In July 2018, the United States Trade Representative (USTR) announced its intention to levy tariffs on a series of imports from China. USTR rolled out proposed tariffs in three waves, with the third list (List 3) covering approximately $200 billion worth of Chinese imports. The List 3 goods comprises 5745 items, approximately 450 of which are commonly used in the residential construction industry.

The NAHB economics department examined the imports identified on List 3 and published a special study that estimated the economic effects that the proposed 10-percent tariff would have on the residential construction industry. The value of the 450 building materials included on List 3 is roughly $10 billion. A 10-percent tariff on these goods, therefore, represented a $1 billion tax increase on the housing industry.

One of the questions going into the fourth quarter of 2018 was to what extent the tariffs—even the announcement of intent to levy tariffs in the future—would affect the amount of imports of building materials and construction supplies. As the recently released January 2019 trade data show, the effects of both tariffs levied, as well as announcement of future tariffs, have been substantial.

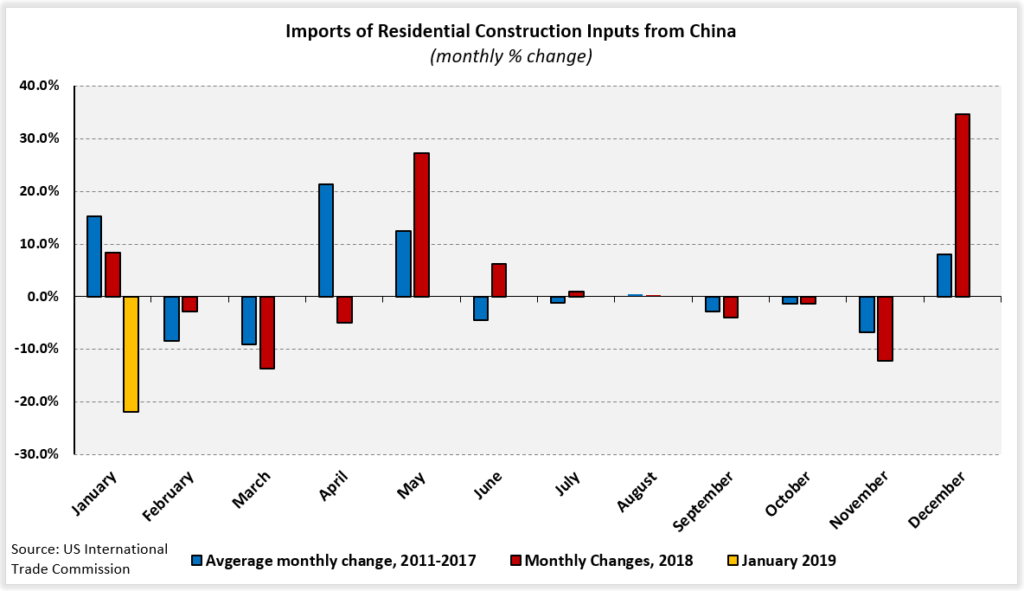

To analyze these effects, the average monthly change in import value of the 450 items between 2011 and 2017 was compared to monthly changes from January 2018 through January 2019. The “floating” nature of major Chinese holidays affecting capital flows necessitated comparison to the historical average in order to smooth out holiday induced seasonal effects that may occur in different months in different years.

As illustrated in the figure below, the largest disparities between trade flows in 2018 and the 2011-2017 period occurred in April and December 2018.

Although the 2018 study on building materials imports focused on List 3, some goods used in residential construction were affected by the section 232 tariffs (i.e. tariffs levied based on national security concerns) imposed on certain steel and aluminum imports (25 percent and 10 percent, respectively). These tariffs went into effect in March 2018 and clearly had an effect on April 2018 imports from China.

When the USTR announced tariffs to be levied on List 3 beginning September 24th, 2018, the office also announced that the tariff rate would be time sensitive. Although the tariff would initially be set at 10 percent, that rate had a planned increase to 25 percent on January 1st, 2019 in the event that China and the United States could not resolve their differences by the end of the year.

Expectations of a substantial tariff rate increasingly took hold as it was reported that the two countries were not making meaningful progress in negotiations. The data indicate that these expectations brought the timing of imports forward (to December) in order to avoid the increase.

On December 17th, 2018, however, President Trump announced that the rate hike would be delayed to March. Consequently, the data show that imports of building materials declined more than 20 percent in January 2019—in stark contrast to the historical 15-percent increase seen in January.

The President delayed the tariff rate increase indefinitely on February 24, 2019, citing “substantial progress” in trade talks between American and Chinese officials. NAHB will continue to monitor import data releases to examine the possible effects of that announcement.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

So what changed Trump’s mind between February 24th and May 5th? Is it just because Trump does not believe the negotiations with the Trade Deal are moving quick enough?

So if China devalued their currency enough to offset the expense of the tariffs … of course T-rump would go through the roof … but that is an option.