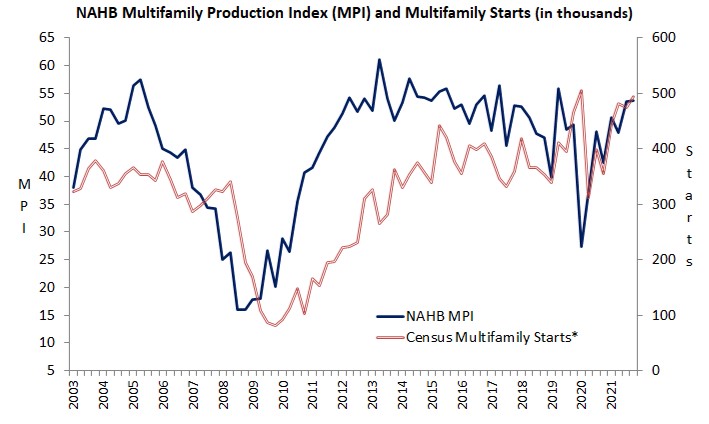

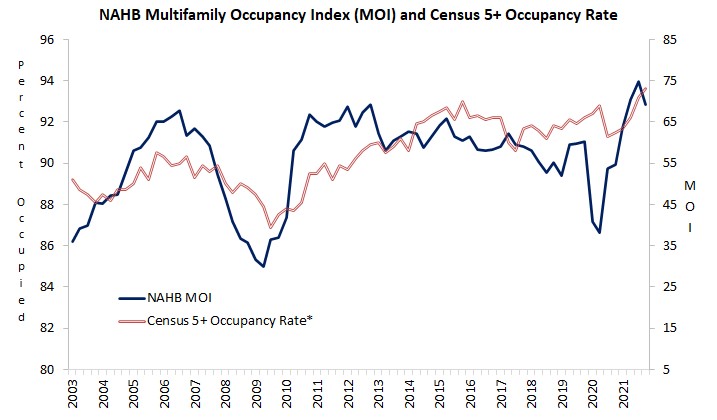

Confidence in the market for new multifamily housing improved in the fourth quarter of 2021, according to the latest results from NAHB’s Multifamily Market Survey (MMS). The MMS produces two main indices. In the fourth quarter, the Multifamily Production Index (MPI) increased one point to 54 from the previous quarter while Multifamily Occupancy Index (MOI) decreased six points to 69.

The MPI is a weighted average of three component indices measuring developer sentiment about production in different segments of the multifamily market: low-rent apartments supported by low-income tax credits or other government subsidy programs; market-rate rental apartments built to be rented at an unsubsidized market-clearing price; and for-sale units (i.e., multifamily condominiums). Each component index lies on a scale on of 0 to 100, where a number above 50 indicates that more respondents report conditions are improving than report conditions are getting worse. Two of the three components increased from the third to the fourth quarter: The component measuring market rate rental units inched up one point to 61 and the component measuring for-sale units posted a six-point gain to 53, while the component measuring low-rent units fell seven points to 48.

Similarly, the MOI measures the multifamily housing industry’s sentiment on occupancy in existing apartments. The MOI is also a weighted average of three components: for occupancy in class A, B, and C apartments. Again, each component index lies on a scale from 0 to 100, with a break-even point at 50, where numbers above 50 indicate rising occupancy. Even though the overall MOI fell six points to 69, it remains well above the break-even point of 50 and as high as it’s been at any time prior to the second quarter of 2021.

All three of the MOI’s components declined at least slightly in the fourth quarter. The index for occupancy in class A apartments declined five points to 72, the index for class B apartments declined eight points to 67, and the index for class C apartments edged down by a single point to 69.

The strength of the MPI indicates that demand for new multifamily construction in many parts of the country has been strong enough to compensate for the rising costs of land, labor and materials. The strong MPI is also consistent with Census production statistics, which show 750,000 apartments under construction and new apartments being started at a rate in excess of 500,000 per year.

For complete results from the Multifamily Market Survey, including the history of each index and its components back to the survey’s inception in 2003, please visit NAHB’s MMS web page.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Hoping to a more positive outcome as we start the year.