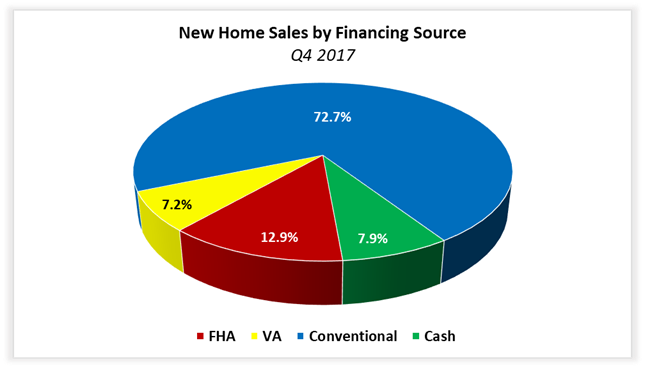

NAHB analysis of the most recent Quarterly Sales by Price and Financing published by the Census Bureau reveals that cash sales accounted for 11,000 new home sales in the fourth quarter of 2017. Cash purchases also accounted for 11,000 new home sales in Q2 2017, but only made up 6.5% of the total. In contrast, they made up 7.9% of purchases in the fourth quarter, a mark not seen since 2014.

FHA-loans financed 12.9% of new home sales during the fourth quarter of 2017. Since its most recent peak in Q2 2015, the share of sales financed with FHA-backed mortgages had fallen over four percentage points. The share of new home sales financed with conventional mortgages declined slightly, from 73.2% to 72.7%.

Census data and NAHB calculations show that new home sales backed by VA products were flat in the fourth quarter of 2017. Market share ticked up from 7.0% to 7.2% quarter-over-quarter but has fallen more than five percentage points since reaching 12.8% in the wake of the Great Recession.

VA loans backed just 2.4% of new home purchases during the housing boom, on average. The chart below illustrates how different types of financing are used in different economic environments.

It is worth adopting some caution associated with the Census data as they are estimates based on sample statistics. The statistical error associated with the FHA, cash, and VA sales estimates from this data set are relatively high, meaning that although the data are presented as single numbers, the true values may be substantially different.

Mindful of these limitations, over the long run the current FHA share is less than half its 28% share from the first quarter of 2010 but still elevated compared to the 10% average of 2002-2003.

Although cash sales make up a small portion of new home sales, they constitute a larger share of existing home sales. Roughly 20% of existing home transactions were all-cash sales in December 2017, according to estimates from the National Association of Realtors.

Conventional financing contracted sharply following the Great Recession, but has expanded as the recovery has continued. In 2006, conventional financing accounted for 90% of new home purchases, falling to 59% in 2010. Conventional loans accounted for 72% of new home sales in 2017, on average, the highest annual average since 2008.

Different sources of financing also serve distinct market segments, which is revealed in part by the median new home price associated with each. In the second quarter, the national median sales price of a new home was $321,100. Split by types of financing, the median prices of new homes financed with conventional loans, FHA loans, VA loans, and cash were $347,800, $233,900, $294,400, and $349,300, respectively.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.