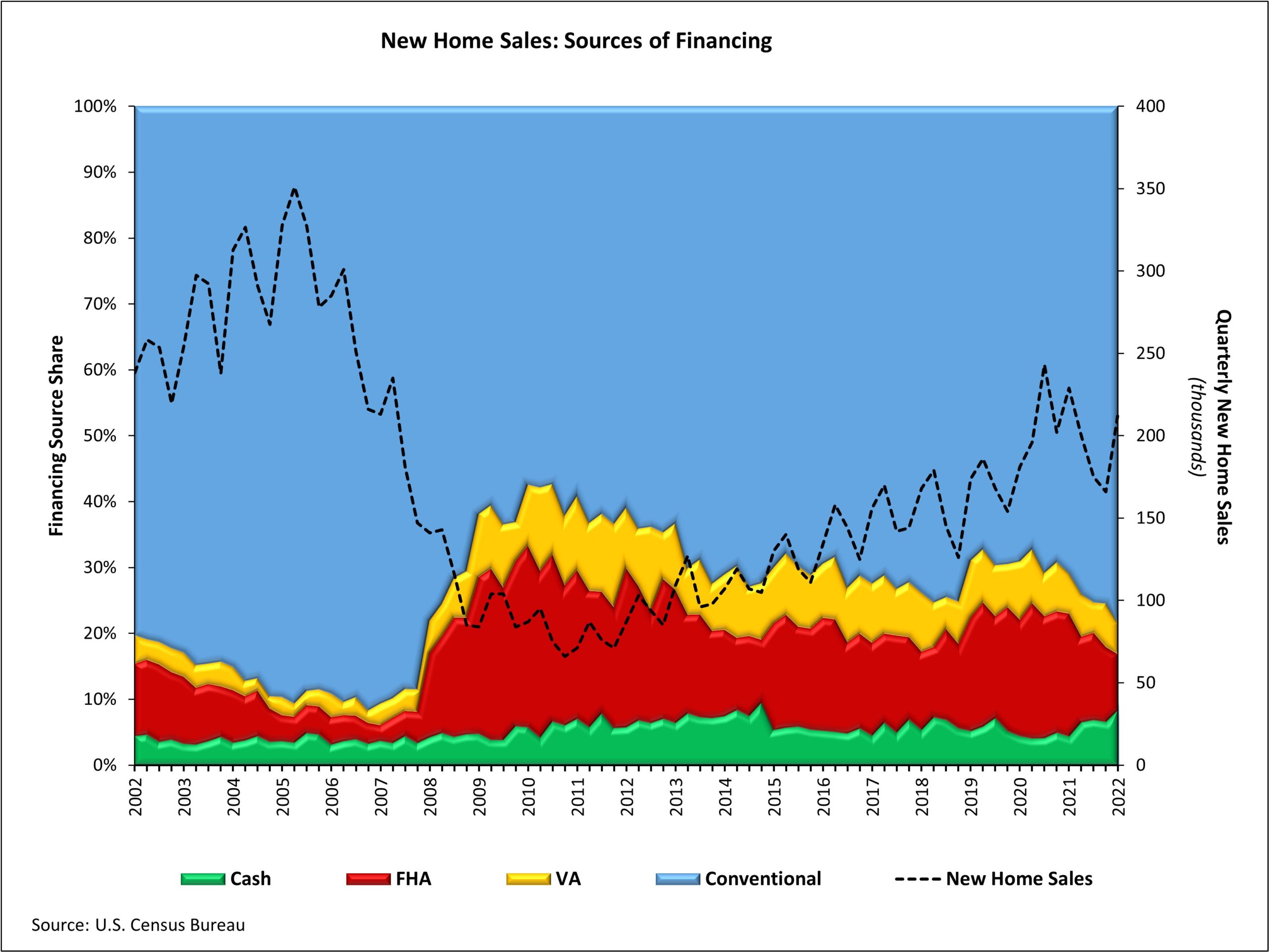

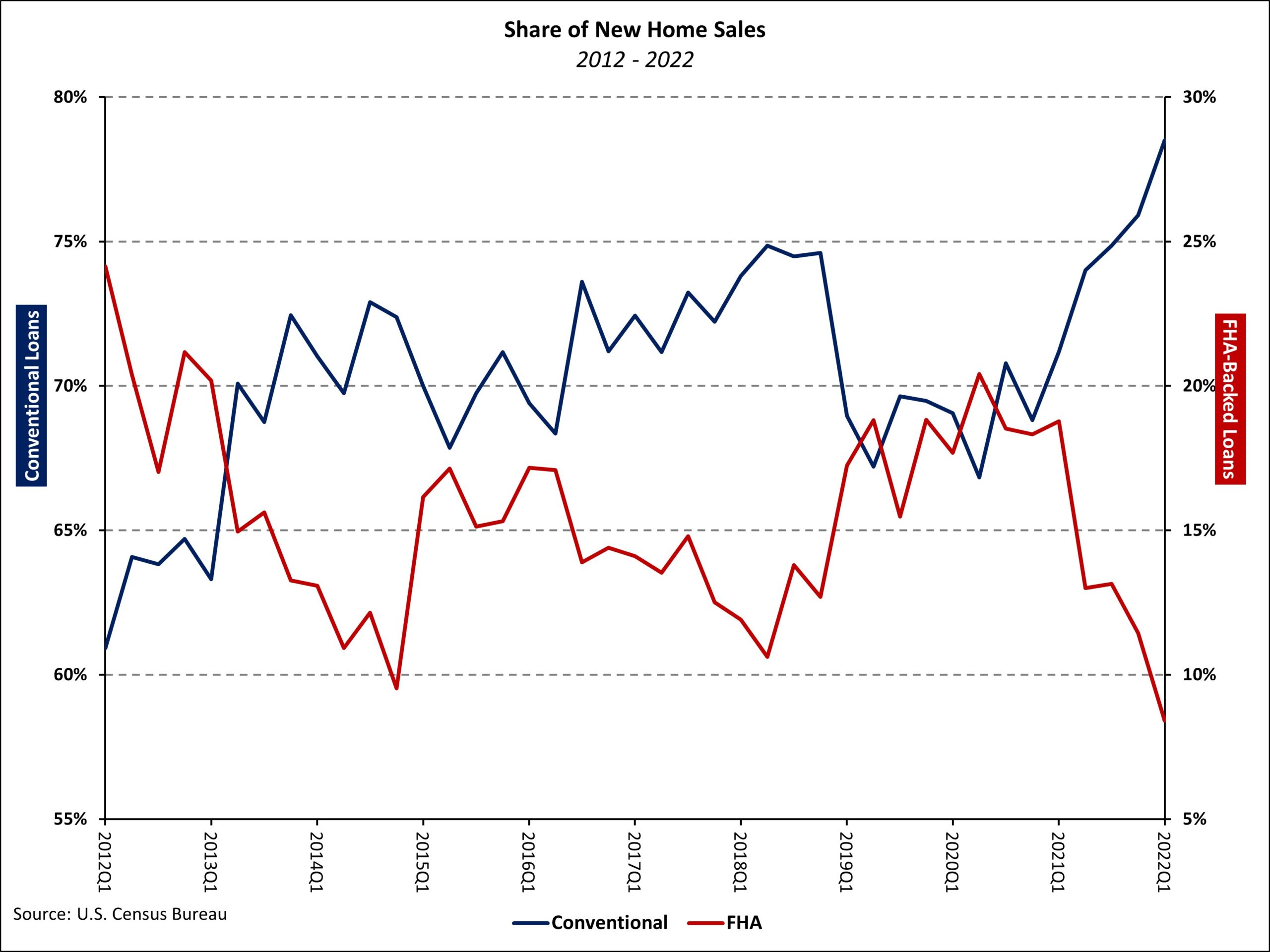

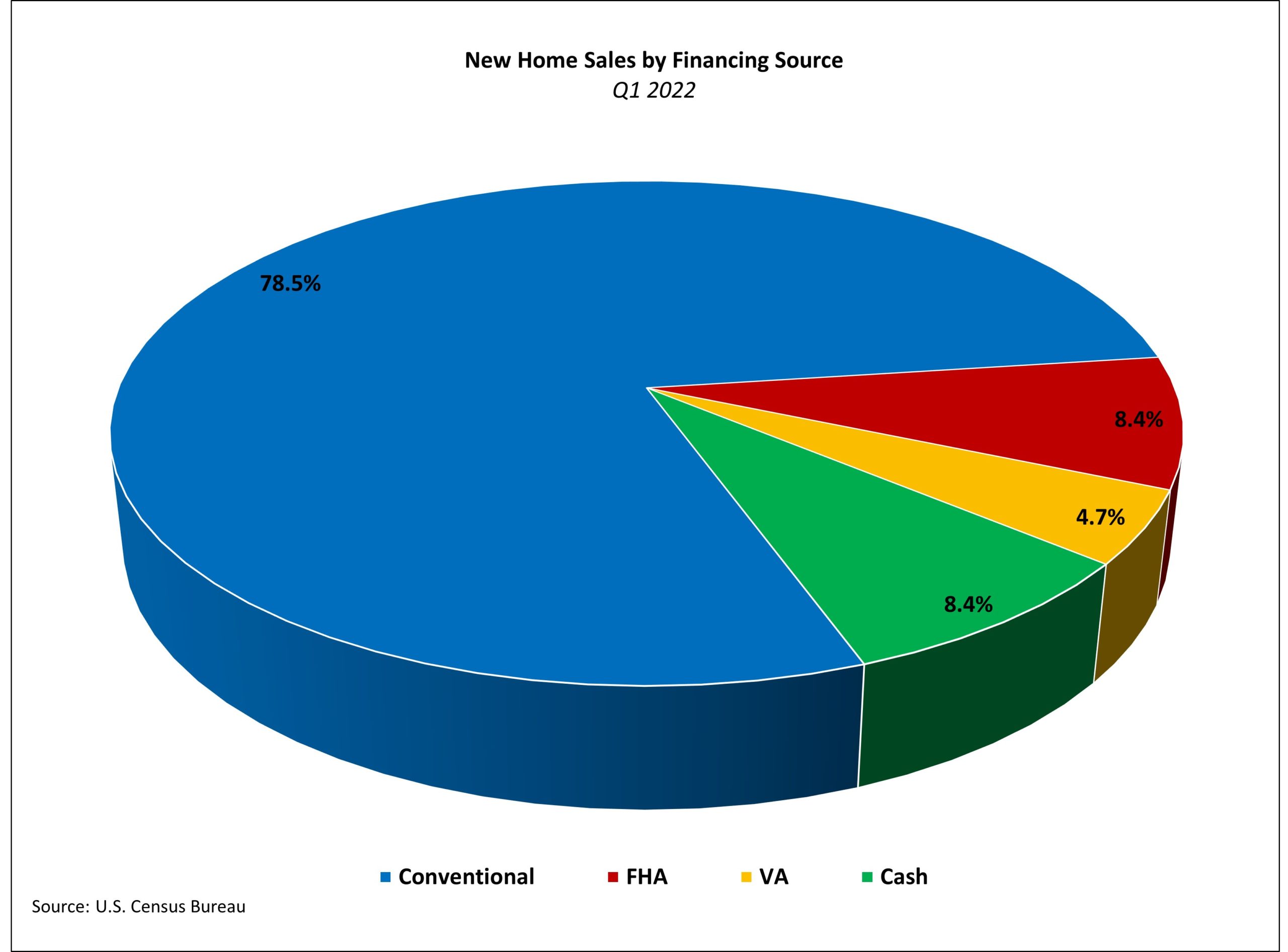

NAHB analysis of the most recent Census estimates concerning sources of financing for new home sales reveals that conventional loans accounted for 78.5% of new home sales in the first quarter of 2022, the highest share in more than a decade. Conventional loans financed over three-quarters of new home sales in the second quarter of 2008 before steadily falling and bottoming out at 57.3% in the third quarter of 2010.

New home sales due to FHA-backed loans decreased to a quarterly count of 18,000 and a market share of just 8% for the first quarter of 2022. This marks a 15-year low for the FHA-share of the new home market. FHA-backed loans have steadily lost market share for newly-built single-family homes as affordability conditions have deteriorated. This reflects challenges for first-time buyers in today’s housing market.

It is worth adopting some caution associated with the Census market share estimates. In particular, the statistical error associated with the FHA, cash, and VA sales estimates from this data set are relatively high. This reduces the reliability of measures of short-term market changes.

Mindful of these limitations, over the long run the current FHA share is now below the 10% average of 2002-2003.

New home sales backed by VA products declined to 4.7% of the total. VA market share has fallen eight percentage points since reaching 12.7% in the wake of the Great Recession.

The reported number of cash sales increased by 7,000 in the first quarter to a total of 18,000 cash sales or 8.4% of the market. The share of cash purchases has trended higher over the past four quarters since reaching its most recent trough of 4.4% at the start of 2021. A rising share of cash sales is consistent with declining housing affordability in the wake of rising mortgage rates.

Although cash sales make up a small portion of new home sales, they constitute a larger share of existing home sales. One-fourth of existing home transactions were all-cash sales in February 2022, up from 22% in February 2021, according to estimates from the National Association of Realtors.

Different sources of financing also serve distinct market segments, which is revealed in part by the median new home price associated with each. In the first quarter, the national median sales price of a new home was $428,700. Split by types of financing, the median prices of new homes financed with conventional loans, FHA loans, VA loans, and cash were $465,200, $376,100, $419,300, and $391,600, respectively.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.