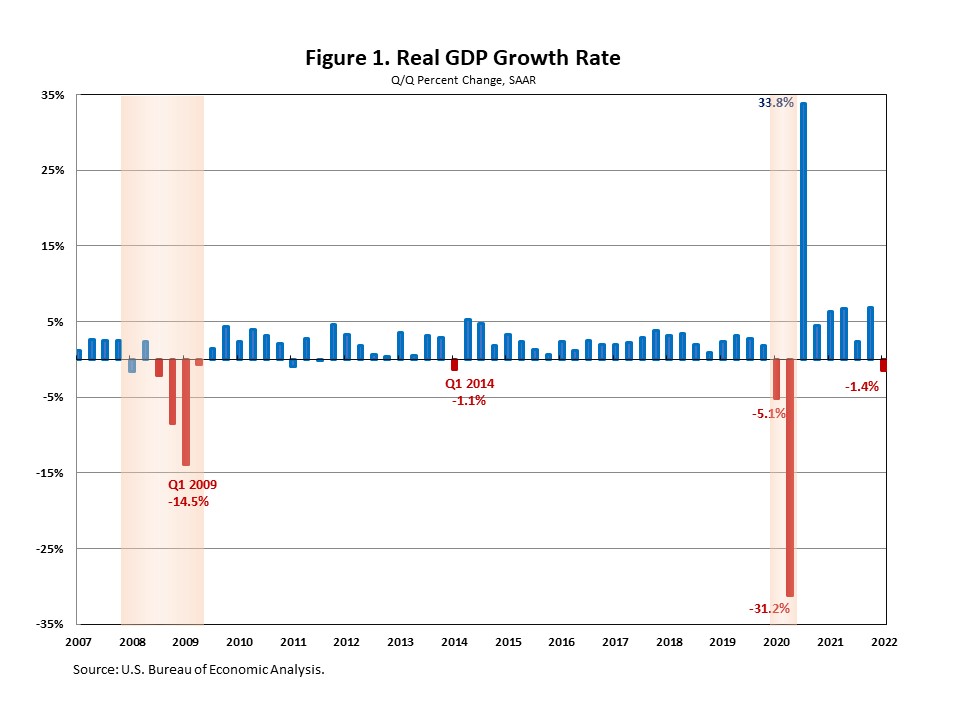

In the first quarter of 2022, real GDP declined for the first time since the pandemic recession, as inflation surged to a 40-year high and supply chain disruptions remain persistent. This quarter’s decrease reflected a deceleration in private inventory investment, decreases in exports and government spending and an increase in imports.

According to the “advance” estimate released by the Bureau of Economic Analysis (BEA), real gross domestic product (GDP) decreased at an annual rate of 1.4% in the first quarter of 2022, after a 6.9% increase in the fourth quarter of 2021. It marks the worst quarter since the pandemic recession in the second quarter of 2020.

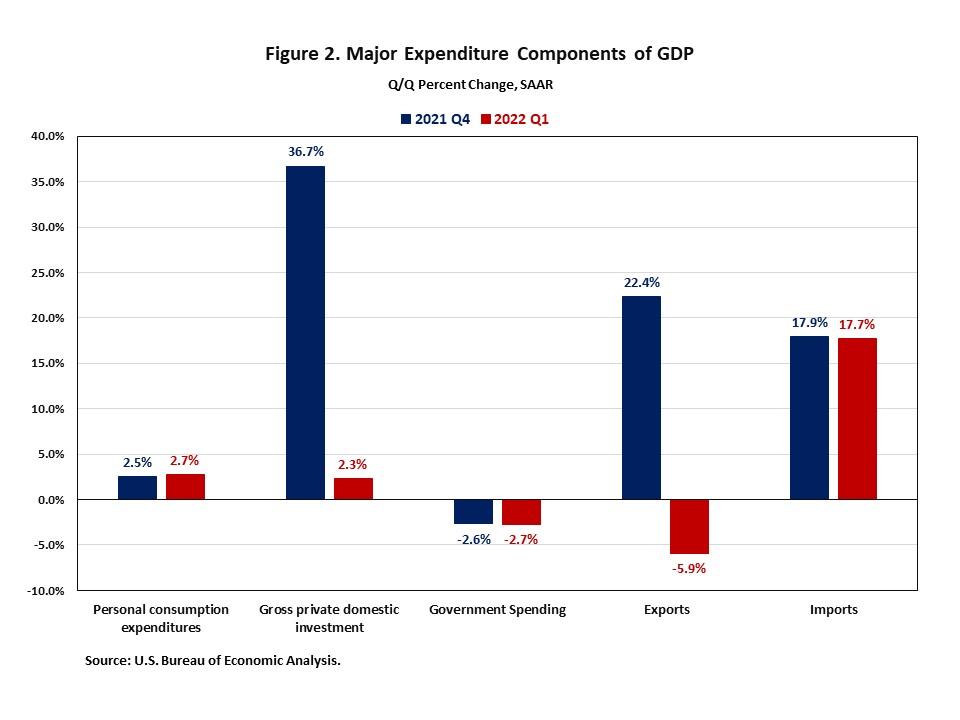

In the first quarter of 2022, the decrease in real GDP reflected a deceleration in private inventory investment, led by decreases in wholesale trade and retail trade, and decreases in both federal and state and local government spending, and exports, while imports, which are a subtraction in the calculation of GDP, increased.

Consumer spending rose at an annual rate of 2.7% in the first quarter of 2022, compared to a 2.5% increase in the fourth quarter of 2021. Expenditures on services increased 4.3% at an annual rate, while goods spending decreased 0.1% at an annual rate, led by nondurable goods, such as gasoline and other energy goods (-15.0%).

While nonresidential fixed investment rose 9.2%, residential fixed investment (RFI) increased 2.1% in the first quarter. The increase in nonresidential fixed investment reflected increases in equipment (+15.3%) and intellectual property products (+8.1%). Within residential fixed investment, single-family structures rose 14.1% at an annual rate and multifamily structures rose 1.1%.

The decrease in exports reflected the decrease in goods, which was partly offset by an increase in “other” business services.

Federal government spending decreased 5.9% in the first quarter, reflecting a decrease in national defense spending on intermediate goods and services, while state and local government spending declined 0.8%.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.